Senior States' members are warning of "absolutely shocking" cuts to public services if deputies reject tax rises worth tens of millions of pounds a year.

The Policy & Resources Committee wants to increase States' income by £50-60million a year through a package which includes a 5% goods and services tax [GST]. If deputies reject GST in January, they will be asked to back an alternative plan to cut public spending by 12% in real terms by 2026.

States' committees have indicated that budget cuts of that size could mean removing funding to the grant-aided colleges, closing a primary school, scrapping family allowance payments and introducing charges in some areas of secondary healthcare.

Other ideas suggested by committees to deliver the alternative plan of spending cuts include removing grants to the Sports Commission and Youth Commission, charging for seats on school buses, replacing some prison sentences with tagging of offenders and reducing or closing public toilets.

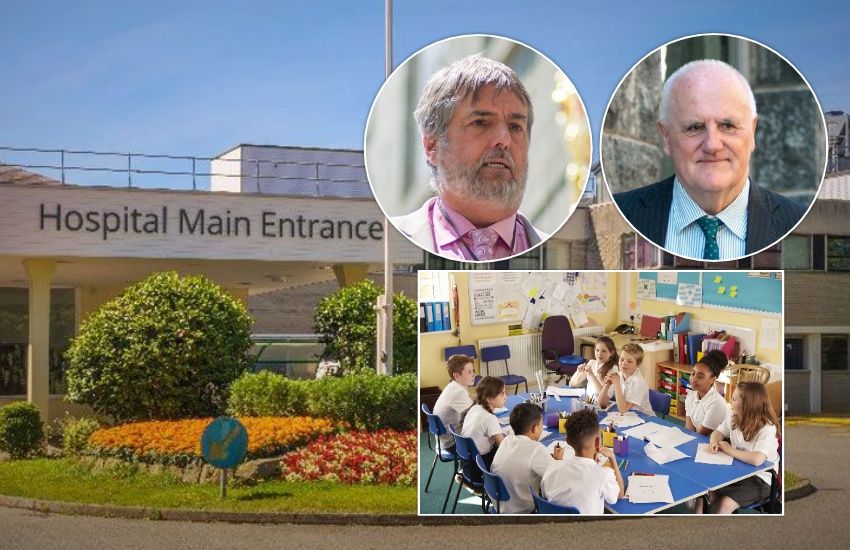

"That's the alternative. We would have to start making really serious cuts to essential public services. Those of you who think we're not of a mind to do that will find that we're very much of a mind to do it because we'll have no option," said Deputy Peter Ferbrache, the Committee's President, pictured top right.

Deputy Peter Roffey, pictured top left, who presented the proposed tax package to the media alongside Deputy Ferbrache, said: "I care about public services. I have become absolutely convinced that if we don't have a real step change in States' revenues over the next year or two then what we're going to have to do to public services is going to be absolutely shocking."

Pictured: States' leaders are warning that charges for some secondary healthcare and the closure of a primary school could be on the cards if deputies reject GST and other tax changes at their first meeting in 2023.

The Policy & Resources Committee previously projected that States' spending would soon exceed income by up to £90m a year. But the Committee is now projecting an even larger deficit beyond 2025 of up to £110m a year plus £20-30m a year in rising long-term care costs.

"The savings incorporated into the [previous] forecasts from public service reform are now expected to be very significantly less than the £10m a year previously assumed and the assumption that demand on health services would create an additional £3m of expenditure each year may not be sufficient," said the States' senior committee.

It asked the States' six principal committees to indicate how they would reduce their costs by 5%, 10% or 15% if necessary. The Policy & Resources Committee said that other committees did not want their lists of indicative cuts published "given their far-reaching consequences and the hypothetical nature of the exercise". But they have been published in the policy letter released today.

The Policy & Resources Committee said: "[It] is of the opinion that it is important that – in helping the States to decide whether to impose new and increased taxation on the community – this policy letter includes illustrations of the type and extent of the cuts that would be necessary should no additional revenue be secured."

The spending committees' submissions on indicative cuts included warnings that they would be "to the detriment of [the economy], employment and subsequent tax take...hugely unpalatable...completely unacceptable in practice...damaging [to] the infrastructure that ensures the safety and security of the Bailiwick...and potentially dangerous for the community".

Instead, the Policy & Resources Committee is recommending higher taxes, largely through a new GST, to increase States' income by £50-60m a year. But its policy letter for debate by the States' Assembly in January includes a fall-back proposal for spending cuts totalling 12% in real terms over the years 2024, 2025 and 2026.

Pictured: Deputy Peter Roffey predicted lots of public opposition to the proposal to introduce GST but also that there would be even more opposition to the cuts in service necessary if deputies block big tax rises.

"We've got good services…we want to maintain those. The people of the Bailiwick are appreciative of that fact," said Deputy Ferbrache.

"Equally, we're going to have to pay for them, and we're running out of runway. If we don't adopt these kinds of measures [tax rises] then we are going to have to recommend to the States that significant reductions are made [in services]."

Deputy Roffey said that in some cases "third world" budget cuts would be necessary to balance the books.

"We're going to get a lot of grief over the next couple of months over this package, but I think it pales to what would happen over the next few years and the grief we would get from our community if we tried to balance the books through slashing public services. I know that's some people's preference, but it's not mine, and I think this is definitely the lesser of those two evils," said Deputy Roffey.

"I think there does need to be a wake-up call. We don't need to patronise the people of Guernsey, but I think the sense of entitlement to really high-quality services while having very low taxation – far lower than Jersey or the Isle of Man – really was born out of a finance sector boom when lots of money was coming in from corporate tax. Now I think we need an adjustment to reality and this is that adjustment...I wish I wasn't the messenger."

The States' Assembly is expected to debate the policy letter at its first meeting in 2023, which starts on Wednesday 25 January.

Tax plan includes 5% GST - but P&R says most families will be better off

Treasury chief won't lead tax plan

Why States' leaders still think GST and tax reform is needed

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.