The 2020 general election was dominated by two issues: secondary education closely followed by tax and spending. There was a clear swing to candidates favouring a 'three school model', efficiency savings and no tax increases - especially no goods and services tax [GST].

Then, having been elected, the States celebrated their first anniversary by enthusiastically agreeing a 'four school model'. Now, to celebrate their second anniversary, the senior committee, Policy & Resources, has unveiled proposals to raise taxes by around £60million a year - including through a 5% GST - having already overseen the largest increases in States' spending for two decades.

So much for island wide voting promoting more accountability in deputies and giving electors a greater say over States' policies.

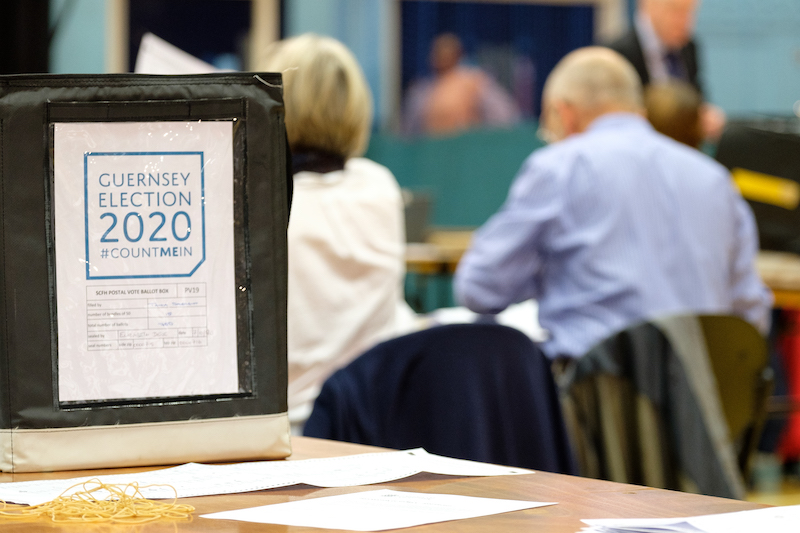

Pictured: Voters who at the 2020 general election backed candidates opposing tax increases could be forgiven for their surprise at the Policy & Resources Committee's current plan for additional taxes of around £60million a year.

Anyone with even a passing interest in local politics who isn't blinded by hatred for previous States' Assemblies can see that this Assembly, alongside doing some good things, has more than its fair share of members who have what Deputy Mark Helyar recently referred to in a States' meeting as "a thin skin".

There's a surprisingly large cohort of them who don't only dislike scrutiny or criticism, but deeply resent them, and frequently bear a venomous grudge against anyone who isn't sufficiently sycophantic.

They are especially offended by journalists and others who have the audacity to invite their explanations for the chasm between what they pledged at the election and the opposite policies they now support - especially on tax and spending.

Some simply won't engage on the issue. Those who do typically say circumstances have changed in the past two years, though patently they haven't. Prior to the general election, the States' Treasury was projecting an annual deficit of at least £80million a year, and now the States' Treasury is projecting an annual deficit of at least £80m a year. If anything has changed, it's that costs associated with the covid-19 pandemic were considerably lower than feared two years ago and a cost of living crisis has emerged since, which makes the prospect of tax rises even more painful.

The about-turn on education - from pledges for a 'three school model' to votes for a 'four school model' - could be largely glossed over because of fatigue with the issue and [as I well know of course] dislike of the 'two school model' it replaced. But there's no such wiggle room on tax and spending - no unpopular policy to replace, no public or political fatigue, no profession in the background holding all the aces but hesitant to play them to defeat a fourth model in the space of just six years.

So an Assembly containing so many deputies consciously elected to drive out inefficient spending and prevent tax rises faces a real problem persuading the island that efficiency savings were a mirage and GST is unavoidable without savage cuts to front line services.

Pictured: The Policy & Resources Committee has a rational case for its tax plan but a huge challenge to convince voters and fellow politicians.

None of this means that the Policy & Resources Committee's tax plan, including GST, is unjustified or unnecessary.

There is clearly a rational case to be made for it: the States currently collects far less tax than comparable jurisdictions; costs were bound to increase, especially on healthcare and pensions, as baby boomers aged; the tax plan put forward appears to leave at least half the population no worse off financially than they would be without it; and why should we imagine that Guernsey can continue to be one of the tiny number of places in the world without a broad-based consumption tax?

The public, on the whole, is sceptical. Sceptical that the States have found all the efficiency savings they should have. Sceptical that the right time to be agreeing GST is when inflation is at a 30-year high. Sceptical that all the tax is being collected that could be collected from 'others', by which most people mean companies owned by non-residents and the very wealthy. Sceptical that a starting rate of 5% won't soon become 8%, which Policy & Resources actually put to the States a little over a year ago, or 10% or however many per cent becomes necessary to sustain the high-spending habits of populist deputies who can't resist any energetic lobby group.

Enough public opposition would probably make Policy & Resources' tax plan what the late Deputy Dave Jones used to call "dead on arrival" in the States' Assembly at the end of January. How much is enough?

The largest petition of recent years - which would require about 6,000 signatures - and a march of perhaps half that number could well be enough to get the tax plan at least kicked into the long grass for the clichéd further consultation so beloved of indecisive politicians. A petition closer to 10,000 and a march of half that number would probably get the States to throw out the tax plan or even - don't bank against this, given its record thus far - persuade the Policy & Resources Committee itself to withdraw the plan to avoid the inevitability of defeat in the Assembly.

Public scepticism is already well past these levels. But it is not inevitable that public opposition will reach them in the form of overt campaigning, signing petitions, marching, attending public meetings, emailing or calling deputies, protesting on the steps of the Royal Court and the various other methods which in recent times succeeded in turning the tide against, for example, incinerators, school models and paid parking.

Pictured: It will be a few weeks before the depth of open public opposition to Policy & Resources' tax plan becomes clear.

Let's assume for a moment that public opposition is significant but not so overwhelming as to make the tax plan "dead on arrival". At that point, the politics of the current Assembly would become decisive.

The tax plan, which should obviously be led by the treasury lead, Deputy Mark Helyar, is now unexpectedly being led by the two Peters - Deputy Peter Ferbrache and Deputy Peter Roffey. Whether one thinks their judgement in this matter is right or wrong, they deserve immense credit for having the courage to front what they know is a deeply unpopular policy which they sincerely believe - and it is sincere - to be in the island's best long-term interests. Neither foolishly went into the 2020 election promising no more taxes, let alone tax cuts, and therefore they can lead the tax plan with straight faces.

There are echoes of the zero-10 tax debate of the mid-2000s. A senior committee with an unpopular tax plan bolstered by the support of Deputy Roffey, whose political instincts might have been expected to lead him into opposition. On that occasion, he helped pull around half a dozen of the more centrist, liberal members of the States, and that was enough to get zero-10 over the line.

And this Policy & Resources Committee usually starts States' debates with the greatest advantage of any senior committee of modern times: the instinctive loyalty of just over half the Assembly. And some of those loyalists who would have spat out 'tax' as if it was a four-letter word on the election campaign trail have already made speeches preparing the ground for a shift to become oh-so-reluctant tax and spend merchants.

On the other hand, on the 'backbenches' there is a group of under-employed 'big beasts' waiting to tear down the tax plan: certainly, Deputies Charles Parkinson, Heidi Soulsby and Gavin St. Pier, and possibly Deputy Lyndon Trott. I haven't added it up, but I wouldn't be surprised if between them they have steered through the States 10 or 20 times the number of difficult and divisive policies which the five members of the Policy & Resources Committee have managed.

Pictured: Earlier this year, Express reported that Deputy Charles Parkinson (left) said the Policy & Resources Committee should resign if it tried and failed again to secure States' support for GST. The spotlight is now partially on Deputy Parkinson and like-minded colleagues to produce an alternative tax plan ahead of the States' debate expected at the end of January.

The coalition which on material votes usually provides the Policy & Resources Committee with a majority is an eclectic mix of deputies and Alderney representatives, but essentially it contains two wings: one is relatively ideological with mostly sincere beliefs about lower taxes, less spending and smaller government and the other is primarily populist without too many political principles but a fierce determination to be on the winning side.

The task the Policy & Resources Committee faces, in pure political terms, is convincing enough of these two sides of its normal coalition that voting for tax increases of around £60m a year, including GST, means neither conceding on the principles of small government nor inevitable unpopularity the next time the island goes to the polls.

If the Committee can pull that off, it will have achieved the single most impressive political victory since, in 1994, the States scrapped the stabilising presence of Conseillers in their original form.

It would be unwise to write off the Committee's chances of pulling it off, such is the depth of unity among its normal majority coalition.

However, even if the Committee can get its tax plan through the States, it faces the challenge of putting GST in place before the next general election, and that may be an even tougher proposition.

P&R's "tribalism and inexperience" led to Dep. Soulsby's resignation

Former Vice President reveals opposition to P&R tax plans

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.