Several unincorporated States companies are in line for bailouts next year if the annual budget is approved, but the treasury lead has warned that taxpayers may not be happy to continue this for much longer.

Guernsey Ports needs a £4m transfer to operate as required next years as it continues to reel from the effects of the pandemic which wiped out reserves causing multi-year losses and emergency funding to meet debts.

Passenger levels are yet to return to pre-pandemic levels and Ports is therefore forecast to lose £6.6m this year. The STSB has begun increasing tariffs, such as for mooring fees and airport car parking, to improve financial performance. These have been baked into estimates for next year, but still aren’t enough to put its financials in the green.

Meanwhile Guernsey Waste needs its operating losses for this year, whatever that figure is at the end of this year, to be to be covered from General Revenue, and another half-a-million to cover its trading deficit for next year. The States agreed to cover operating losses in this way since September 2022.

Guernsey Dairy needs £700,000 to cover cash requirements next year, as well as another amount for it's short-term loan facility’s final bill at the end of the year, also out of General Revenue. The budget states that “the delay in the funding decision for a new dairy has led to increasingly higher maintenance costs on ageing equipment with no realistic prospect of Guernsey Dairy being financially self-sustainable in the near future”.

Small trading deficits have accumulated yearly and depleted its cash reserves. As a new dairy facility has been deprioritised in the capital projects portfolio, P&R say the dairy is likely to stay put with its current equipment “for at least the next seven years”.

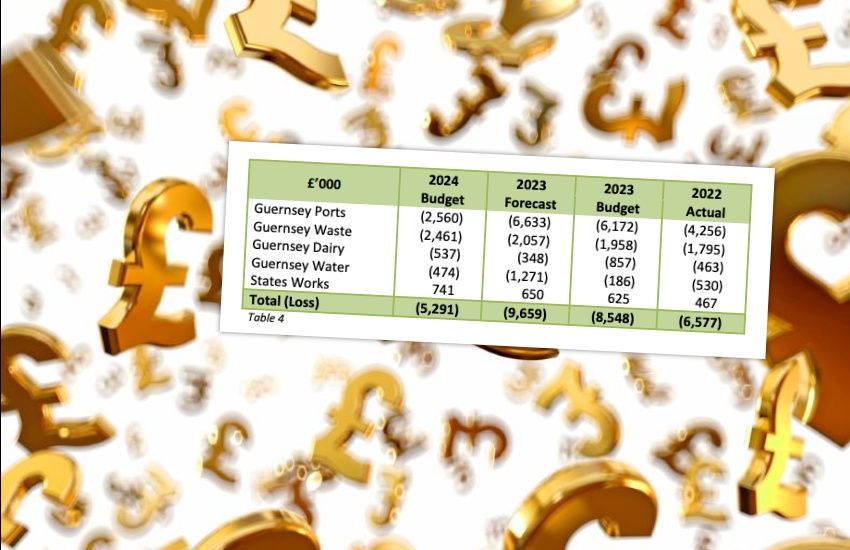

Ports is forecast to lose over £2.5m next year, Waste around £2.5m, the Dairy just over £0.5m, and Water £474,000.

Only States Works is forecast to be in profit next year. Guernsey Water is also able to fund its recent losses out of its reserves.

Pictured: It could cost £15m to keep the Dairy running on site until 2030.

The government budget for next year predicts a revenue surplus of £24m once trading losses are account for – but once asset depreciation and other costs are factored in “the surplus swings to a deficit of £13m”.

“All bar one of the unincorporated trading assets are currently operating at a deficit – resulting in a need to temporarily move from a purely ‘user-pays’ to a partially ‘taxpayer funded’ model,” P&R’s 2024 Budget Report says.

“Going forwards if the fees and charges paid by the users for these entities can't be increased sufficiently to cover the costs of operation, there is an unfair additional burden on the taxpayer meaning that, for example, in the case of Guernsey Ports all taxpayers are subsidising mooring fees for those with boats.”

Presenting the budget to the media, treasury-lead Deputy Mark Helyar further said the companies aren’t “washing their own faces”, adding that if they are unable to commercially resolve themselves soon then taxpayers may start asking questions about funding their operations out of the general tax pot.

He added that States trading companies, managed by the States Trading Supervisory Board, will be included in yearly accounts next year to give a better overall picture of public finances on the march to achieve IPSAS compliant accounting standards.

“Losses will go straight through to the final numbers,” he said.

A change to how the biggest loss-maker, Guernsey Ports are funded going forward will also be considered “including whether there are realistic options for incorporation or if continued taxpayer funding might be appropriate as a contribution towards the economic value created”.

The draft budget - at a glance

Property tax shake-up key feature of 2024 budget

Ports propose increased charges at airport and harbours to eliminate taxpayer funding

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.