Ongoing recruitment challenges are adding to the heavy workload on Revenue Service staff as they continue to work their way through the income tax backlog.

However, Express has been assured that the backlog does not impact the island's wider revenue and budgeting forecasts as the Revenue Service is also dealing with the tax codings and estimations which feed into those figures.

Nikki Forshaw, Director of the Revenue Service said work is ongoing to reduce the backlog - with some returns from 2020 still waiting to be assessed - and that increasing the number of tax forms submitted online will help reduce that backlog in the future.

She said the backlog has grown due to a number of other factors too.

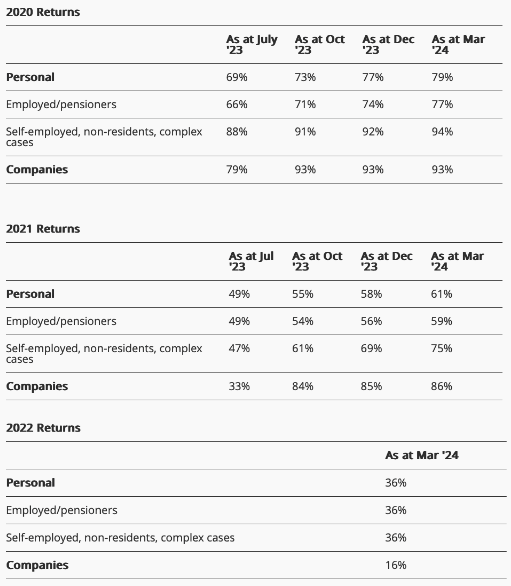

Pictured: The latest statistics show that the backlog is reducing from 2020 onwards but the progress appears to be slow moving.

"We do understand people's frustrations," said Mrs Forshaw, "the team are working as hard as they can to respond to customer queries, along with other tax authorities around the globe.

"We do experience peaks around the filing deadline, I think we had over 50% of the returns filed in the last two months leading up to the filing deadline, so it's a combination of factors, I think some resources were diverted during COVID and there was a period where we were only able to recruit on short term contracts during that time.

"And also, it is just a very difficult environment to recruit into at the moment. And we have been carrying about 12% vacancies for some time now.

"There is a lot to the work we do, and there's quite a lot of in the international space that we're involved in such as Moneyval, and the introduction of Pillar 2 coming in and secondary pensions. So there's quite a lot of other activities that do sit within the Revenue Service."

Despite all of these challenges, Mrs Forshaw said work is always ongoing to tackle the backlog of income tax returns with progress being made constantly.

Pictured: Nicky Forshaw, Director of Revenue Service.

"We've taken a number of steps to help reduce the backlog," said Mrs Forshaw - who stressed the importance of online returns to speeding up the process overall.

"One of those is encouraging more people to file online. The more people that file online, the more efficient the assessment process is. It's quick to process and it can give customers an immediate assessment, and it prepopulates their information for the next year.

"So what we're looking to do is enhance how we process those online returns, because some customers when they file, they can get an assessment within a couple of days of having filed online, so that's a real positive."

With an increased number of tax returns expected to be filed for 2023, Mrs Forshaw has said that a recent rule change won't mean an automatic increase in the backlog either.

Married couples must now submit individual returns, which Mrs Forshaw says will actually ease pressures in other ways.

"At the moment when individuals marry, separate, or change their circumstances, all of that is manual work for the Revenue Service.

"We have to make sure that the ETI has come in with the correct marriage reference rather than the single reference and things like that. So we do anticipate that as that extra work falls away there'll be capacity to process the separate returns.

"I don't think people realise quite how much manual joining up and separating of individuals that creates for the system."

Pictured: 2023 tax returns must be submitted by 31 January, 2025.

Mrs Forshaw said half of tax returns for 2022 were submitted within the last couple of months before the deadline - as opposed to during the prior ten months.

That in itself isn't a problem, said Mrs Forshaw, who explained that delays may arise when people then need help filing their return close to deadline day.

"There's a number of people looking for support in filing those returns, and it means we're having to send out a huge number of reminders, which do generate queries in themselves. So it does create a peak."

For people who have simple tax returns, an assessment can be sent out quickly after an online return is filed, said Mrs Forshaw - who is also hoping to expand that service further to incorporate even more returns.

"We are looking to expand the sort of income types that the system can automatically assess, because if you've got double tax relief, or you're only resident partway through the year, at the moment the system can't give you an automatic assessment on that basis. But if you've got fairly straightforward affairs, and you're filing regularly every year and you haven't got any outstanding forms, you can submit in the morning, it can be processed overnight, and you can have an assessment in the post the next day.

"So not everybody is going to fall into this backlog and that's actually something that we really need to clear up."

Nonagenarians taking to the net

Push to do online returns continue

Revenue paid £600k+ in late repayment 'interest' in 2023

Public urged to avoid filing 2023 tax returns just before the deadline

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.