The first drop-in session to help people fill in their income tax return online is being held tomorrow (Monday), as the Revenue Service continues pushing the "many benefits for customers, the service, and for the island’s tax payers" of doing the annual task online.

The service has also made changes to the way we can access paper tax returns, to make that process more efficient and cost effective too.

But, the main aim is to encourage as many people as possible to do their returns online, with the Director of the Revenue Service saying it is the "best and most efficient method for us, and for you".

Nicky Forshaw has also sought to explain why the paper tax return has changed, and been extended to 39 pages this year. It now exactly mirrors the order and format of questions in the online return, meaning staff can scan in the completed return to save time.

Staff at Edward T Wheadon House, where the Revenue Service is based, have also been tasked with checking details with every individual collecting a paper form - with some people saying they've been refused more than one even if they are collecting them for their partner, or an elderly relative or neighbour.

“I do understand some of our customer’s reactions and frustrations to the changes in the way we provide paper tax forms and have asked my team to be sensitive to people’s requirements," said Ms Forshaw.

Pictured: Anyone wanting a paper return is being asked to pick one up in person so their details can be checked.

"Customers will be aware that we have a backlog, and these changes are designed to enable greater efficiencies in our processes and to help our team assess tax returns quicker, by reducing the amount of duplicate or unnecessary returns. By ensuring customer’s contact details are up to date, we can also make sure that if we need to contact you about your return, we can do so.

"The best and most efficient method for us, and for you, is to complete your tax return online. The more people file online, the more efficient the assessment process will be. If you are able to file online, please give it a go.

"We recognise that not all of our customers that need a paper tax return can get to Edward T. Wheadon House in person. For these customers, we are working with the parishes to set up sessions so customers can visit us at alternative locations in the north, west and south of the island. At these sessions we will be able to issue paper returns, deal with tax matters, or help customers get online. More details will be released in the near future.”

Pictured: The Revenue Service says filing a tax return online is better for them and for you.

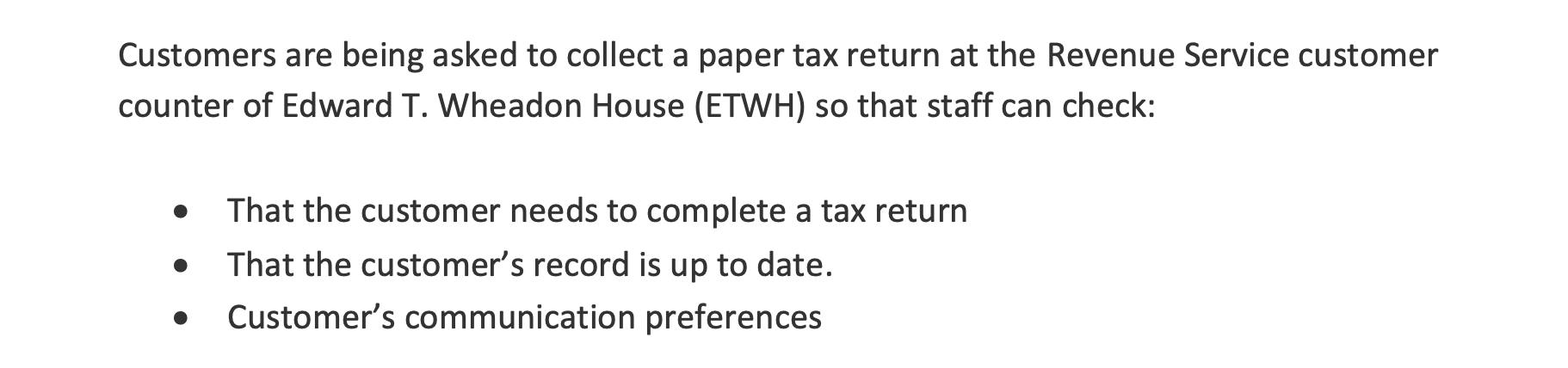

To help more people file their tax return online, staff have arranged a number of drop-in sessions at Wheadon House.

The first is on Monday 13 May between 08:45 and 16:00. There will then be one a month until the end of the year.

Anyone attending the drop in sessions are asked to take a mobile phone, tablet, or laptop with them so staff can help them set up their own online portal to fill out their return.

TIMELINE: How the tax return backlog has grown and grown

Revenue Service apologises to customers who are “rightly frustrated”

Progress on income tax backlog

Revenue Service extends tax deadline

Income tax/social security merger will "make life easier"

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.