A new 5% goods and services tax [GST] may have grabbed many of the headlines - but Deputy Peter Roffey says that making social security contributions "fairer and less costly" for lower- and middle-income families is an equally important part of tax reforms published yesterday which are expected to go to the States' Assembly in January.

The Policy & Resources Committee is proposing an increase in social security contributions to 8.5% for employees, 8% for employers and 14.5% for the self-employed. However, it is also recommending a new personal allowance on social security contributions at the same level as the income tax allowance - currently around £13,000 a year. Contributions would be paid only on income above the personal allowance.

In addition, social security contributions would be paid on all income, whereas at present some people - who are typically better off financially - are not charged contributions on income generated outside of work.

It is estimated that these changes would boost States' income by around £19million a year as well as reducing social security contributions for thousands of lower- and middle-income households and increasing contributions collected from better off residents.

"One of my frustrations throughout this whole process, and I predict it will happen again when your headlines come out, is that all the focus is on GST, with almost no mention of what will be a once-in-a-generation, root-and-branch radical change in our social security system," said Deputy Roffey, the President of the Committee for Employment & Social Security.

"To my mind, the social security changes are just as consequential and just as important as the tax changes."

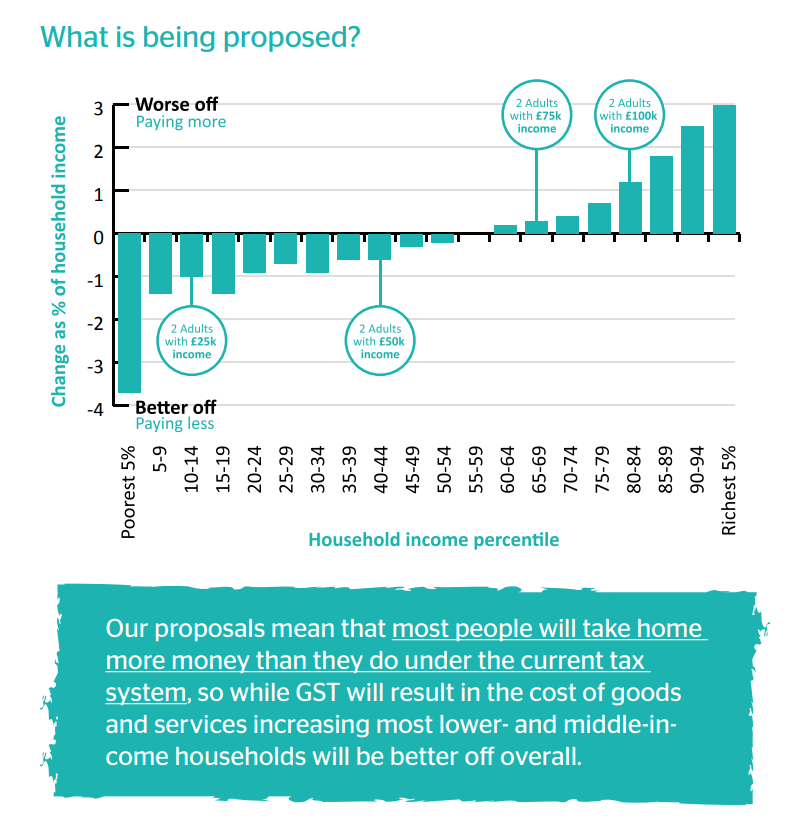

Pictured: This chart, contained in a leaflet being delivered to all households, sets out the effect of the tax package on all households based on their level of income.

The Policy & Resources Committee's proposals - including the changes to social security contributions, 5% GST and a new lower income tax band of 15p in the pound on income up to £30,000 - are designed to increase States' income by around £55m a year.

But the Committee insists that its tax package is fair because overall it would leave most families better off with only the most affluent 40% of households paying more.

Deputy Roffey said the changes proposed to social security contributions were important for securing the future of the island's social security funds and critical to leaving most lower- and middle-income households better off overall as a result of the proposed tax package.

Pictured: Deputy Peter Roffey is encouraging other deputies and the public to focus on proposals to reform social security contributions as much as proposals to introduce GST.

"Our current social security system, for historical reasons and happenstance and the way it has grown, is really not fair and really not at all progressive," said Deputy Roffey.

"Individuals and households on identical incomes can be charged wildly different amounts of social security depending on how their income is arrived at. We want to have a system where you pay in relation to your income.

"The other aspect is the regressive and unfair nature of social security at the moment. Unlike income tax, there is no personal allowance. There is a threshold below which you don’t pay social security…but the second you go over that, you don't pay social security contributions just on the amount you earn above that threshold, you pay it on every single pound you earn from the first pound, which makes it incredibly hard on low and middle earners.

"The idea is to bring in an income tax-style allowance - at about £13,800. Above that, they would be paying a somewhat higher social security rate…but because they won't pay on that first £13,800, it will be a long way up the income scale before they're actually worse off than they are now.

"When we're talking about mitigation against GST, take into account the 15% tax band, take into account the £600 extra personal allowance from tax, but the real heavy lifting in mitigation is being done by bringing in a personal allowance on social security contributions."

Pictured: Deputy Peter Roffey said that the current Social Security contributions system is harsh on many less well paid workers but needs to collect more revenue from affluent residents with high levels of unearned income.

The Policy & Resources Committee's policy letter, which sets out its proposals in detail, states: "For someone working 35 hours a week on minimum wage - about £17,400 a year - the proposed restructure would reduce their contributions liability by about £860 a year against what they would be expected to pay in 2022.

"Any employed person with an earned income of £65,000 or less - and no significant unearned income - should pay less in contributions than they do currently." Although they may pay more overall under the proposed tax package if they live in a household with other income which leaves them within the island's better off 40% of households.

"The progressive nature of the change...makes it an ideal choice to balance a GST, since it is able to offset much of the regressive impact on low- and middle-income households by increasing their disposable income to counter the increase in their costs."

The Committee estimates that making these changes would have administrative costs to the States of £1.6m initially and £150,000 a year thereafter.

Pictured: Pensions would be increased ahead of the introduction of GST under proposals which the States are expected to debate in January.

The introduction of GST is expected to add around 3.4% to the price of goods and services. In advance of the introduction of GST, the Committee is proposing a one-off additional increase of 3.4% to States' pension rates and income support rates to protect the most financially vulnerable households.

In addition, it is proposed that families with relatively low household income who do not qualify for income support should receive cash payments towards their additional costs as a result of GST.

Deputy Roffey said: "What about people who are just not particularly well off? They’re not on benefits and they do not receive a full pension. Households below a certain level of income will just get some cash to compensate them for the impact of GST - if they are on modest incomes but above income support level and not full pensioners. It's fairly crude – it' s what Jersey do and it’s the best way we can do it really."

The Committee's policy letter states: "It is, therefore, proposed that a cost support payment be introduced - as is applied in Jersey - calculated based on the number of individuals in the households, with a baseline rate of £450 a year...to households with a gross income of £28,000 or less that are not in receipt of income support.

"Engagement with [income support] staff suggest that this might be made payable in monthly instalments. This implies an ongoing cost of £1m [annually]."

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.