Personal debt up to £30,000 could soon be written off through statutory debt relief orders, with a Jurat chosen to decide if the debt can or can't be wiped.

Low value debt relief orders help individuals who have no reasonable prospect of repaying low levels of personal debt and allow them to have a fresh start.

These situations often arise out of a sudden change in personal circumstances, and in instances where the concerned individual is faultless.

Debt is noted has having a strong link with mental health problems, suicide, and drug abuse.

The Committee for Economic Development will bring proposals to the States next week for debate – if approved, legislation would be drawn up and brought back to the Assembly for approval.

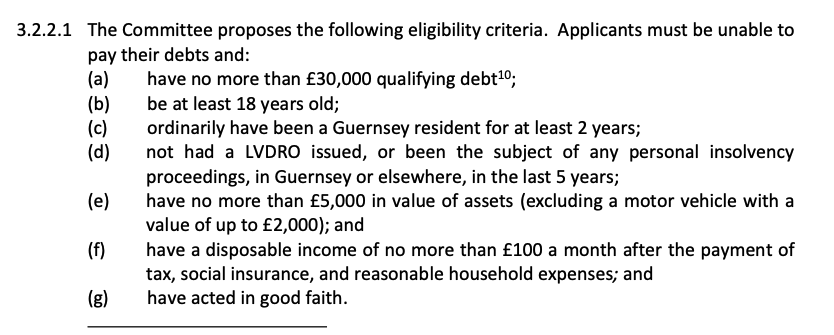

The eligibility criteria for an order would be as follows:

Secured debts, criminal fines, child maintenance, and civil fines would be excluded from the orders. Any debt not listed in an approved order would also be ineligible for relief.

A year-long grace period would be realised through an order, where lenders would be prevented from pursuing protected debts. If an individual’s financial situation has not improved at the end of this period, the debts would be written off.

The Committee envisages that the courts could extend this grace period in certain circumstances. A Jurat would decide whether an order should be made, the Committee envisages.

Whilst some lenders claimed legislation was unnecessary as they can personally write off the debt, the Committee deemed new measures appropriate to protect against “less compassionate lenders”.

Pictured: The Committee for Economic Development has worked alongside Citizens Advice, insolvency firms, advocates and His Majesty's Sherriff to inform the proposals.

Citizens Advice Guernsey work with a “significant number of people” who fall into this category, the policy letter states.

Currently, Citizens Advice acts as an intermediary between debtors and creditors to establish an acceptable and manageable repayment plan. However, there is no statutory requirement to adhere to the process, and the payment period could be indefinite since no debt is written off.

There were 104 clients using these services in 2019, with a total of £4.34m of unaffordable debt. If orders were introduced with a £30,000 top limit, Citizens Advice estimate that around half of indebted clients would be eligible to apply.

Poor budgeting, reduced income and the breakdown of relationships were the main causes of debt assessed by the Citizens Advice at the time.

Citizens Advice have indicated its willingness to act as intermediary in any future administrative relief process should the policy be adopted.

You can read the policy letter HERE.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.