Former Treasury Minister Deputy Charles Parkinson thinks the Policy & Resources Committee should resign if its flagship fiscal policy - a new goods and services tax (GST) - is proposed to the States and kicked out by deputies.

In a new podcast with Express, Deputy Parkinson, a vocal advocate of company tax reform, is highly critical of the Committee's current campaign to promote GST as its first option and income tax rises as a fall-back option to plug a projected annual deficit of £85million in States' finances.

“They’re offering two possibilities: the devil and the even worse devil - higher income tax or a GST,” said Deputy Parkinson, who was Treasury Minister between 2008 and 2012.

He said the Committee is overlooking the case for reforming company tax as a much better way of addressing the new black hole in public finances, which the Committee says is the result of changes in the age profile of the island's population.

Deputy Parkinson said that company tax “is not being approached properly at all" in the latest tax proposals led by treasury lead Deputy Mark Helyar.

“After the States' debate last autumn, when Policy & Resources pulled its policy letter because it was quite clearly not going to get supported, it said it would come back to the States next June [2022] with a revised version focusing on corporate taxation," he said.

“The latest briefings have hardly mentioned corporate taxation and the leaflet they’ve been pushing out barely mentions it either.”

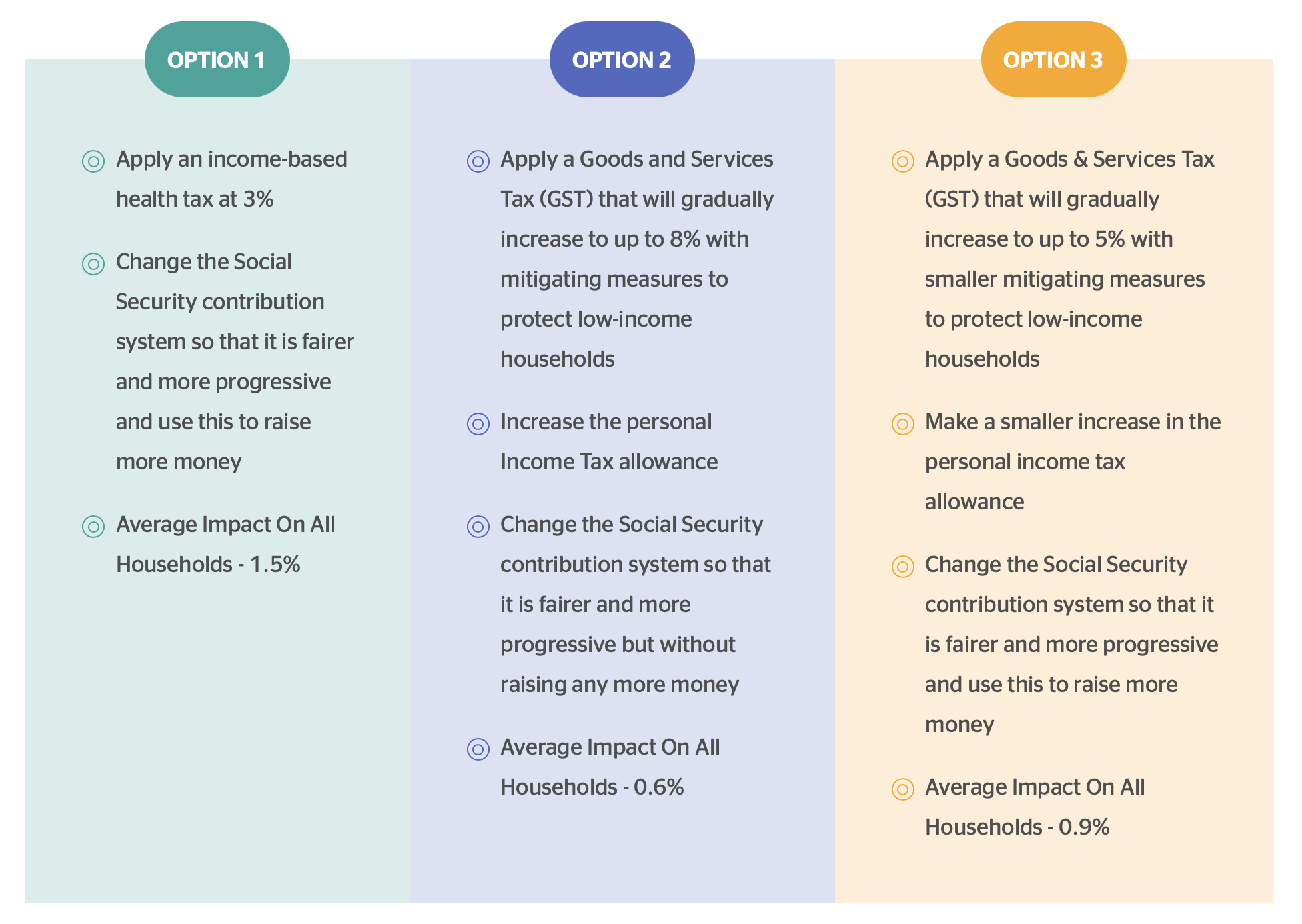

Pictured: Initially, during 2021, the Policy & Resources Committee developed three options for raising more tax revenue.

Following hours of debate, including a lengthy speech from Deputy Parkinson on company tax, the Committee pulled its proposals at the 11th hour with Deputy Helyar telling the States: “We’re admitting we were wrong".

The Committee then successfully proposed an amendment to investigate other options for raising more tax revenue, undertake more public consultation and report back to the States by July 2022 with detailed proposals.

Deputy Parkinson said that company tax reform had barely featured in the Committee's tax review since then and therefore the debate is now back to square one.

“This takes us right back to last September when this is essentially what the policy letter said and that was a policy letter that I spoke against," he said. "What I’ve said consistently is that what we need to do firstly is to reform our corporate tax system, which would bring some more revenue.”

Pictured: Deputy Charles Parkinson does not have confidence that the Policy & Resources Committee is able successfully to reform company taxation in a way which would raise more tax revenue and retain the island's competitiveness.

Deputy Parkinson told Express that the current Policy & Resources Committee simply does not have the required expertise to design a credible alternative company tax framework to the existing one which he believes needs substantial reform.

He said that successfully redesigning the company tax framework could mean there would be no need for a new GST or increases in income tax.

He said the additional tax revenue each year "at the lower end could be one or two tens of millions and at the upper end could be many tens of millions and potentially could resolve the need for us to raise other taxes completely".

"The work needs to be done to establish a new corporate tax regime," he said.

Pictured: “Guernsey isn’t in imminent danger of collapsing but it can be argued that we’re standing on a platform that is starting to catch fire,” said Deputy Parkinson.

Deputy Parkinson said the Policy & Resources Committee would inevitably propose GST and that it was highly unlikely to get through the States' Assembly.

“It is unlikely to succeed because we have a ruling conservative coalition - call them what you like - and significant numbers of people who that coalition would ordinarily rely on for support… are clearly opposed to GST,” he said.

Express asked Deputy Parkinson what should happen next if GST is proposed to the States and kicked out.

“What happens next if Policy & Resources loses its proposals is a key question. My answer to that is: if you’ve brought forward your flagship fiscal policy, on which your entire budget spending plan depends, and it is defeated, you should resign,” said Deputy Parkinson.

“I’m hearing on the grapevine that this P&R is planning not to go and that they're saying that if it gets defeated ‘we’ll just soldier on and the problems won’t go away and we’ll just carry on trundling on towards what we predicted to be a financial disaster’.

“I think this is completely irresponsible and the island deserves better than that.”

You can listen to the full interview in our latest PODCAST.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.