The owners of properties which have fallen into disrepair are directly in the States' crosshairs with a second attempt to force them to sell, refurbish or tidy up derelict sites on the way.

The 2023 Budget suggested new measures be introduced in the coming years to alleviate the housing crisis.

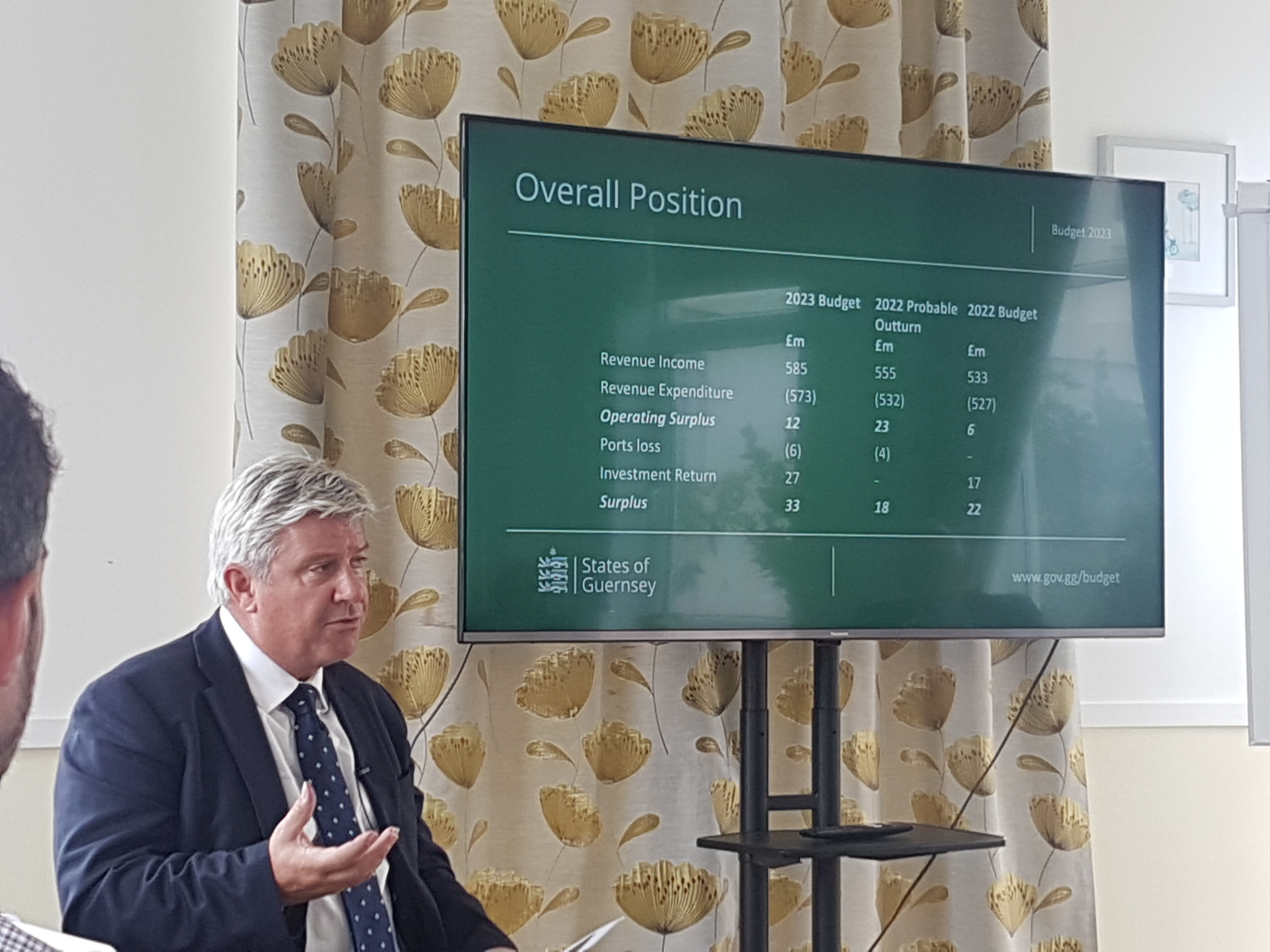

In presenting the 2023 Budget, Treasury lead, Deputy Mark Helyar said he wants to tax second home owners, and those who leave properties to rot, while also considering offering relief from document duty to encourage downsizing, while warning additional document duty could be charged on properties purchased as investments along with additional charges on unoccupied or derelict properties.

Pictured: Deputy Mark Helyar presented the 2023 Budget earlier in October.

Now, the Development & Planning Authority (DPA) has formally outlined its plans to prevent properties being left to fall into disrepair - whether they be private dwellings or hospitality sites.

The DPA has this week submitted a policy letter asking the States to give them permission to serve civil notices on land owners and occupiers compelling them to improve the condition of their land "where it is adversely affecting the amenity of an area".

The DPA said this would include, but would not be limited to, "land which is in an unsightly condition", and could include "redundant hotel sites", "derelict premises in town" and other "known eyesores" across the island.

This would not apply to redundant greenhouses and related structures, as other measures already exist under the Planning Law to encourage removal of these structures.

Addressing members of the States' this morning, President Deputy Victoria Oliver said: "Such powers would also play an important part in securing revitalisation and acting as a deterrent to prevent the future creation of eyesores through dereliction and neglect".

Pictured: The above could be unacceptable under new legislation being requested by the DPA.

Similar provisions already exist in Alderney, Jersey, England and Wales while Section 46 of the Land Planning and Development (Guernsey) Law, 2005, permits the States to allow for the control of the use of land by Ordinance.

Deputy Oliver said this would come under the Government Work Plan which already enables opportunities for regeneration, and she says spatial planning is a key enabler of this.

She wants these powers to be ratified, enabling the Authority "to make the best and most efficient use of land which currently detracts from the amenity of an area".

Pictured: Deputy Victoria Oliver, President of the DPA.

“We’ve already produced a Development Framework for three Regeneration Areas in St. Peter Port but having these powers would enable us to make sure that the limited space on our island is being put to best use. There are existing provisions in place for this, but they don’t deal with unsightly land in a comprehensive way," said Deputy Oliver.

“Islanders and visitors already enjoy the beauty of our island, but we’re all aware of sites which spoil our otherwise picturesque scenery. As well as making the most efficient use of our space, this would be an opportunity to further improve the charm of our island and deter the creation of more eyesores."

Some deputies questioned why redundant glasshouse would be exempt from future civil notices in the States' this morning. Deputy Oliver highlighted that existing planning laws already cater to this end, and including them in any new notices regime would be conflicting.

She added that the proposals would work "hand in hand" with the measures touted previously by Deputy Helyar, and would "act as a deterrent" for years after additional tax charges on derelict properties had expired.

Deputy Aidan Gabriel questioned what would qualify as 'unsightly', given some species rely on run-down sites as a habitat. Deputy Oliver said a definition of "dereliction" would be confirmed through consultation with Law Officers.

States spending set to increase by nearly £50m next year

Toughest situation for "donkeys' years"

2023 Budget proposals out today

"We're nearing the day that we will have to turn off services"

P&R tight-lipped on whether tax proposals remain on track

Firm appointed to review whether companies could pay more tax

FOCUS: Opposition across the States to P&R's latest GST plan

EXPLAINED: Why the States' leaders believe GST is needed now

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.