The Guernsey Party will try to stop tax rises hitting those who earn between £80,000 and £89,999 per year in the States next week.

The Policy & Resources Committee want to reduce the threshold at which personal income tax allowances are withdrawn from £90,000 to £80,000 as part of tax changes to be voted on by politicians at their early November meeting.

If agreed, these changes would come into force from 2024.

But Deputies John Dyke and Simon Vermeulen want to see no further reductions in the threshold for these allowances, which have been gradually withdrawn from around £139,000 since 2017.

By 2019 the withdrawal threshold had been reduced to £100,000, further reducing to the current £90,000 limit at the start of 2023.

The pair expect this to reduce the anticipated revenues for the States in 2024 by £1.5m. If the amendment and others, such as attempts to stop large increases in domestic TRP, are successful it will seriously limit the States’ ability to raise new revenue next year.

This is while government spending is forecast to rise by 1% in real terms in 2024

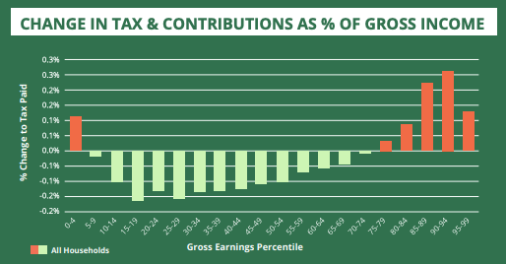

Pictured: P&R hope to raise an additional £2.2m in revenue next year through a reduction in allowances, and other tax rises such as TRP and duties on fuel, alcohol, and tobacco.

Presenting the draft budget last month, Deputy Mark Helyar said lowering the income tax allowance would ensure high income households pay more, but in a way that doesn’t make the island’s tax system uncompetitive.

“Anybody who earns over £80,000 in Guernsey would start to have their allowance withdrawn for everything they earn over that amount… it’s not commonly understood by the public that people who earn large amounts don’t get any tax allowances.” he said.

“They pay 20% up on the ground up on every penny they earn.”

The amendment is the fifteenth amendment to P&R’s budget, with an expected four-day debate to begin on 7 November.

Pictured (top): Deputies John Dyke and Simon Vermeulen

The draft budget - at a glance

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.