The Policy & Resources Committee says the island cannot “meaningfully diversify” its tax base without introducing GST, as it publishes policy recommendations for raising tens of millions of pounds extra per year from islanders.

The States’ senior committee, which led on the tax review, will ask the Assembly to agree that “any restructure to meaningfully diversify the tax system requires the introduction of a broad-based Goods and Services Tax.”

The policy letter – which will be submitted to the States as a ‘green paper’ that cannot be amended – adds that there should be measures “to mitigate its impact on lower income households in the context” through the restructuring of the Social Security contributions system.

P&R’s proposals also ask the States to agree to spending cuts, making government more “affordable” and making public services “proportionate to the island’s size and population”, which hints heavily of reductions in some services.

The extent of that, and the ways it will be achieved, are yet to be fleshed out. The Committee says it wants “to seek direction from the States on the main policy recommendations” and “to allow debate on the principles of taxation before committing further resources to establish the full details of how these principles should be applied.”

“The gap between the revenues received from taxation and the cost of the services and infrastructure they need to pay for is increasing and will continue to widen without action,” says the policy letter, which is signed off by all five members of P&R.

Pictured: P&R has submitted its policy letter under Rule 17(9) which stipulates that matters of general policy can be“considered by the States without amendment on the understanding that if the propositions are accepted the Committee will return with detailed proposals which could be accepted or rejected with or without amendments."

This includes Deputy Mark Helyar, who chaired the steering group overseeing the tax review, but has denounced the work as being "misfounded from the outset", saying it reached the "wrong answer" because it was premised "on the wrong question".

P&R said: “The most recent financial analysis, as set out in the Funding & Investment Plan suggests General Revenue funding gap of approximately £54m per annum by 2025, after factoring in savings in the cost of delivering public services of a further £10m per annum.

"In addition, the funding gap on the Guernsey Insurance and Long-Term Care schemes, under current assumptions, totals £33m per annum. The combined total of £87m would require funding of between 24% and 25% of GDP with the likelihood of further pressure on health and care expenditure in future years.”

Pictured: The Tax Review Sub-Committee arrived at three options: a 3% income-based health tax, a GST increasing over time to 8%, or a combination of income-based and consumption taxes.

The Committee states that cuts to public expenditure would not, on their own, be enough to fill the projected revenue shortfalls as the ageing demographic reaches a head and the island’s workforce contracts.

“While many people will argue that the States should cut expenditure or grow the economy before considering raising taxes to fund our public services, the scale of this issue is such that all three routes to more sustainable finances (increasing revenues, reducing expenditure and facilitating growth) are necessary if we are to meet the needs of our community beyond the end of the current political term.

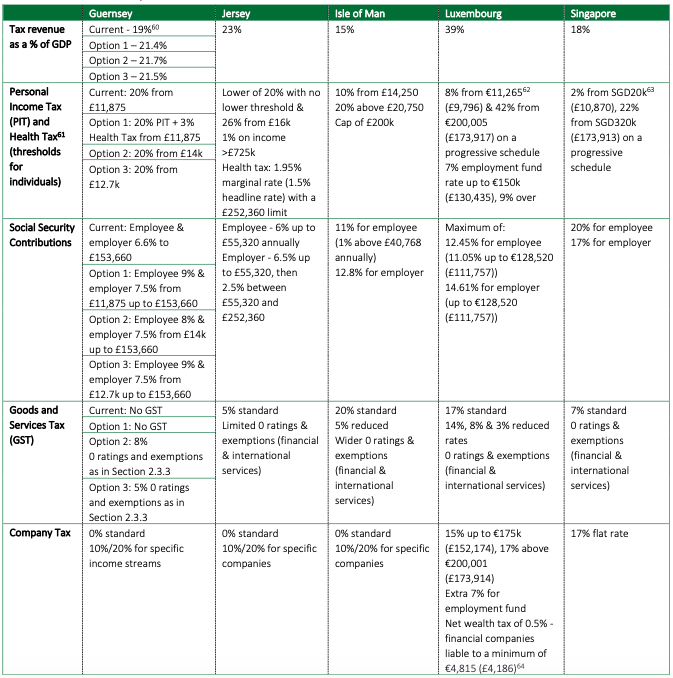

The steering group in charge of the review benchmarked Guernsey’s tax system against those in Jersey, the Isle of Man, Luxembourg and Singapore.

Pictured: The steering group was made up of Deputies Helyar and Mahoney from P&R, Employment & Social Security President Deputy Peter Roffey and Mark Thompson, a non-States Member of that Committee. They benchmarked Guernsey against tax systems in Jersey, the Isle of Man, Luxembourg and Singapore.

These jurisdictions were selected according to economic structure, tax structure, tax as a share of GDP and the size of the economies, with a focus on the financial sector.

The steering group's report states that the relatively recent introduction of a GST in Jersey and other jurisdictions “provides examples of how the scheme can be designed so as to reduce the administrative burden on companies.”

P&R states that concerns about the regressive impact of a GST on people with lower income are “valid” and will be “mitigated” against in the final proposals.

It also stresses that the impact on companies and “higher earners” must be studied and carefully considered.

The policy letter will be debated by the States at its meeting commencing the 28 September.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.