Self employed people say they've been forgotten as the States work to financially support individuals and businesses through hardship funds and other payment schemes during the corona virus pandemic.

More than a million pounds has already been paid out to help a large number of individuals and businesses but those classed as self employed say they are unable to access that help, despite losing their incomes too.

A small business support group on Facebook suggests a number of those concerns are about the owners of limited companies, treated as self-employed by Social Security, who will not be able to claim under the payroll support scheme for themselves.

A number of sole traders and limited company owners are believed to have applied in error, and are now trying to contact the team running the payroll sharing scheme to rectify this and find out what can be done instead.

Despite moving staff around so there are more people working to process claims for the financial support measures, the phone lines are said to be very busy and email is believed to be the best way to register a claim or a question.

For more details on how to apply click HERE.

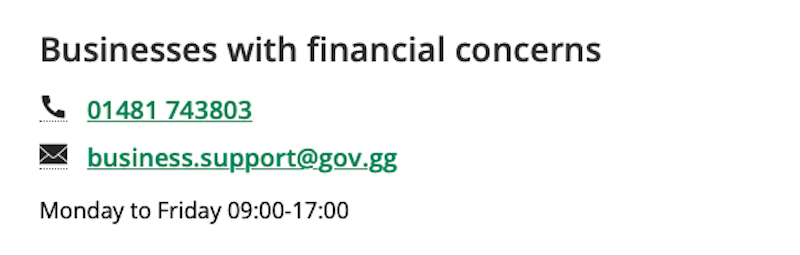

Pictured: Businesses and self employed people can contact the States for help using the above methods. Individuals should call 723516 or email hardshipfund@gov.gg

According to the most recent information released by the States, more than £800,000 has already been paid out in benefits due to the pandemic, with more than 1,000 people who have made claims for unemployment or sickness benefit, income support or to the newly-established hardship fund benefitting.

In the first week of operation, 156 grants to small businesses were approved, amounting to £468,000, while the new payroll co-funding scheme approved 24 applications, totalling circa £100,000.

The financial support measures also included deferral of certain taxes and other costs for businesses, such as commercial TRP, and employers’ social security contributions. The Revenue Service has approved 877 claims for deferral of revenues, with an overall value of £3.4m.

The financial support programme is being led by Deputy Lyndon Trott, Vice-President of the Policy & Resources Committee.

“I’m incredibly impressed with how our business community has recognised the seriousness of this public health crisis, and supported the measures introduced by government to ensure we protect the lives and health of Islanders as our top priority," he said.

"Many businesses have been able to carry on their work, quickly setting up what they need so their staff can work from home, or if their work is essential, maintain good hygiene practice and social distancing to protect staff. But for many others, and in some cases entire sectors, working simply isn’t an option and they have had to soak up the economic impact as best they can.

Pictured: Deputy Lyndon Trott.

"Many businesses understandably need help if they stand any chance of surviving, and the truth is, some won’t be able to.

"We’re doing all we can to support businesses as well as individuals who have seen their pay cut, been furloughed, or found themselves suddenly unemployed. We’ve worked quickly to bring in the measures, we are already making payments and we are looking at what more we need to do. After listening to the concerns from certain parts of the business community, we’ve expanded the sectors eligible for support through the payroll co-funding scheme.

"Throughout this crisis and beyond, we must be conscious that the funds used to support those facing financial difficulties, because of the coronavirus, are public funds.

"As a consequence of the circumstances we are also seeing far less in terms of public revenues. It is not only businesses and individuals that have seen their income cut. Clearly this expenditure was not envisaged when we planned the Budget for 2020. All of those plans now need careful reconsideration if we are to manage public finances successfully through this crisis. We are beginning to look at what we’ll need to do to help the economy recover, but we are acutely aware that we still don’t know how long restrictions on business will need to be in place and how severe the impact will ultimately be.

This crisis has thrown up new challenges on a daily basis. It will be difficult on all of us for some time, but we will come out the other side, by supporting each other and working together.”

Pictured top: Edward T Wheadon House.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.