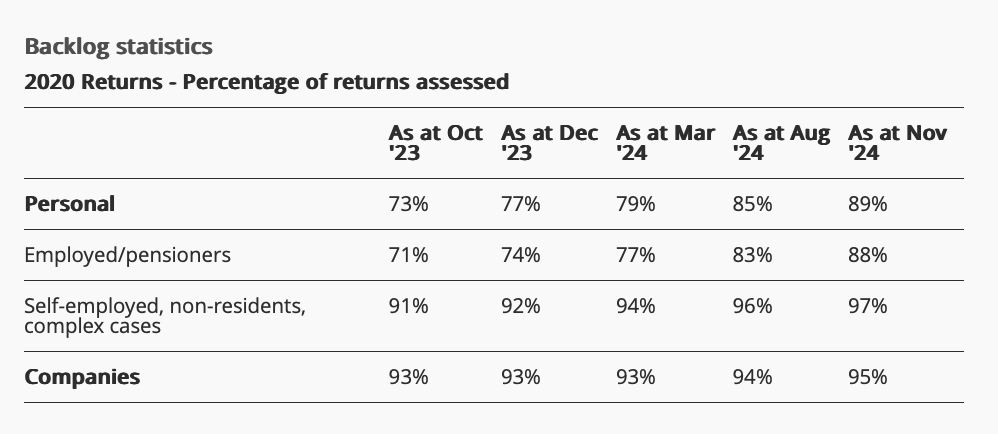

89% of personal tax returns have now been completed for 2020, as Guernsey's Revenue Service staff continue to wade through the backlog.

Statistics are compiled regularly to show what stage the backlog is at.

The latest data, for November 2024 shows there's a 4% improvement on the 2020 tax return completion rate since August.

Of the outstanding tax forms from 2020 that are still being processed, the Revenue Service has still got to do 12% of those submitted by pensioners, and 3% of those submitted by self employed or non-resident people or those classed as 'complex cases'.

5% of company returns from 2020 are still outstanding too.

Pictured: The latest backlog statistics.

Progress is also being made on the outstanding tax returns from 2021 and 2022.

To date, 76% of all personal returns submitted for 2021 have been dealt with, while 53% have been done for 2022.

90% of companies returns have been dealt with for 2021, and 77% for 2022.

The deadline for submitting tax returns for 2023 is 31 January 2025.

The gov.gg website states that "an automatic penalty is imposed if your retune isn't received by the deadline".

Earlier this year, the Revenue Service asked people not to submit their tax return for 2023 just before the deadline.

The Revenue Service has also tried to encourage more people to fill their returns in online.

Tax office completes 85% of 2020 personal returns

TIMELINE: How the tax return backlog has grown and grown

Public urged to avoid filing 2023 tax returns just before the deadline

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.