Deputy Heidi Soulsby wants the States to look into tax breaks to encourage homeowners to rent out spare bedrooms to essential workers moving to the island.

She believes that such a scheme could be introduced quickly to assist States' committees and companies struggling to recruit staff from outside the island for key posts.

Deputy Soulsby, pictured (top), set out her idea in an amendment submitted to the draft 2023 Budget which the States will debate next week.

Her amendment is aimed at encouraging owner-occupiers to put spare bedrooms to good use for the wider benefit of the island. It is not aimed at houses already rented out to multiple workers - known as houses in multiple occupation.

Pictured: Various health services, including some hospital waiting times, are under severe strain because of the difficulties associated with recruiting key workers to the island.

If deputies approve the amendment, the Policy & Resources Committee will be directed "to consider the options and issues in relation to introducing a room-to-let annual tax-free allowance and/or other benefits for personal taxpayers who let a room, particularly for key workers".

The Committee, of which Deputy Soulsby is Vice President, would be required to report back to the States with any recommendations by no later than March 2023 – emphasising the speed with which Deputy Soulsby believes a scheme could be set up.

The amendment is seconded by Deputy Gavin St. Pier.

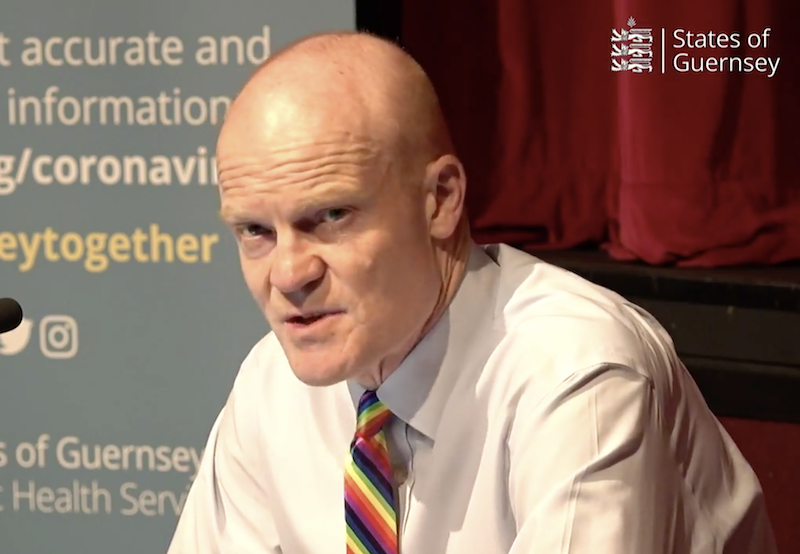

Pictured: Deputy Gavin St. Pier, who is backing Deputy Heidi Soulsby's amendment to the draft 2023 Budget. He has also submitted two of his own amendments and is seconding another.

"We are advised that we have a housing crisis and it is understood that people are not coming to Guernsey due to the lack of affordable housing," said Deputy Soulsby.

"This is particularly acute when it comes to key workers with the Committee for Health & Social Care holding a high number of vacancies at a time of increasing demand for their services.

"To date, options that have been considered to deal with the problem have focused on building new houses. However, this is not a solution in the short term.

"At the same time, there is evidence that there are a significant number of under-occupied properties.

"It is worth exploring what can be done to incentivise the use of such properties whilst the housing situation is acute."

Pictured: Deputies Neil Inder (right) and Mark Helyar recently won the backing of the States to progress plans to develop key workers' housing on a green field at the Princess Elizabeth Hospital as long as equivalent land elsewhere is protected from development - but Deputy Heidi Soulsby believes that encouraging homeowners to rent out spare bedrooms could be a quicker response to the urgent need for more key workers' housing.

Express is reporting today on several amendments submitted to the draft 2023 Budget which try to alleviate challenges in the supply and affordability of housing.

Deputy Sasha Kazantseva-Miller is proposing an investigation which could lead to ownership of local market houses being restricted to people qualified to live in them.

Deputy Gavin St. Pier wants the States to look into providing developers with tax breaks to encourage them to build less expensive first-time buyer homes.

Deputy St. Pier is also proposing an investigation into whether tax should be charged on the profits made from the sale of second homes.

The States meet on Tuesday 1 November to debate the draft 2023 Budget and amendments submitted against it.

States to debate keeping local market homes for local residents

Tax breaks could encourage more affordable first-time homes

Housing plans to alleviate crisis

States spending set to increase by nearly £50m next year

Toughest situation for "donkeys' years"

2023 Budget proposals out today

"We're nearing the day that we will have to turn off services"

Developing 650 GHA homes will prove challenging

"A little of the heat has come out of the housing market"

P&R says States "must tackle" housing needs and cost of living

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.