Now is not the time to introduce GST, deputies proposing a “fairer alternative” to the Tax Review have argued.

Deputies Heidi Soulsby and Gavin St Pier have created a package of measures to reduce Guernsey's structural deficit by £62m., which include cuts to States spending that they say are absent from Policy & Resources’ review.

They would also put far less money aside for spending on building projects than P&R, reducing the deficit by £19m. a year, arguing that the Island does not have the capacity to deliver the projects envisaged.

Their plans would set in train reviews of corporate tax and what government does, as well as quickly close the public sector pension scheme to new entrants in favour of an alternative package with less risk to the taxpayer.

Social Security reforms put forward under P&R’s plans would largely remain intact.

Deputy Soulsby quit P&R over her opposition to its approach to the Tax Review.

“What we're trying to do is take a more balanced approach than the report that Policy & Resources have produced,” she said.

Pictured: Deputies Gavin St Pier and Heidi Soulsby outlining their alternative package to P&R's Tax Review.

P&R, which has proposed a GST at 5% as part of its measures to address the deficit, was too focused on tax, she added.

“I don't believe that currently the public believes the government has done enough,” she said. “And I don't believe it's done enough. And I think that's shared by many others in the Assembly. We think it's really important that we focus on budget reductions.”

But it went beyond that, she stressed.

“It's not just enough saying, ‘make savings of a certain percent,’ we've got to look more strategically than that. There hasn't been that exercise where we look at what government is doing. Is it fulfilling the needs of the community? Is it doing more than it should for the community? Are there things that government should not be doing, or things that could be done better by those outside in the third sector or in the private sector? And we think that that is an exercise that absolutely has to be done and I think that's what the public had been asking for.”

GST is not part of the proposed package at this stage with both deputies saying there are better alternatives that can be implemented now, but it would remain an option for the future if needed.

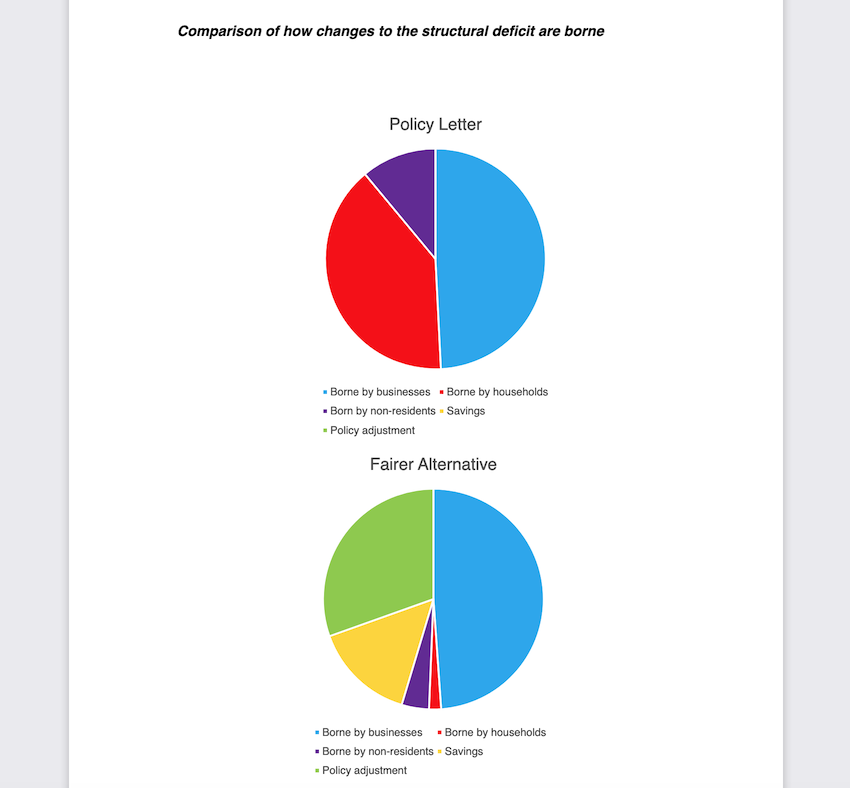

Pictured: Comparisons of how the structural deficit is addressed by the two plans.

Their plans rely on a big reduction in the amount of money being put aside for States building projects.

Currently, the States rules say that capital spending should average 2% of GDP a year, but Deputies Soulsby and St Pier are proposing this is cut to 1.5%.

Deputy St Pier said that they recognised there was a need to invest in infrastructure.

“An important part of the work that needs to be done is actually identifying what our capital needs are and what we can actually deliver over what timeframes,” he said.

“At the moment, we have a very large bundle of capital projects, which is costed around about £500m, but it's just all in a big bucket. And actually, the deliverability of those really is constrained in very real terms by the capacity of the island, and the capacity of government.

“We need to be much clearer over what time period we're going to be able to deliver those things. And that should then drive what our capital spending needs are, rather than just in essence, picking a number. I think that will help shape what the real size of the structural deficit is.”

The States debate on Policy & Resources tax review begins on Wednesday 25 January.

As well as the Deputies Soulsby and St Pier amendment, it faces a challenge by way of an amendment by Deputies Charles Parkinson and Liam McKenna which proposes a new territorial corporate income tax to raise at least £20m a year, holding States revenue spending for the next two years and reprioritising initiatives in the Government Work Plan to limit fresh spending.

Social security changes help poorer families and 'middle Guernsey'

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Former VP reveals opposition to P&R tax plan

ANALYSIS: Resignation another symptom of the most divided States

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.