It cost the States of Guernsey £631,107 in compensation payments in 2023 due to the Revenue Service not repaying customers in a set time frame, a figure which has tripled since 2021.

In response to a series of questions, the President of Policy and Resources explained that a supplement is paid by the Revenue Service where a repayment is due to a customer “and it is not made within one year of the Revenue Service having received a fully completed tax return”.

Deputy Lyndon Trott said further supplements are due for every following six months the repayment isn’t made.

This has led to repayment supplements topping £400,000 in 2022 and reaching £631,107 in 2023.

The figure was £195,143 in 2021.

Deputy Trott did argue that the increase between 2022 and 2023 is accounted for by two large corporate repayments.

Deputy Steve Falla asked the original Rule 14 questions and has since commented on the answers he received: "My concern is that this is taxpayer's money being paid in interest back to the people who've overpaid," he said.

"This is a consequence of a Revenue Service in disarray... while I do have sympathy with Revenue Services... it looks like the situation is going from bad to worse."

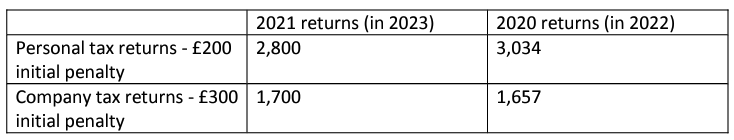

Deputy Falla was seeking answers to a series of questions on £200 fixed penalty notices, and other tax related issues.

He asked how many £200 fixed penalties were imposed in 2022 and 2023, to which he was provided the following table:

He also asked “how many £200 fixed penalties were later not pursued after the taxpayer had evidenced they had indeed filed a return?” due to members of the community approaching him with that exact scenario.

In response, Deputy Trott said:“Penalties may be rescinded for a variety of reasons, not just where the taxpayer has evidenced submission of a return, therefore this data is not available."

Deputy Falla said the fact his question wasn't actually answered is disappointing.

It was also revealed that the interest rates for surcharges and supplements isn't currently scheduled for review.

You can read the full Q&A ONLINE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.