With just days to go before Guernsey's politicians have another crack at deciding a way forward for taxation, a fourth option has been added to the list of possibilities.

Deputies Heidi Soulsby and Gavin St Pier, having worked together on their Fairer Alternative plan, met members of Policy and Resources again on Friday to discuss the three options P&R would be putting before the States next week.

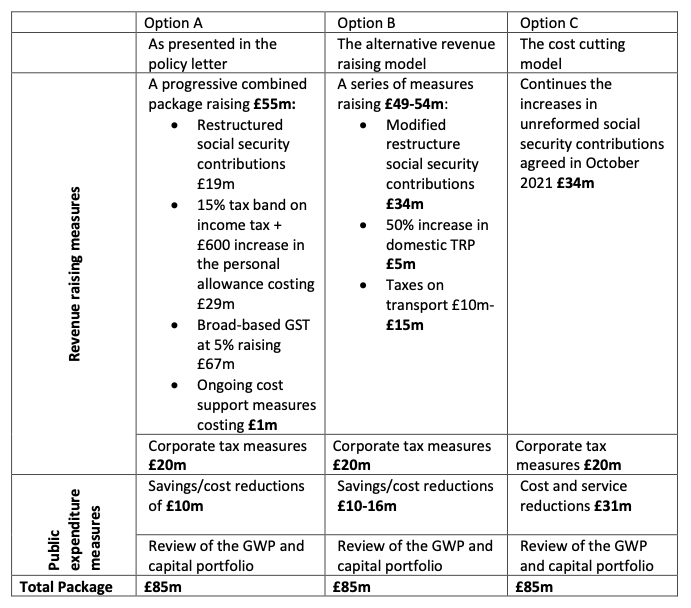

Option A is the original P&R plan, which includes GST. Option B recommends new charges including paid parking and a doubling of domestic TRP among its proposals while Option C centres around large cut backs.

Pictured: P&R's three options - the preferred one is A, with B and C provided as alternatives.

The Fairer Alternative team have put their Option D forward which would see future tax plans split into two phases.

Deputies Soulsby and St Pier had two meetings with P&R this week - one on Monday before Options B and C had been published and one on Friday.

On Friday, the Fairer Alternative duo walked P&R through their 'composite amendment' which includes savings plans, social security reform and revenue raising.

Deputy St Pier said: "When we met on Monday, we undertook to meet again. We walked Deputies Ferbrache and Murray through the current draft of our composite amendment which would pick up all the options that P&R have now tabled, together with a further one of our own, Option D.

"Our package has taken account of the debate so far. We know that there are fairer alternatives," he said.

"We will offer a two-stage approach," he explained. "In Stage 1, we will be seeking agreement on an initial £50m package of expenditure restraint, social security reform and revenue raising.

"Stage 2 will see more work undertaken to lift the stones on controlling spending and alternative revenue sources, including corporate taxation."

Deputy Soulsby has acknowledged over recent weeks that the original Fairer Alternative plan was defeated because personality politics was at play.

However, she is now warning that the States are in danger of deciding nothing after a second Tax Review debate. To mitigate that risk she said the composite amendment offers viable alternatives to what P&R are proposing.

"P&R remain totally committed to their package, including GS, in what is now called Option A," she acknowledged. "However, we agreed that there is a risk that the States could emerge with nothing and so there is a need for other viable options.

"We were pleased that whilst they prefer their GST-led package, they recognised that we have a credible alternative. We agree that there are real long term financial challenges for which the Staes needs to plan, but we remain of the view that the case for GST simply is not proven at this stage.

"We need to build the community's confidence that we are taking action to address the root causes of the long-term deficit. For example, the work that has already been done to remodel our health and care system needs to be implemented."

Tax challengers unconvinced – fresh amendment expected

Case made for alternative course of action on tax

Alternative tax package promises greater States savings

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.