A study comparing four offshore finance centres, including Guernsey and Jersey, has concluded that there may be a case for lifting the effective age of retirement in the island to help retain key talent and ease the pressure on public finances.

The first Island Index Report has been produced by professional services firm PwC and is designed to “gauge how prepared Jersey, Guernsey, Malta and the Isle of Man are for the disruptions ahead”.

These include faltering productivity growth in financial services and the impacts of climate change, geopolitical instability, technology disruption and ageing populations.

The pension age in Guernsey is between 65 and 70, depending on date of birth.

The report concludes that economic projections suggest that Guernsey, Jersey and the Isle of Man are likely to underperform the OECD average GDP growth in the coming decades.

Meanwhile, the more populous Malta’s GDP per capita is moving up to the OECD average and will begin to converge with the three Crown Dependencies in the coming decades.

The report identifies global ‘megatrends’ that the islands all face. These include slowing global growth – which the OECD expects to halve by 2060 – as well as growing inequality caused by technology and automation, increasing regulation of financial services, competition and consolidation within the sector, and widespread moves towards net-zero carbon emissions.

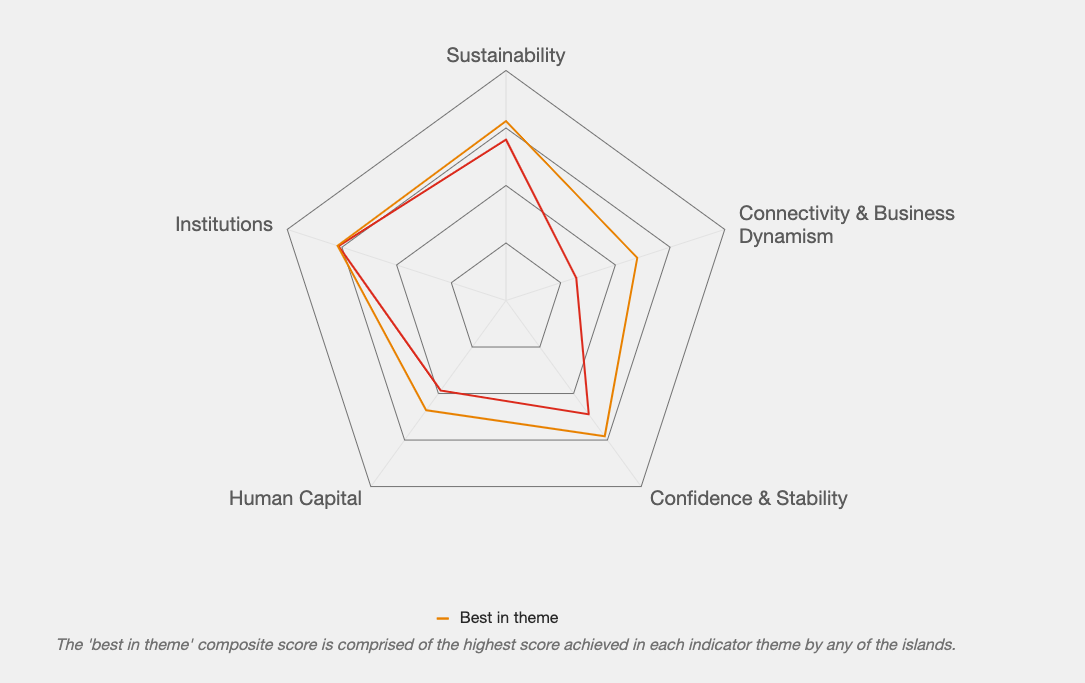

The report compares the islands against five “dimensions” with PwC has identified as most relevant to the future of island states between now and 2050.

These are Environmental Sustainability; Connectivity and Business Dynamism; Confidence and Stability; Human Capital; and Institutions.

PwC said Guernsey rates highly on the effectiveness of its institutions but it is "facing a worsening demographic outlook and the resulting impact on talent availability".

"The States of Guernsey has recently committed to a population growth of 300 people a year for the next decade. While this could help to boost workforce numbers and bridge some of the talent gaps, it may not be enough to offset the continuing increases in the dependency ratio.

"This highlights the need to encourage older workers to delay what is often quite a young age of retirement and bring in more family-friendly policies for parents who want to return to work."

Pictured: Guernsey rates highly in confidence, but much lower in connectivity.

"Guernsey sits at an inflection point. After a period of low population growth coupled with low levels of public investment, policy makers are looking to loosen labour markets and raise investment. Therefore, decisions made in the coming years could greatly change the long-run trajectory of the economy.

"Specifically, the proposed capital outlay programme by the States of Guernsey could see a significant uplift in investment locally, creating opportunities to crowd in private investment through the regeneration of key assets - including St Peter Port waterfront (Eastern Seaboard) and the upgrade to the islands energy infrastructure. Further, recent changes in migration policy could see stabilisation and possible moderate growth in the workforce size, further helping to uplift economic growth from its current trajectory."

You can read the full report ONLINE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.