The decision on the way we pay tax and social security, and our public services are funded, could end up being a decision between three options - including the original plans and two new alternatives.

The Policy & Resources Committee will have to try and get the States to support one of these plans by a majority next week, when the Tax Review debate resumes on 15 February.

Today P&R are standing by the original proposals - now to be known as Option A - which the committee have said they "will continue to strongly argue for".

Option B removes the proposed goods and services tax seen in plans A but does introduce other policies which have previously proven to be hugely unpopular in Guernsey including paid parking, and the doubling of TRP charges.

A third set of proposals - Option C - will be presented as a cost cutting model with most of the emphasis on reducing public spending across different sectors.

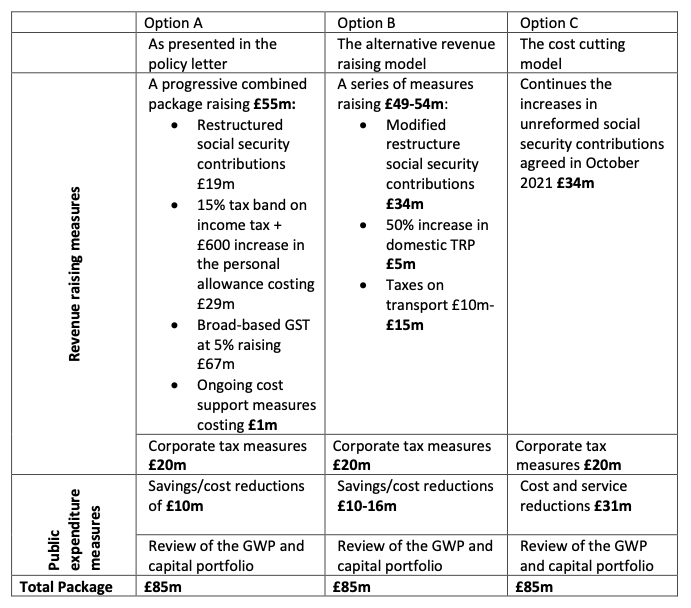

Pictured: The three proposals which will be debated by the States next week.

Each of the three proposals includes an element of cost cutting, and each will include a direction to look at changing the way corporate tax is charged and collected.

The Government Work Plan and the island's capital portfolio will also be reviewed if any of the three options are backed by the States.

Beyond that, the three options vary. The States could also reject each of the three options meaning none of the proposals above are brought in.

It must be highlighted that although P&R have presented the alternative options, the debate next week will see the committee try to convince a majority of States members that Option A - the original plans, with the inclusion of GST and a restructured social security system - is the best option for the island's finances and future.

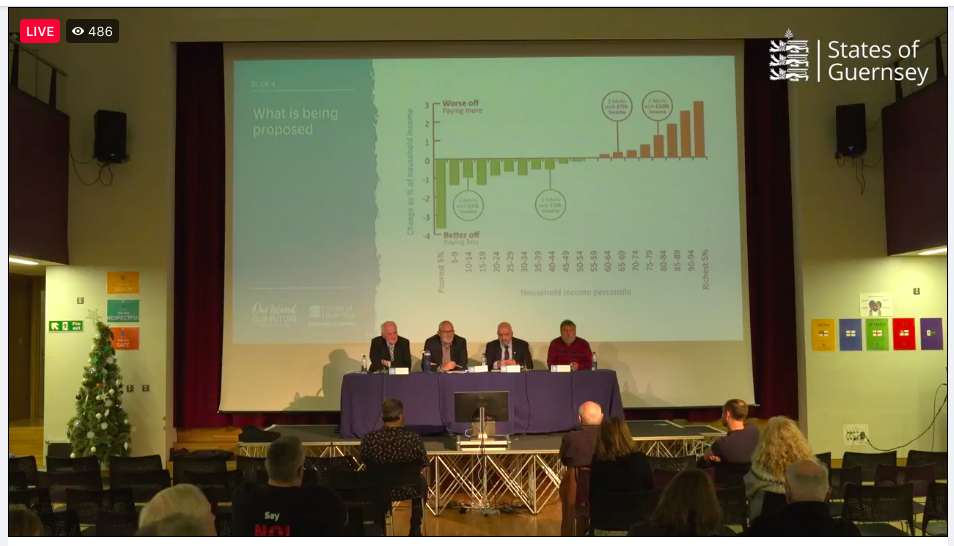

Pictured: The original Tax Review plans were published in November last year.

States Members will have a choice between Option A and the new options B and C or they could reject all of the proposals.

Option B suggests a "modified restructure of social security contributions" which would bring in more money than the original plans according to the examples given.

B also includes a proposed 50% increase in domestic TRP, and "taxes on transport" - which "may include a form of distance charging, motor tax or paid parking". Together those two charges could bring in an additional £20m per year.

Option C would raise even more money through "increases in unreformed social security contributions" which were agreed in October 2021.

As well as reviews of corporate taxation, the GWP and the capital portfolio, Option C would see government spending cut backs in the region of £31m a year - more than the combined cut backs suggested through options A and B combined.

Follow Express for more...

Deputies warned against opting for "comfort blanket" of delay on tax

Case made for alternative course of action on tax

Act now on tax call from Ferbrache as States losses mount

WATCH: Highlights from the GST rally

Deputies urge P&R to drop GST plans

"Unacceptable" and "damaging" service cuts if States reject GST

Alternative tax package promises greater States savings

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.