The Policy & Resources Committee has confirmed that it will back setting up compulsory secondary pensions for all employees when the proposed scheme returns to the States for further debate in the next few weeks.

The States' senior committee acknowledges that secondary pensions will initially hit public finances hard but considers them necessary for today's working population.

"The introduction of secondary pensions will result in an immediate and significant negative impact on the States' financial position due to income foregone and additional expenditure," said Deputy Peter Ferbrache, President of the Policy & Resources Committee.

"This impact is projected to peak at £9.4million in year eight, following which it will reduce as pensions are taxable when drawn down and the increase in retirement income reduces later life dependency on income support.

"Members continue to support the introduction of secondary pensions...[it] is considered to be a responsible and sustainable initiative that gives today's working population the opportunity and assistance to prepare for a more financially secure retirement."

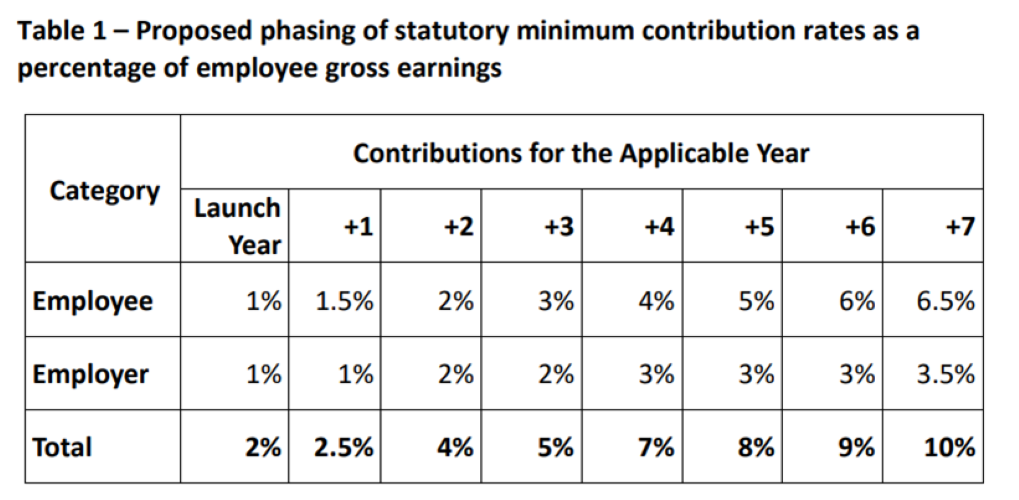

Pictured: This table indicates how contributions to the secondary pensions scheme will increase annually until they reach the level necessary seven years after introduction.

The Policy & Resources Committee's position is set out in a letter published today as an appendix to the latest policy letter on secondary pensions. The policy letter itself has been submitted by the Committee for Employment & Social Security and is expected to be debated by the States' Assembly at their meeting which starts on 25 May.

The States will be asked to approve governance arrangements for the new scheme - known as Your Island Pension (YIP) - and proposals to check that employers are making the contributions required to their employees' secondary pension accounts.

They will also be asked to direct the Committee for Employment & Social Security to return to the States in five years' time with proposals for "a pension savings regime for self-employed and non-employed people", who are not obliged to make contributions to the YIP scheme.

If the States agree this phase of the proposals and then associated legislation later in the year, the Committee for Employment & Social Security expects the YIP scheme to start on 1 October 2023.

The Committee said this lead-in period would provide employers and pension providers with sufficient time to prepare.

Auto-enrolment obligations for employers will then be phased-in over a period of 15 months according to their number of employees, starting with larger employers.

Pictured: The Committee for Employment & Social Security hopes that the scheme will begin to collect contributions before the end of next year.

Deputy Peter Roffey, President of the Committee for Employment & Social Security, said: "To deliver the intended aim of supporting people to save for retirement, we need to ensure that employers comply with their secondary pensions obligations.

"Whilst we are confident that the vast majority of businesses will comply, it’s important to have these measures in place for those who would seek to deprive employees of the benefits of a secondary pension scheme.

"The proposed compliance measures have been crafted in such a way that they come at minimal cost to employers and the States, by adapting existing processes wherever possible."

The Committee said: "The main aim of the secondary pension scheme is to support more working-age people to save for their retirement, thereby enabling them to enjoy a more comfortable retirement and controlling welfare expenditure in the longer term."

Pictured: The Committee for Employment & Social Security and several predecessor committees have advised the States that most people of working age are either unable or choosing not to put enough aside for a reasonable standard of living in retirement.

"In March 2013, an estimated 40% of working-age residents in Guernsey and Alderney were members of an existing private pension scheme, which includes both occupational and personal pension schemes. The implication of this is that the remaining 60% of working-age residents may have intended to rely solely, or in large part, on the States' pension to finance their retirements, or, at the very least, had not actively made plans to secure long-term financial security for themselves.

"More recent data from 2017 suggests that only around 35% of employed people between the ages of 16 and 65 in Guernsey and Alderney were saving into a private pension, including both occupational and personal pensions, again implying that the remaining 65% may intend to rely heavily on the States' pension during their retirement.

"While the States' pension provides a much-needed safety net, it needs to be supplemented by other sources of income in order to achieve a comfortable retirement.

"The States' pension is not intended to fully replace a person’s income from employment and is unlikely to be sufficient to sustain a person’s lifestyle in retirement on its own.

"In fact, while pension policy direction has aimed to maintain a link between the value of the States' pension and the earnings of the working age population, the gap between median earnings and the value of the States’ pension is increasing and will continue to do so unless the current uprating policy changes. The current policy is to increase the rate of the States' pension each year by RPIX plus one third of the real increase in median earnings."

Pictured: Alderney is set to be included in the new secondary pensions scheme.

It is proposed that the new YIP scheme should be extended to Alderney at the same time as it starts in Guernsey.

This move is supported unanimously by the States of Alderney's senior committee, Policy & Finance.

The Committee for Employment & Social Security recently appointed a locally-based firm - Sovereign Pension Services - to run the scheme.

ESS boss confident of getting final approval for new pension scheme

Secondary pensions firm pulls out - but new scheme still on for Jan 2023

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.