Sophisticated scams, bank account closures, pension plan transfers and insurance for boiler repairs are among the growing complaints from consumers landing on the desk of the Channel Islands' key financial complaints body.

The Channel Islands Financial Ombudsman, a pan-island independent dispute resolution service, saw its case load increase by a fifth last year, as the world emerged from lockdown and new issues emerged.

According to the CIFO, fraud complaints "sadly increased" during the pandemic "as less technology savvy individuals were suddenly forced into the online and payment worlds as fraudsters lurked, taking full advantage of the situation".

It added: "Further complicating things, email as a means of communication is now widely recognised as not being secure. Fraudsters have hacked the accounts of businesses or their customers and waited for an opportunity to substitute fraudulent payment instructions to divert large payments for such things as home purchases or significant investments."

A case study below, provided by the CIFO, illustrates the point.

When it comes to account closures, the CIFO is seeing a "resurgence" of mass account closures by financial services providers. It also found that, during covid, some people struggled to meet their bank's request to provide proof of ID and residency.

Most cases investigated by the financial ombudsman last year went the way of the service provider rather than the complainant.

In 2020, almost 60% of complaints investigated by CIFO were 'won' by the individual making it - however, this dropped to 45% last year.

269 case files were opened last year, an increase of 20% from the previous year.

However, 360 case files were also resolved last year, more than double the number in 2020.

The most common issue in the 269 case files was poor administration or delay with 106 (39%). Non-payment of insurance claim was the second most common issue with 43 (16%). Complaints about fees and/or charges was the third most common issue with 33 (12%).

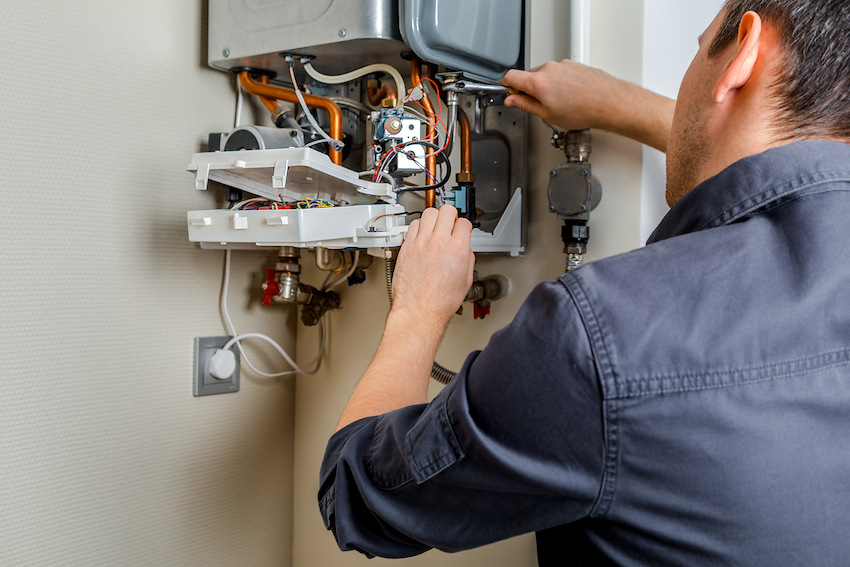

A notable number of enquiries and complaints arising at the CIFO’s door related to home emergency insurance claims - for example, boiler repair insurance - and payment fraud. The home insurance complaints mainly involved firms based in Guernsey, which has a far larger insurance market than Jersey.

Pictured: The CIFO received a number of complaints about boiler repair insurance, which mainly related to financial services providers in Guernsey.

Most Jersey-related complaints related to banking.

The CIFO is the independent dispute resolution service for unresolved complaints involving financial services provided in or from Jersey, Guernsey, Alderney and Sark. Complaints can be brought by any individual consumers and small businesses from anywhere in the world, plus certain local charities.

It awarded a total of £701,610 compensation in 2021, with an average of £4,585 compensation per case that warranted a monetary award.

Emerging issues last year included ‘authorised push payment’ fraud; complaints about bank account closures; pension plan transfers and pension trustee responsibility; and investment losses.

Of the case files that were resolved in favour of the complainant and involved financial compensation, the largest award for compensation was £104,351. The lowest amount awarded was £20.

The CIFO has shared a number of real-life case studies, which illustrate the wide range of issues it deals with.

For example, ‘Mrs A’ invested £75,000 with a bank, which recommended a single diversified investment product for her to invest in, on which the bank forecast would pay interest of 3% a year - or £2,250 per annum.

Less than a year later, Mrs A visited the bank to check on the value of her investment and was told the value of her investment had dropped due to market turmoil arising from the covid outbreak.

Mrs A decided to withdraw her funds and incurred a £6,000 charge for surrendering the investment only 10 months into a 10-year fixed investment plan.

Mrs A made a complaint to the bank as she felt that the covid outbreak was prevalent in the news at the time she invested and the bank should have advised caution against investing at such a time.

She also felt that, as she was only offered one product, the bank had used ‘hard sell’ tactics to coerce her into investing in that specific option.

However, the CIFO found that the bank had acted appropriately, nobody could have foreseen the impact of covid on the markets and the complaint was not upheld.

In another example, a bank customer, ‘Mrs Y’, lost her funds from a joint account with her spouse after authorising online payments to a fraudster who was inciting fear by pretending that the customer’s bank accounts were under threat from criminals.

In January 2021, Mrs Y received a ‘vishing’ phone call from a fraudster claiming that her funds were in jeopardy from criminals who had accessed her joint accounts.

The fraudster told Mrs Y to make various payments throughout the day to move, and thereby safeguard, her money. The fraudster instructed Mrs Y not to contact anyone or use her mobile phone during the interaction, which lasted most of the day.

Mrs Y, who was in a state of shock and fear, was first instructed by the fraudster to make a payment of £20,000 to a bank account in the UK, which Mrs Y’s bank intercepted.

Mrs Y’s bank contacted Mrs Y as they believed it to be fraudulent, but Mrs Y was told by the fraudster to tell the bank that the payment was genuine. Having received her assurance, the bank then proceeded with the transaction as instructed.

The fraudster continued to terrorise Mrs Y on the phone by warning her that the criminals were still in her joint accounts. The fraudster then instructed Mrs Y to make another online payment of £25,000 to a different UK bank account and that transaction went through.

Later that afternoon, Mrs Y was again instructed by the fraudster to authorise two more transactions, each for £25,000. Both payments were intercepted by the bank and neither went through.

When Mrs Y’s husband was alerted later that day, he tried to contact the bank but could not get a response. When Mr Y finally reached the bank, they assured him that the first transaction of £20,000 was still being held for fraud checks.

However, the bank had in fact already completed this transaction, along with the second transaction of £25,000 - meaning that £45,000 had been transferred to the fraudsters.

The bank was able to recover approximately £17,000 of that, leaving Mr and Mrs Y with a loss of around £28,000.

Mr and Mrs Y complained to the bank asking to be reimbursed, but the bank declined to do so. The bank did, however, agree that they had provided incorrect information to Mr Y on the phone and offered a distress and inconvenience payment of £300. Mr and Mrs Y rejected that offer and brought their complaint to CIFO.

The CIFO investigated and noted that the first transaction had been stopped because the beneficiary’s bank account in the UK was on a UK banks’ watch list – which the Channel Islands bank had access to.

The CIFO also noted from the bank’s recording of the first transaction call that the fraudster’s voice could be heard at the very end, instructing Mrs Y to hang up.

The CIFO felt that the bank should have noted that and been put on notice of potential fraud as it could reasonably have been feared that Mrs Y was potentially acting under duress, partly from hearing the fraudster’s voice on the call but also more generally from the content of the call and the answers Mrs Y gave to the bank’s questions.

This was even more concerning as the bank had intercepted the first attempted payment because of concerns about the beneficiary account.

Had the bank recognised these signs and made more enquiries (possibly including contacting Mr Y who was also a joint account holder) before releasing the first payment, CIFO concluded - on balance - that the fraud would have been uncovered and no additional payments would have been made.

The CIFO upheld the complaint and recommended that the bank compensate Mr and Mrs Y for the amount which had not been recovered from the beneficiary banks, plus interest at an annual rate of 8% simple, plus a distress and inconvenience award of £500 – in total, about £30,000.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.