Deputy Mark Helyar wants to tax second home owners, and those who leave properties to rot, under new plans aimed at alleviating the growing housing crisis.

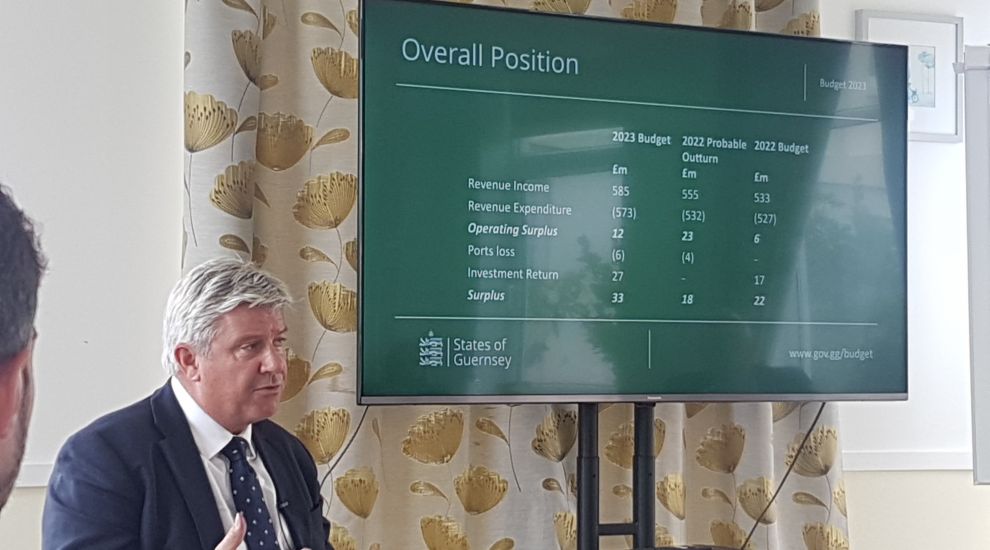

The Treasury Lead on the Committee for Policy and Resources announced those plans during his presentation of the 2023 Budget earlier this week.

Among the proposals for a public spending glut this year, following by a warning of dire service cuts or increased taxes next year, Deputy Helyar repeatedly described the future as uncertain and said the States have to stop kicking cans down the road.

Among financial pressures facing the island and individuals are growing concerns over the island's housing market.

Earlier this year, the P&R Committee said that a crisis in the supply and affordability of housing was at the top of the list of major challenges which the States must tackle immediately.

The Committee's draft 2023 Budget includes several changes which it said would support the housing market. These include relief from document duty to encourage downsizing, additional document duty on properties purchased as investments and additional charges on unoccupied or derelict properties.

Pictured: The draft 2023 Budget includes proposals to introduce penal rates of TRP for owners of derelict or unoccupied properties which could be released back into the market to add to the supply of housing.

Deputy Helyar said these proposals were met positively by his political colleagues - most of whom attended a States presentation of the Budget plans on Monday.

He also said he knows many members of the public want action on housing and he is committed to doing just that including by taxing owners of derelict properties, and by increasing costs for second home owners.

"I think it's been on the menu for a long long time," he said, "but no one's ever pressed the button to.

"I've had lots and lots of comments from members of the public, 'Why aren't you doing anything about hotel sites?', 'Why have we got so many empty houses?', 'Why are there so many second properties here?'

"There are lots of places in Europe, Denmark for example, where if you have a second home and don't live in it, you have to pay a very significant amount of tax on it. because we've got such a little amount of space and I know States Members are not keen on building on agricultural land either, getting some of the brownfield sites we have being used for an economic reason is really important."

Efforts to encourage downsizing will also be made through the 2023 Budget.

Deputy Helyar wants to increase the TRP between those at the lower and upper ends of the field. Properties below 200 TRP will see charges frozen this year - that amounts to around 3/4 of residential properties.

He hopes this will encourage those with larger properties to look at smaller homes instead, freeing up family sized plots for the younger generations.

The draft Budget will be debated at a special meeting of the States which starts on Tuesday 1 November.

READ MORE...

States spending set to increase by nearly £50m next year

Toughest situation for "donkeys' years"

2023 Budget proposals out today

"We're nearing the day that we will have to turn off services"

P&R tight-lipped on whether tax proposals remain on track

Firm appointed to review whether companies could pay more tax

FOCUS: Opposition across the States to P&R's latest GST plan

EXPLAINED: Why the States' leaders believe GST is needed now

Guernsey leaders abruptly pull GST plans

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.