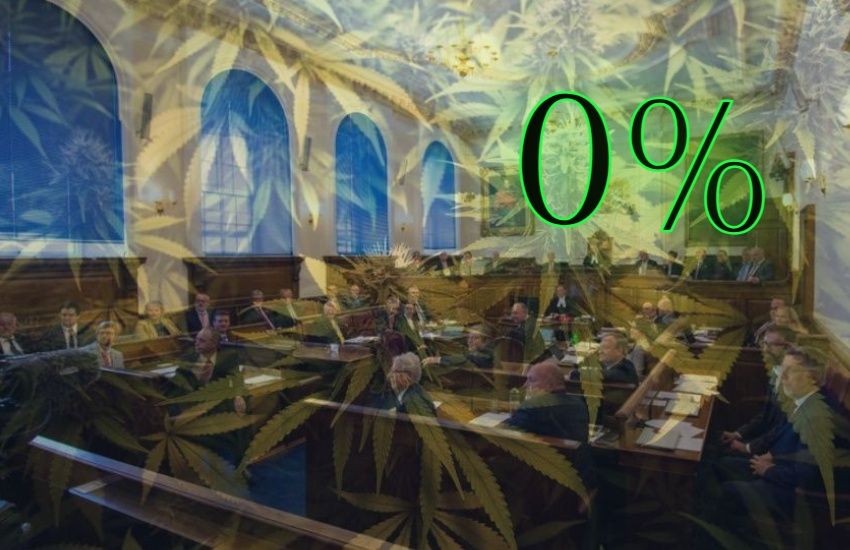

Two senior politicians want to reduce the rate of tax applied to cannabis cultivation and other income generating activities from 20% to 0% “to encourage more development in this sector”.

Deputies Neil Inder, President of Economic Development, and Mark Helyar, Policy & Resources treasury lead, are seeking an amendment to the 2023 budget to this effect.

They note the local medical and CBD industry “is in the early stages of development” and therefore they're suggesting removing profit taxes from the licensed production, processing and “any other licensed activity or use” of cannabis products.

The new tax framework would be effective from January 1 2023 until 2028 if the amendment is successful and if the 2023 budget is passed by the States Assembly.

One major player in the local medical industry has welcomed the prospect, telling Express it will allow Guernsey to be more competitive in the international market.

The amendment and budget are set to be debated by the States from Tuesday next week.

Pictured: Guernsey’s cannabis industry has got off to a rocky start.

Greg Dobbin, Chief Executive of 4C LABS (one of the only local firms licensed to cultivate cannabis), said the reduction in taxes would increase “the industry's competitiveness internationally and improves competitiveness particularly in contrast to Jersey and the UK”.

He added that investor confidence could also improve as it shows the States of Guernsey’s willingness to create these competitive tax structures.

Mr Dobbin said: “Broadly, the States of Guernsey senior politicians have done an excellent job of creating a durable framework for the Medical Cannabis industry. The Bailiwick of Guernsey Cannabis Agency is an example of the States level of attention to detail in this file.

“But we are at a disadvantage with regards to the power, shipping and labour costs in Guernsey relative to other jurisdictions. Guernsey is a more expensive place to operate based on the above and that is why a revision of the tax structure is important as it will enable us to be more competitive.”

He said any money saved as a result could offset prices and be reinvested into the local operation.

"At 4C LABS we have a long term view of the road to success in this industry, the senior politicians in Guernsey understand what it will take for both our company and Guernsey to be successful in this industry and have once again demonstrated their support through this new proposed tax framework."

Pictured: Greg Dobbin welcomed the prospect of lower profit taxes.

Express broke the news in January that several growers claimed to be in a dispute with another cannabis company, The House of Green, after it failed to obtain the necessary licences to cultivate and store large quantities of the plant.

The cultivators said they had been left £0.5m out of pocket for the product. The market value of the product has since been disputed by The House of Green.

Shortly afterwards, James Smith – Chief Revenue Officer at 4C Labs – commented that the process for obtaining licenses was an “overwhelming process” with “a lot of rules and a lot of regulation”.

In August 4C were granted licenses from the United Kingdom to import and distribute cannabis products internally and externally.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.