In 2012, Guernsey's media were reporting a "growing backlog" in returns and assessments at the Income Tax office. The backlog appears to have quadrupled in the following decade - despite resources being thrown at the Revenue Service to help it cope.

The backlog of income tax returns waiting to be assessed was first reported from around 2010.

The States of Guernsey's website only holds media releases dated back as far as 2012, and so we've used historic media articles to collate data which shows that in May 2011 there were 18,116 people waiting for their 2010 tax return to be assessed.

By November 2012 the backlog was said to have been reduced to 7,226 - but it's not known if that figure relates solely to tax returns for the previous year waiting to be assessed, or if the number included all tax returns waiting to be assessed for any prior year.

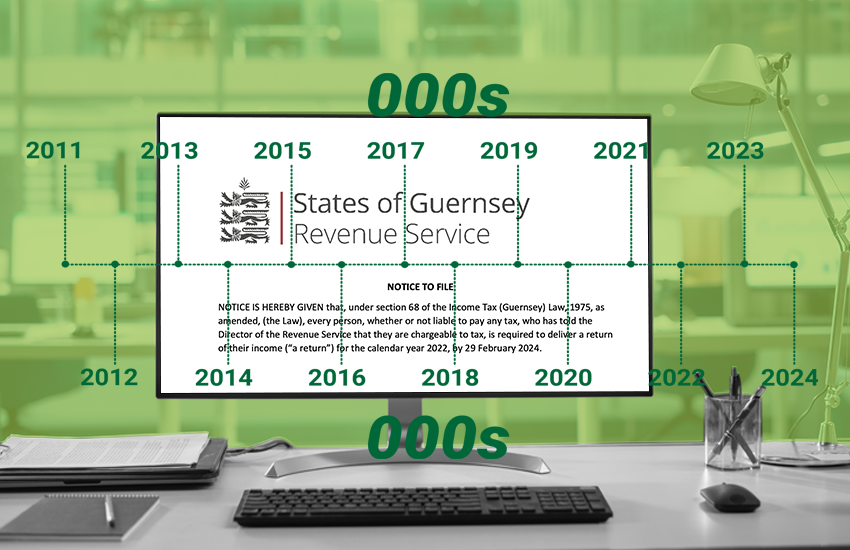

By comparison, data published by the States for 2020, 2021, and 2022 shows that there are currently 40,920 personal tax returns waiting to be assessed in total across those three years.

This is based on an average of 33,000 personal tax returns being submitted during each of those years.

The data shows that the backlog in dealing with personal tax returns during each of those individual years is gradually reducing but the overall figure reaches above 40,000 when the data for March 2024 is combined across each of these three years.

Pictured: Express has used the data for personal tax returns (published on gov.gg HERE), along with the figure of 33,000 which was given to us as the total number of tax returns expected to be submitted each year to work out the data in this article.

By March 2024, 6,930 personal tax return assessments were still to be assessed for 2020, 12,870 for 2021, and 21,120 for 2022.

A direct comparison between 2012 and 2022 would suggest the backlog has at the very least doubled - and at worst it has quadrupled.

Prior to 2012, the tax office said it aimed to deal with returns within four months of them being submitted. It is not known what the current target is, or how long it actually takes as anecdotal evidence suggests this can vary massively between individuals.

In 2011, staff were said to be taking at least five months to assess an individual tax return on average. By 2022 staff were still dealing with tax returns from 2018 - suggesting the backlog had grown from less than one year to four years.

May 2011 - 26,978 personal tax returns for 2010 were submitted by February of 2011, with 18,116 still waiting to be assessed some four months later.

June 2011 - The then-Director of Income Tax said staff were now at least five months behind, with the backlog of personal tax returns waiting to be assessed growing. He also stated that staff were being "verbally abused" by members of the public who were calling the office to enquire about the status of their tax return. Rob Gray said that the 11 staff employed to deal with tax returns at that time had been reduced to seven due to sickness, retirement, and resignation.

January 2012 - The Income Tax Office was encouraging online returns notably because it would “free up staff time from mundane data processing” and “because, in the course of time, it may be possible for the Income Tax Office to make significant reduction in costs”.

May 2012 - The States agreed that online, as opposed to paper tax returns, would now be the standard for all tax payers going forward. Since then paper returns have only been available by request.

Also, during early 2012, it was reported that customers should only call the Income Tax office for “urgent matters” so staff could deal with the growing backlog in returns and assessments.

August 2012 - Phone calls to the Income Tax office were to be restricted on 13 Thursday afternoons from September 2012 onwards so staff could deal with the growing backlog. Media reports from the time quote Rob Gray - the then Director of Income Tax - as saying that his staff were spending about 29 hours a week on the phone dealing with about 650 calls each week, so for 13 weeks staff would instead be focusing on paper and online returns on Thursday afternoons without being interrupted by the telephone.

At this time it was said to be taking a minimum of five months for a paper tax return to be assessed.

Pictured: Income Tax staff were based at Cornet Street until 2017.

September 2012 - The backlog of tax returns waiting to be dealt with was said to be 10,779

November 2012 - The backlog had reduced to 7,226 by the end of November, partly due to the telephone lines being closed on a Thursday.

December 2012 - By the end of 2012, the decision had been taken to close the Income Tax office to visitors on a Thursday afternoons so the backlog could be dealt with. The training manager at Income Tax was reported at the time to have said that the office was 40% under staffed.

March 2013 - The Income Tax office was now closed all day on Thursdays to allow staff to tackle their growing backlog.

December 2013 - The BBC reported concerns that Guernsey's Income Tax office did not have enough staff to deal with new legislation around a tax deal with the US being introduced, as it struggled to combat the growing backlog of returns and assessments. Extra staff were being recruited to help. The Income Tax office remains closed on Thursdays.

January 2014 - The window for filling in tax returns for 2013 was shortened due to the ongoing backlog. Personal and company returns could not be filed online until after February, or using a paper form until March as staff used the first few weeks of the year to try and catch up on previous years' returns. The date for filing all returns remained unchanged at 30 November.

June 2015 - The Guernsey Press reported that the island's Income tax receipts were £17.5m. lower than expected. Express has been unable to find any data showing what the backlog in assessing tax returns was for this year.

Early 2016 - A new position was created, with the island's first Director of Income Tax Transformation appointed. The Guernsey Press reported that Tim Loveridge wanted "the entire process of dealing with the tax office to be less arduous".

Pictured: The Revenue Service launched in October 2018, bringing together the former Income Tax and Social Security offices in a move aimed at improving both services, while streamlining resources.

October 2018 - The integrated Revenue Service, combining all staff dealing with Income Tax and Social Security, was launched. At the time Express reported that these changes were to be accompanied by organisational restructuring and ongoing work to replace administrative IT systems, and that further integrated services and operational improvements would also be introduced at a later date, with the States saying this included "improving and increasing the service’s online functionality."

April 2019 - A customer survey found 60% of people who had used the island's new Revenue Service were satisfied with it.

September 2020 - The deadline for submitting 2019 income tax returns was extended from November 2020 to February 2021, in recognition of the impact Covid-19 has had on islanders and businesses.

January 2021 - The deadline for submitting 2019 personal tax return was extended further, to March 2021 after the island went back into lockdown unexpectedly in January 2021.

April 2021 - Around 5,500 people were sent £200 fines for submitting their 2019 tax returns late. When those fines were investigated it was found that 400 people had actually sent in their returns before the extended deadline and their fines were rescinded.

January 2022 - The Revenue Service appealed for former staff to return to help clear the continuing backlog in income tax returns. Accountants were also recruited to help clear the backlog. At this time, Express reported that more than three in ten tax returns from 2019 had not yet been processed and some tax returns were outstanding from 2018.

Pictured: Public facing staff at the combined Revenue Service are based at Edward T Wheadon House in the Truchot.

July 2022 - The States said they were making progress in dealing with the backlog with staff aiming to clear the backlog from 2018 and 2019 returns by the end of 2022.

October 2022 - The budget for improving the States' collection of revenue increased by £5million in one-off costs and by more than £1m a year, within four years of the Revenue Service being launched.

January 2023 - Married couples are no longer jointly assessed with wives, or the younger partner in a civil partnership, now legally obliged to file their own tax return.

February 2023 - A number of civil servants were moved to the Revenue Service temporarily to help out after it was revealed that around 1,400 people had been provided with incorrect assessments, with a faulty data transition between an old and new computer system blamed.

The current Director of Income Tax Nicky Forshaw apologised, while the States Chief Resources Officer, Bethan Haines said that: “The days of those backlogs are soon to be behind us because people will get their assessments very quickly and hopefully that will start to restore the confidence that we're on top of this, and that's an imminent change expected.”

Revenue Service staff were still dealing with tax returns dating back to 2020 at least during this time.

Pictured: Guernsey's Revenue Service apologised to thousands of people early last year after admitting errors with tax allowances and coding notices as well as social security contributions.

March 2023 - The deadline for submitting 2022 returns was extended after technical difficulties stopped some people from being able to do them online.

February 2024 - The Revenue Service was reminding nearly 20,000 people to submit their 2022 tax returns as the deadline neared.

April 2024 - The Revenue Service announced that "nearly all of the returns from 2019 have been completed except for a small number of complex cases". It also said that "steady progress has been made towards processing the 2020 and 2021 returns".

Revenue Service apologises to customers who are “rightly frustrated”

Progress on income tax backlog

Revenue Service extends tax deadline

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.