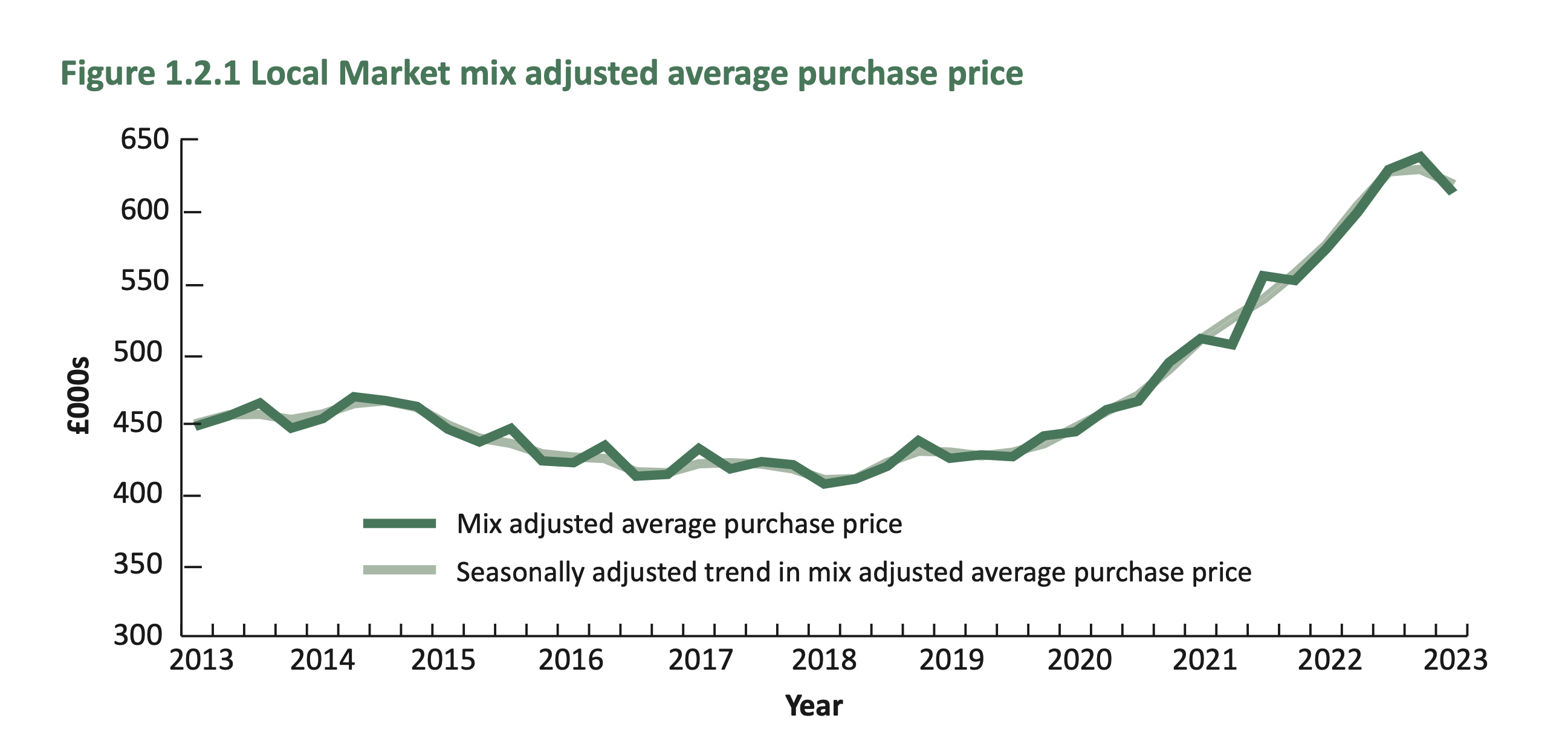

The average purchase price for a local market house has dropped by 4% this year - but the price still remains far higher than it was a year ago, and five years ago.

The latest data released by the States shows the 'mix adjusted average purchase price for Local Market properties' was £613,942 in the first quarter of 2023.

That is 3.8% lower than the prices using the same measurements during the previous three months, covering the last quarter of 2022.

While prices have dropped, they are still 7.1% higher than they were during the first three months of last year, and they are a massive 50.7% higher than they were five years ago.

Pictured: Following a long period of price rises, the mix adjusted average purchase price of a local market property has dropped slightly.

As prices have increased hugely over the past five years, before dropping slightly so far this year - the number of properties changing hands on the Local Market has fallen with 113 Local Market transactions during the first quarter of 2023. That is 68 fewer than the previous quarter, 86 fewer than during the first quarter of 2022 and 27 fewer than five years previously.

Nick Paluch, Director within the Residential Sales Team at Savills Guernsey, said things are getting back to a "more norma rhythm" after the prices peaks we've seen recently.

“Certainly when compared to the heights of the previous two years or so activity has been subdued," he said. "The rise in the cost of living and increased mortgage rates has led to buyers reducing their budgets, while vendors who haven’t needed to sell immediately have decided to sit tight. This is reflected in the price drop reported in the Local Market for the first quarter of this year. Prices do still remain higher than a year ago, but we’re now starting to see things settle as the market moves back into what you might describe as a more normal rhythm following a period of unprecedented activity.

“Consequently we’re experiencing a return to a more needs based market – people buying and selling due to a change in circumstance such as a new job or for family reasons rather than being driven by a purely lifestyle decision. Demand is still higher than we expected and – while there might not quite be the same level of urgency in the market as there was 12 to 24 months ago – we do expect things to start picking up. A little bit of sunshine always brings more positivity. The underlying reasons that make Guernsey such a great place to live and work have not disappeared."

Pictured: Rent prices have remained higher than they were a year, and five years ago.

Purchase prices may have dropped slightly in the Local Market but rental prices have remained high and have infact increased further over the past few months.

The mix adjusted average monthly rental price for Local Market properties was £1,778 in the first quarter of 2023. That is 3.1% higher than the previous quarter, 7.0% higher than the first quarter of 2022 and 36.8% higher than five years previously.

Gill Mooney, Head of Lettings at Savills Guernsey, wasn't surprised by this news as demand continues to outstrip supply in certain size and price ranges.

"The rental increases recorded for the first quarter of this year are not necessarily surprising and are broadly reflective of the market. There remains a lot of people coming from overseas to work and we’ve seen consistent demand – particularly for smaller family homes and one and two bedroom properties for individuals and couples. It’s the larger homes that are taking a little bit longer to let.

“Interestingly what we’ve seen on the Local Market is that many landlords are choosing to work with their existing tenants to keep any potential rental increases to an affordable level rather than go for the higher market rate. Where agreements are up for renewal and a tenant has been in place for some time many landlords are choosing to look at the bigger picture. They value the long term and trusted relationship they have with the tenant and rather than go through the process of remarketing and have their property sit empty while they wait for someone new – where they could possibly achieve a higher price – they look at what’s reasonable and come to a compromise.”

Pictured: Nick Paluch, Director within the Residential Sales Team at Savills Guernsey.

The raw median price (realty only) of the 14 Open Market transactions in the first quarter of 2023 was £1,779,375.

Mr Paluch said it was not a surprise that the Open Market has held property values.

"The lifestyle on offer in the island is a significant draw for those looking on the Open Market – and there continues to be a core number of committed buyers who are willing to make a move regardless of conditions on the Local Market. Despite any further increases in the interest rate from the Bank of England, the long term forecasts remain positive.”

The way the States collate the data used to portray housing prices is used as a measure of the 'value of the properties sold during the quarter' and is 'not a reflection of the values of individual properties nor the change in the value of any one property over time'.

The average purchase prices vary according to many factors, including the age, location and quality of a property.

Average house prices soar over 50% in half a decade

House prices remain 10% higher than last year

OPINION: Will the States really try to drive down house prices

House prices drop slightly again

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.