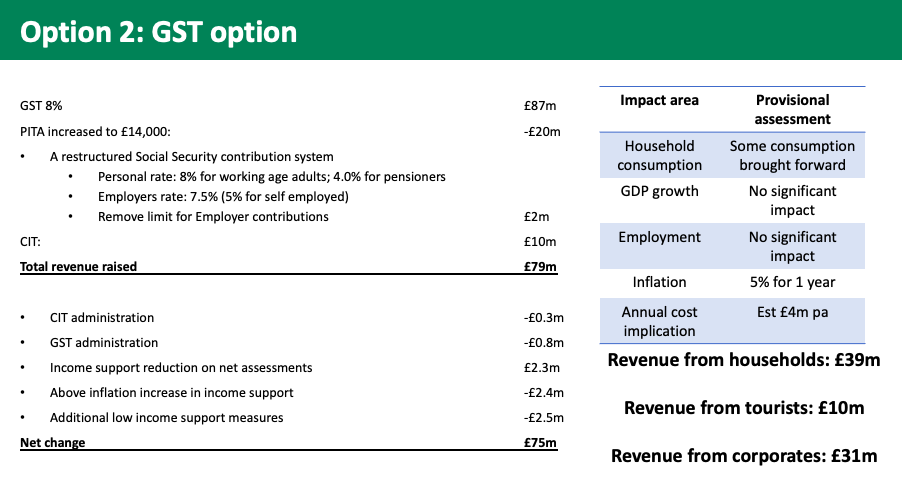

A Goods and Services Tax, increasing over time to 8%, has been earmarked as the "strongest economic solution" to raising more than £70m a year in new taxes.

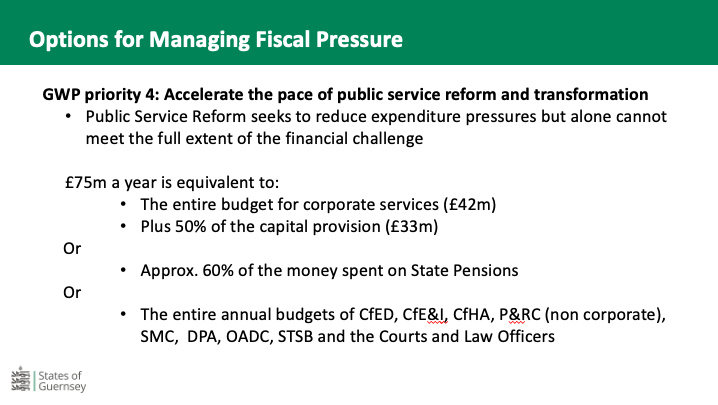

Policy & Resources is leading the States-agreed review of Guernsey's tax base, with mounting, long-term financial pressures forecast to create a revenue blackhole in the region of £70m to £75m.

A steering group has arrived at three options to combat this: a 3% income-based health tax, a GST increasing over time to 8%, or a combination of income-based and consumption taxes.

Each of the three options would also include a restructuring of Social Security contributions and measures to raise an extra £10m annually from corporate taxation.

P&R's Treasury Lead Deputy Mark Helyar, who is heading up the work, said he personally favours a combination of income and consumption tax of the options on the table.

However, the steering group's findings are pointing towards GST, which has loomed on the horizon for years and now appears more likely than ever.

"The final version [of this review] hasn’t been to P&R," said Deputy Helyar of the options being worked up for debate in the States. "Yet the risk and reward analysis ended up favouring option 2."

Pictured: New taxes will need to be combined with accelerated public sector reform and economic growth.

He continued: "Our current tax base is unsustainable. It is uncomfortably narrow with almost two thirds of our income derived from taxes and contributions charged against people’s income.

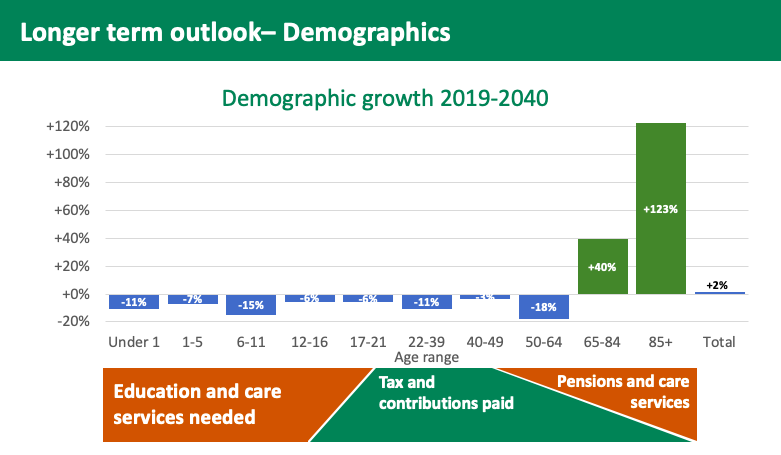

"The number of older people in our community is increasing and so is the volume of pensions and care services they need. We also need a long-term solution to support investment in our Islands’ infrastructure.

“None of these options are a fait accompli. It will be for the States to assess these three options and provide direction as to the path that we should take."

In a presentation alongside States Treasurer Bethan Haines and Liz Laine from P&R, the trio emphasised that Guernsey is almost unique is not having GST.

They said it would diversify the tax base and "economically probably has the strongest case", avoiding an over-reliance on income tax. However, the effect on inflation is a concern and the cost of "mitigations" for people on lower and middle income would be high.

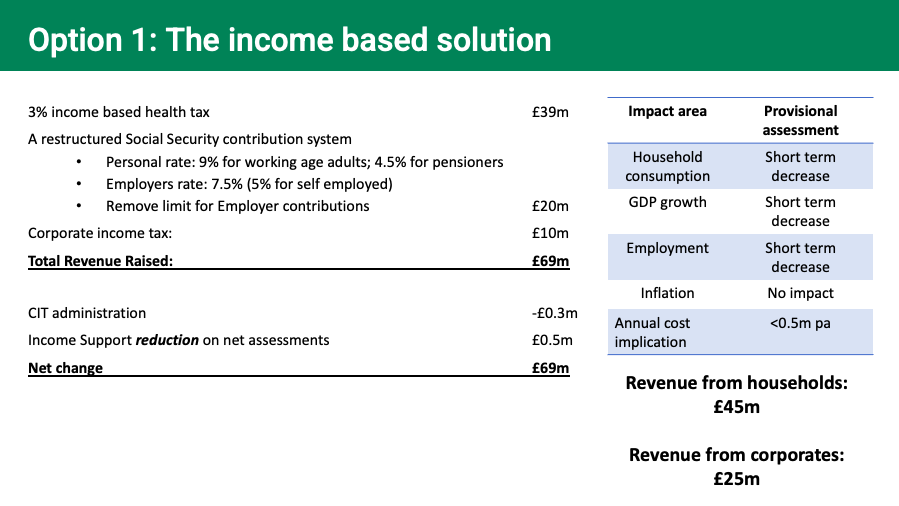

Pictured: Option 1 is classified as a health tax to provide clarity on how that money would be used by the States towards ever-increasing healthcare needs from an ageing demographic.

The proposals are still being drawn up for all three options. These will be submitted to the Greffe later this month as a green paper for debate in the States at the end of September.

It is extremely unlikely that any changes would be implemented before January 2024 at the earliest. In the case of GST, it is expected that it would be introduced at 3% - as was the case in Jersey - and "increase gradually" to 8% with some targeted mitigations and exceptions that are yet to be fleshed out.

These would include increasing personal tax allowances in some form.

Policy & Resources say of the option:

Guernsey is almost unique in NOT having a GST so there are limited competitive issues with introducing one;

It would diversify the tax base away from income tax reliance and will raise revenues from tourist spending;

Is expected to have little effect on labour market and employment decisions;

Would have an impact on inflation for 12 months (about 60% of the rate applied);

Is regressive at low incomes so requires mitigation both from within the tax system and through other means

Pictured: Option 2 is a GST that would, over time, rise to 8%.

An income-based solution is regarded as "simple and progressive" with little inflationary impact. However, there appears to be little appetite for it from the steering group, who say it would:

• Increase reliance on income and working-age population;

• Have the largest potential impact on short term labour/employment market; and

• Have the largest potential impact on consumption

There are also concerns that it would anti-competitive for Guernsey to increase personal taxation compared to neighbouring jurisdictions.

A combination of a lower level of new income tax and GST remains an option to be worked up in further detail.

Pictured: The working-age population is dwindling, creating an environment where a smaller number of people are going to have increasing financial responsibility to fund the population's needs.

Meanwhile, the changes to Social Security contributions would mean that everyone pays a personal contribution at the same rate (with a reduced rate for pensioners) which are assessed on all income.

All contributors would get an allowance, employers continue to pay on earned income only and the self-employed would pay a reduced “employers” rate on their self-employed income.

The proposed restructure also includes the removal of the Upper Earnings Limit for employers, which is £153,000 in Guernsey, which would generate more revenue from these businesses.

When published, the policy letter will ask the States to give direction on the key principles, after which, further development and engagement will take place before the final proposals are presented.

Pictured top: Policy & Resources will present the three options to the States in more detail on 29 September as a green paper for debate.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.