There’s two weeks to go to file tax returns for 2022, with over 19,000 submitted so far.

The Revenue Service is encouraging those still outstanding to file them online through MyGov prior to the deadline on 29 February.

It said over 70% of those received have been done digitally, and using the online portal is quicker to use, process, requires fewer resources, and shortens the backlog.

The Service will host a drop-in session to help the public with the return, provided they bring their own device. It will be at Edward T Wheadon House on 16 February between 08:45 and 16:00.

Paper copies are also available from the building or Frossard House.

2023 returns will be available to complete from early March.

A disclaimer appeared at the top of the tax return page until yesterday morning, warning that businesses were having issues filing documents.

A Revenue Service spokesperson told Express: “A small number of corporate customers reported a minor issue this week, and we quickly responded to their feedback and resolved the issue.

“We have removed the notification on the webpage [yesterday] morning. Most customers are completing their returns successfully without any issues.”

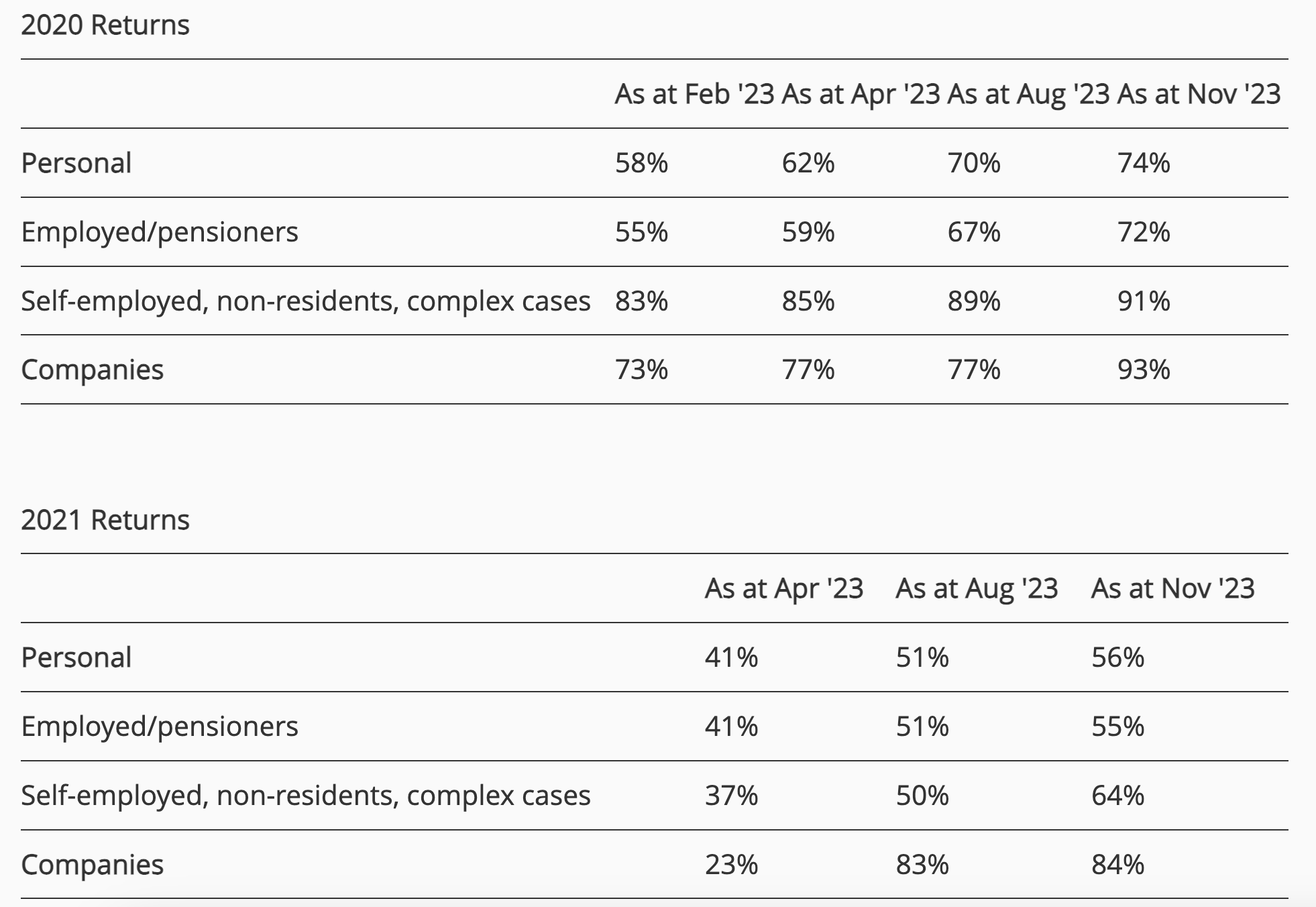

Pictured: Outstanding assessments for the previous two rounds of tax returns.

The States publish updates on the backlog of assessments from previous years every quarter.

In November 2023, between 91% and 94% of all returns had been assessed for the 2019 financial year.

There is still some way to go for returns filed for the 2020 and 2021 years, as shown above.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.