Proposals are out today for the largest changes to personal tax in decades.

The Policy & Resources Committee wants a new goods and services tax [GST] at a rate of 5% on almost all purchases and an increase in social security contributions to 8.5% for employees, 8% for employers and 14.5% for the self-employed.

But it also wants to cut income tax to 15p in the pound on income up to £30,000, increase the personal tax allowance by £600 and introduce a personal allowance on social security contributions at the same level as the income tax allowance - currently around £13,000.

The Committee estimates that its proposed changes would boost States' income by £55m a year. Around £23m would come from households, £27m from businesses and the remainder from visitors and other non-residents.

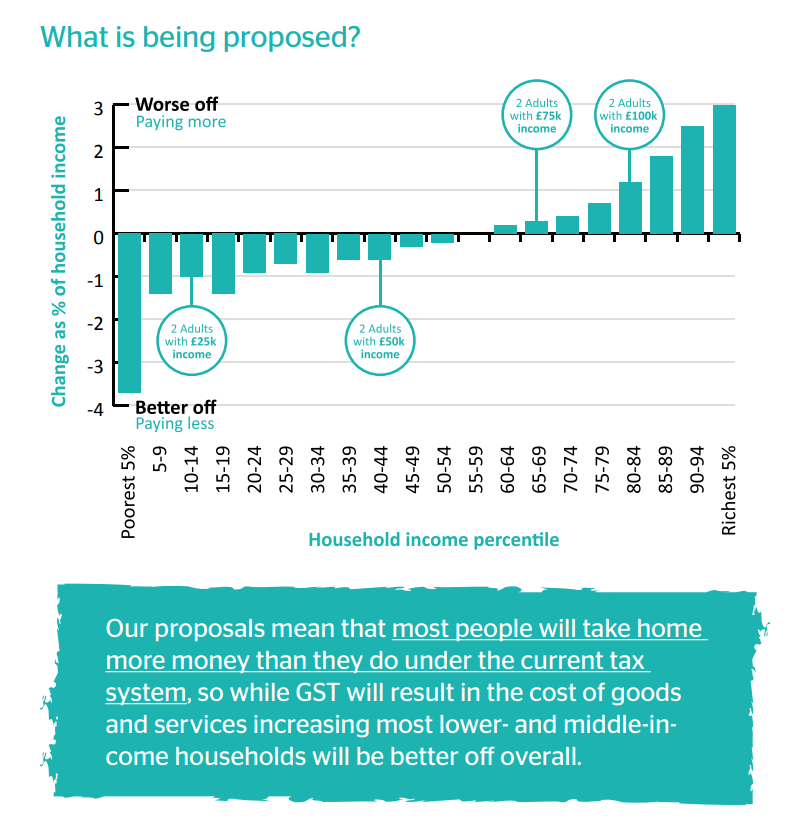

The Committee insists that its tax package is fair and progressive. It says the overall effect of the changes would leave most families better off with only the most affluent 40% of households paying more.

The long-awaited proposals should finally be debated and voted on by the States' Assembly at the end of January 2023. If approved by States' members, the Committee hopes the changes will be in place before the next general election in June 2025.

Pictured: Households will face GST of 5% on almost all purchases from 2025 if the States agree at the end of January, but the Policy & Resources Committee says most families will be better off because of other measures in its tax package.

Unveiling the proposals, the Committee's President, Deputy Peter Ferbrache, said: "The States have already decided that there has to be an increase in taxes. Nobody really wants that. Nobody is desirous and punching the air that we've got to have that. But our position in relation to the tax situation is very difficult indeed. We've got a structural deficit."

The Committee first suggested substantial tax increases in the summer 2021. Since then, it has projected a funding gap in States' finances of between £55m and £90m. Deputy Ferbrache said his Committee is now projecting an even larger deficit beyond 2025 of up to £110m a year plus £20-30m a year in rising long-term care costs.

"The main expenditure for the States – and there is not much the States can do about it, much as the States might wish to – is on healthcare and pensions," he said. "The working population has shrunk and people are living a lot longer…in health costs, on average, a 70 year old costs four times more than a 35 year old."

Deputy Ferbrache said he had a duty to deliver a difficult message: that people in Guernsey are not paying enough tax to maintain public services at the standard expected.

"We’re looking to raise £50-60m a year in taxation spread between business, households and visitors," he said. "If, pro rata, we had the same percentage [of tax collection] as Jersey, we would have just over £100m a year more in tax. I know nobody appreciates this, but we are undertaxed compared with our neighbouring jurisdictions.

"So we have to make these proposals. If approved by the States, there is going to be a mixture of tax increases, cost cutting and hopefully extra income from the economy."

Pictured: Deputy Peter Ferbrache said that people in Guernsey have been "undertaxed" for a long time and would be paying £100m a year more if tax was applied at the same rate as in Jersey (above).

Deputy Ferbrache said he expected public and political debate to be dominated by the proposal to introduce GST at 5%. But he urged people also to consider the raft of other measures being proposed and to remain open-minded about the whole package.

"The recommendation is 5% GST as part of the package. We know it is potentially a regressive tax and, therefore, there are various things we are going to do – personal allowances will be increased…income support and pensions will be increased...there will also be a lower income tax band of 15% on income up to £30,000...and a new personal allowance on social security contributions. GST of 5% is part of an overall package.

"Most lower- and middle-income households will be better off. We don't pretend they're going to be much better off because the idea is to increase taxes, but at least they won't be worse off, which is the best we can do. The burden will fall, as it should, on those who can afford it more.

"You’ve got to get to percentile 60-64 [the most affluent 40% of households] before you are worse off under these proposals. At that level, you are slightly worse off. You’ve got to get two adults with an income of £100,000 before you are more than 1% worse off. Quite rightly, the richest 5% will pay the most."

Pictured: This chart, contained in a leaflet being delivered to all households from today, sets out the effect of the tax package on all households based on their level of income.

The Committee has delayed putting its tax plans to a vote in the States' Assembly on several occasions. In October 2021, it asked deputies to back GST in principle, but withdrew the proposal when it became clear during debate that it would be heavily defeated if pushed to a vote. It committed to taking its plans back to the States by July this year, but instead commissioned a review of company taxation. It intended to lead a States' debate in the fourth quarter of this year, but now hopes to do so in January next year.

Deputy Ferbrache said it was important to the Committee that its proposed tax changes, including GST, are introduced before the end of the States' term, partly in the hope of avoiding a single-issue general election in June 2025.

Asked if he was confident that the timeline was achievable, Deputy Ferbrache said: "All I can say is that the advice we've received is that we should be able to do it by then. I can't give a guarantee."

Pictured: The Policy & Resources Committee is determined that GST and its other proposed tax changes will be in place before the next general election in 2025, but members of the Committee and officials acknowledge that is a challenging timeline.

The Committee knows it is facing claims by some deputies and others that it is under-estimating how much additional tax could be generated from companies and not doing enough to contain increases in public expenditure.

In a leaflet now being delivered to all households, the Committee states: "We continue to look at the options around corporate tax and believe there is scope for more revenues to be generated from companies. Our proposals also include restricting expenditure on public services. These two elements are key parts of the overall package of measures.

"It is possible that limiting spending, reviewing corporate tax and a range of other measures could close the gap by up to £40m over time, but that still leaves a deficit of £50m-£60m a year needed to deliver the essential services the community needs."

Pictured: Express reported earlier this year on Deputy Charles Parkinson's view that the Policy & Resources Committee should resign if it fails again to secure States' support for GST. Deputy Parkinson is widely expected to lead an alternative tax package based around increasing taxes on companies.

Deputy Ferbrache said it was unrealistic to rely on additional company taxes to plug more of the projected funding gap.

"A lot of people thought that corporate tax would be our saviour. We went out to Ernst & Young and we asked them to look at what we could do. What could we realistically squeeze from the corporate lemon. They told us the most is £20m," he said.

"So at the moment that’s the most we’d be likely to increase taxes on corporates for the foreseeable future and we intend to do that…but it’s not going to bridge the considerable gap we've shown to you."

Having in the last two years been responsible for the fastest growth in public spending for the past two decades, strap in to expect a higher taxes model…. https://t.co/IxnACBHzEL

— Gavin St Pier ???????? (@gavinstpier) November 27, 2022

Pictured: Deputy Gavin St. Pier, who last week narrowly failed in his bid for a seat on the Policy & Resources Committee, said at the weekend that growth in States' spending since the 2020 general election was contributing to the Committee's need to raise taxes.

Deputy Ferbrache also repeated a previous admission that his Committee had found it harder than he expected to contain States' spending and conceded that "savings have been pitiful".

"Controlling public spending has been exceedingly difficult. I and the other members of P&R really want to attack that with vigour, but it is so difficult," he said.

"We have found it far more difficult to be able to achieve realistic savings than, frankly, I anticipated a couple of years ago. But we have certainly not given up on that. It is factored into the equation that we will be able to make some savings.

"We are going to propose tighter restrictions on committees' budgets in 2024 and 2025. We've got to because there just isn't the money. It's going to be very difficult indeed. Although principal committees have been by and large receptive and collaborative, when it actually comes to making difficult decisions that is proving more difficult."

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.