The review of taxation has been denounced by the politician who oversaw it.

Deputy Mark Helyar, as Treasury Lead for the Policy & Resources Committee, was appointed the Chairman of a Sub-Committee under resolution to review how the island could, if needed, raise an extra £70m-75m per year through taxation to meet massive revenue shortfalls.

In presenting the findings of this review to media - who he says have "constantly misquoted and traduced him" - Deputy Helyar said that, of the three, he preferred the latter option.

However, the political leader of the Guernsey Party - which ardently opposed tax rises in its election campaign - has stressed that tax rises will not resolve the "largely structural and governance-based" problems that he says are rife in the States.

Pictured: Deputy Mark Helyar's election pledge, which can be found in his online manifesto.

"The product [of the tax review] is not a report which I have drafted or my “belief” that it’s the right thing to do - it is the product of a committee tasked with answering an objective question. The whole issue is prefaced with the assumption ... “IF the States keeps spending as it does now”.

"What I want and believe is that the States should stop wasting money, cut cost and actively seek out ways to do that, not just put up taxes."

In a personal statement to his Facebook followers, he added: "The whole resolution relating to the tax review, like much of the work of the previous States, was misfounded from the outset - it asked the wrong question and therefore has reached the wrong answer.

"No attempt has been made to comprehensively solve the underlying problems which are largely structural and governance-based - we have a system where it is easy for officers and members to commit to more spending and very difficult to cut cost because we have no centralised control/brake."

Pictured: Deputy Helyar said he is "being constantly misquoted and traduced by Guernsey’s media". He has not cited any specific examples of this.

He says the public "has every right to be angry about possible tax rises", adding: "Importantly, I don’t believe the public trusts a government which has failed consistently to deliver savings to sensibly spend even more income - government will simply become even bigger than it is already."

Deputy Helyar argues that there is a "very long list" of things the States could be doing to save money it is currently spending. He is yet to set out any of the items on that list. He has committed to doing so before the States debate at the end of September.

Some time this month, his committee will be publishing the tax review as a 'green paper' for the States to consider and debate, but with no ability for the States to amend it.

"As we approach the debate I will be sharing more about what could be, but isn’t, being done," he said.

"I have a lot more to say about this and will be doing so - there is a very long list of things we could be doing to save money, not just public service reform."

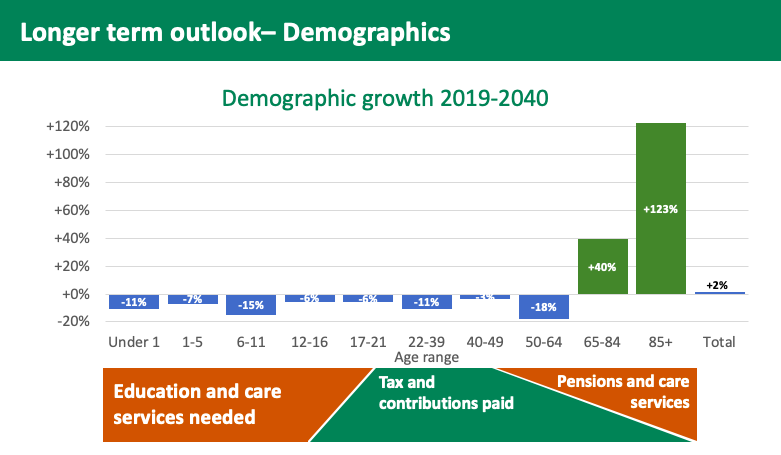

Pictured: The working-age population is dwindling, creating an environment where a smaller number of people are probably going to have to pay more to fund the population's growing needs.

In a statement last week, The Guernsey Party said that: "it will not support tax increases or the introduction of GST, without first fully exploring the opportunity to totally transform Guernsey's finances through a range of alternative methods."

The party said Guernsey "needs to be bold and inventive with radical but workable solutions." It did not provide any examples or ideas.

"Simply looking to raise extra tax revenue to cover the cost of what we do today, whilst continuing to spend as usual, is definitely not the answer," said the GP.

"We must first look at what we do, how we do it and whether we can do it better and more efficiently. Government reform has to be actually delivered, not just promised. This will enable vital savings to be delivered centrally rather than through individual committees."

It also emphasised the need to "urgently introduce" IPSAS accounting standards to ensure that the States' accounts can be relied upon for key decision-making.

This was first proposed in the 2012-2016 term of government and in 2017 a resolution was passed to spend £1.2m converting to internationally recognised accounting principles.

Another commitment to finally doing so has been made this year, as part of the Government Work Plan.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.