Butterfield's head office has reported the firm's financial results for the quarter ending September 30, which covers the purchase of Credit Suisse Trust in Guernsey, Singapore, and the Bahamas.

The net income for the third quarter of 2022 was $57.4million or $1.15 per diluted common share, compared to net income of $49.1 million, or $0.99 per diluted common share, for the previous quarter and $39.8 million, or $0.80 per diluted common share, for the third quarter of 2021.

The core return on average tangible common equity for the third quarter of 2022 was 31.6%, compared to 27.8% for the previous quarter and 17.9% for the third quarter of 2021. The core efficiency ratio for the third quarter of 2022 was 57.0% compared with 60.2% in the previous quarter and 66.3% for the third quarter of 2021.

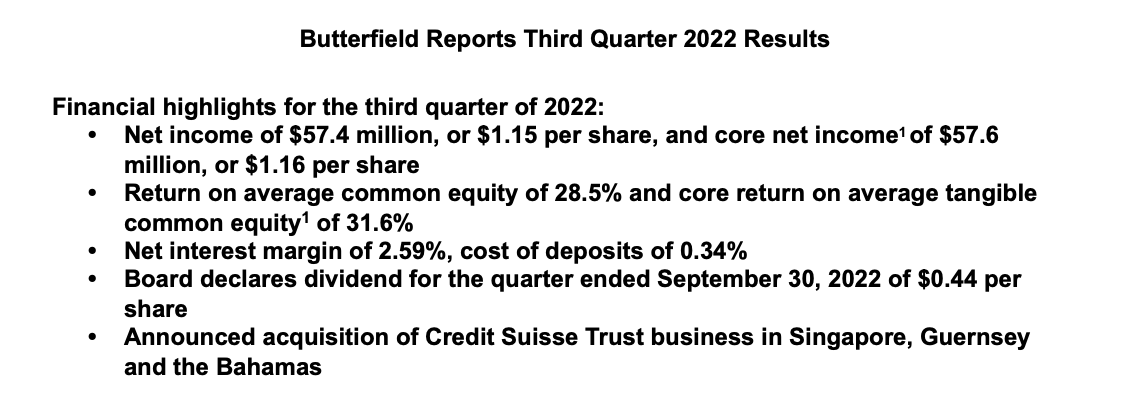

Pictured: The headlines from Butterfield's Q3 results.

Michael Collins, Butterfield's Chairman and Chief Executive Officer, commented: "The Bank posted solid results for the third quarter of 2022, as we continued to demonstrate resilient non-interest income in our chosen operating jurisdictions, while remaining well positioned for the rising interest rate environment. Butterfield remains asset sensitive, which we expect will continue to benefit the Bank during this period of rising market interest rates.

"We regularly monitor and review credit quality in our loan book and, at this point in the cycle, we have not seen any significant signs of credit stress. A number of mortgage customers have moved their facilities from floating rate to fixed rate over the past six months, protecting their cash flow and improving the credit quality of our loan portfolio. As anticipated, we saw deposit levels decrease due to clients investing their funds and the strengthening of the US dollar.

"During the quarter, we announced the acquisition of the Credit Suisse trust business in Singapore, Guernsey and the Bahamas. This strategic transaction will position Butterfield as one of the largest private client trust companies in Singapore. Importantly, this acquisition allows Butterfield to review and selectively acquire each individual trust client in accordance with our risk appetite, without the requirement to purchase legal entities. We look forward to welcoming our new clients and staff as we integrate the business during the first half of next year.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.