High earners and those with more land will bear the brunt of Policy & Resources’ proposed tax increases in 2024, with around three quarters of households estimated to pay less as a percentage of their income.

But new revenue raising measures for government will square up with the continued spending demands of States committees, with spending set to increase by 1% in real terms next year, based on the draft 2024 Budget Report published today.

This is despite Policy & Resources demanding that every department find annual savings of up to 2.5%.

Presenting the budget, Deputy Mark Helyar, Vice-President of P&R, said the projected financial position of the island for the coming year is “not as bad as it could’ve been” but warned there are “significant variables in this budget” with a shortfall of £13m predicted after depreciation of States assets is factored in.

Deputy Helyar said the “extremely difficult financial situation” will not be resolved by measures in the yearly budget and turned to his political colleagues to make responsible choices in the separate Funding & Investment plan debate next week.

That will determine what the projects the island wants to do and how it will pay for them, such as major infrastructure projects, wider reforms to the tax system, and whether to borrow hundreds of millions along the way.

“But we’re looking to do what we can to minimise the deterioration of our financial position in 2024, while not impacting people on lower and middle incomes,” he said.

The draft budget includes £5m worth of savings, but Deputy Helyar said if more is to be found “it requires all deputies to make strides to look at areas where they can cut services”.

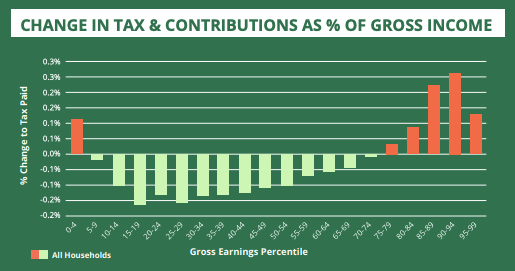

Pictured: P&R says the increased tax liability in the lowest income households is down to TRP increases for those 'asset rich' but 'cash poor'.

· Inflation-matching increase to the personal income tax allowance to £13,900.

· Removing income tax allowances for individuals earning £80,000, down from £90,000.

· Upping the tax caps to £160,000 for non-Guernsey income, and £320,000 for worldwide income. Xx

· Large hikes in all forms of TRP, including disproportionately high charges for unoccupied or derelict properties and land for commercial parking.

· New TRP bands for smaller domestic properties with bespoke rates based on the rate of inflation.

· Inflation-busting increases to booze and tobacco duty; 3.3p on a pint, 14p on a bottle of wine, and 62p on a packet of 20 cigarettes.

· Fuel duty raised in-line with inflation; 3.2p on a litre.

· Mortgage interest relief phase out paused again due to raised interest rates and high market value of homes.

· Increasing pension contributions relief protected from withdrawal to £2,500.

Pictured: Smokers could see a whopping hike in duty if the budget is approved next month.

The draft 2024 budget says that “the overall impact of these changes would result in a small improvement to the financial position of the majority of lower- and middle-income households.

“These households will benefit from the increase in personal income tax allowance, which will be greater than the additional amount that they would pay via Social Security contributions and TRP.”

Deputy Helyar said increasing the tax caps and lowering the threshold at which the personal income allowance is withdrawn would ensure high income households pay more, but in a way that doesn’t make the island’s tax system uncompetitive.

“Anybody who earns over £80,000 in Guernsey would start to have their allowance withdrawn for everything they earn over that amount… it’s not commonly understood by the public that people who earn large amounts don’t get any tax allowances.” he said.

“They pay 20% up on the ground up on every penny they earn.”

The increase in pension relief on contributions is to prevent eroding the value of it in real terms, as money would be paid out as a benefit, taxed, and then recuperated, he added.

You can read more about P&R’s proposed changes to property taxes HERE.

The budget will be debated by the States in November.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.