The mix adjusted average purchase price of local market houses has risen to almost £630,000 - nearly £200,000 more than the average prices a decade ago.

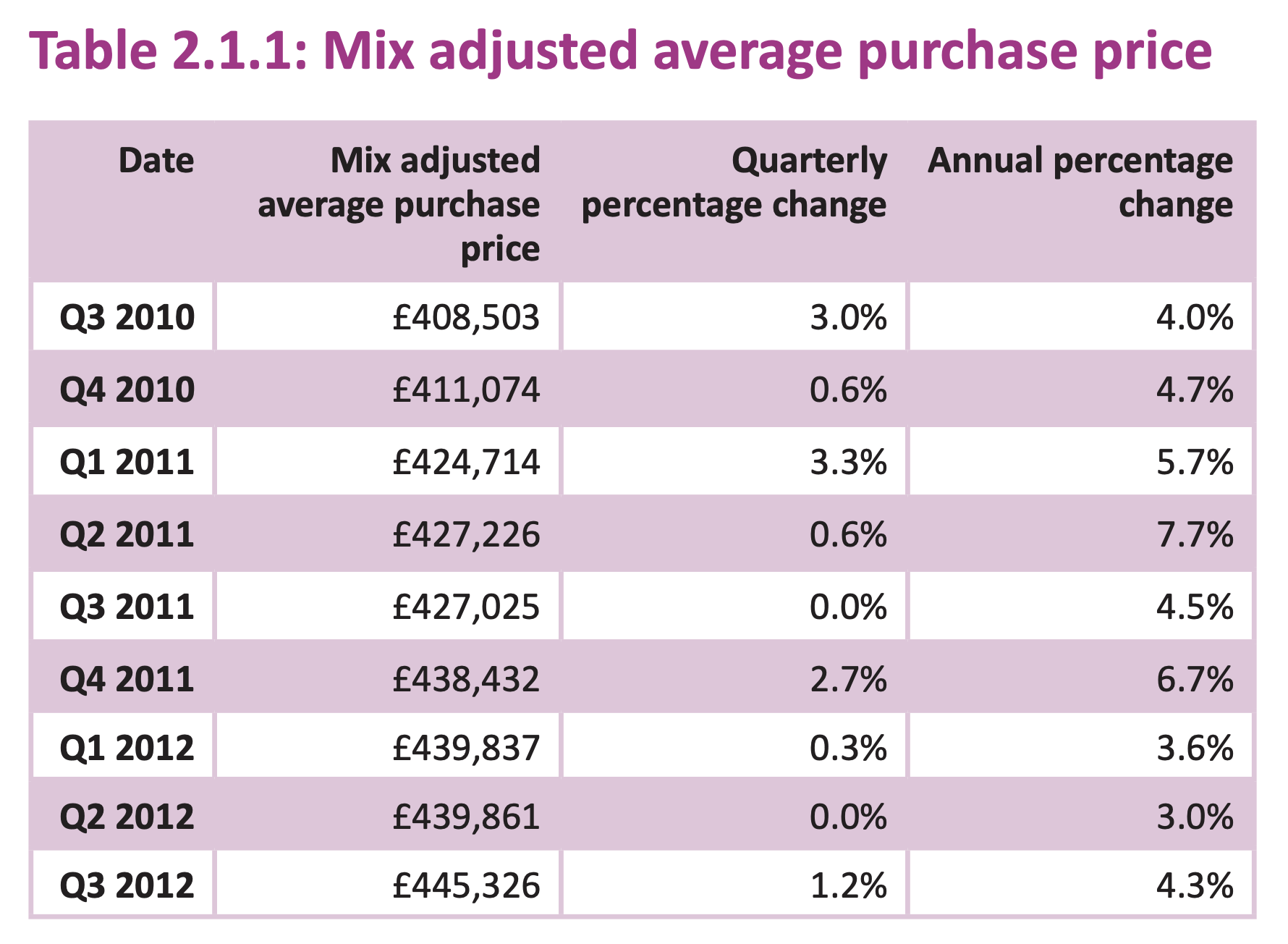

States data from September 2012 showed the mix adjusted average local market house price at point of purchase was £445,326. That in itself was 4.3% higher than it had been a year previously.

The States measure house prices by using the 'mix adjusted' measure which is the average cost of purchasing a property including both realty (the bricks and mortar) and personalty (fixtures and fittings).

This method also 'weights' properties according to their type and the number of bedrooms so as to reflect the profile (or 'mix') of all the owner occupied and buy-to-let property units across Guernsey.

The States started measuring house prices in this way in 2008, and publishing that data in 2011. That means a like for like comparison can be made between the average purchase price of properties between 2008 and 2022, but not to properties sold prior to then.

Pictured: The States started publishing the 'mix adjusted average purchase price' in 2011.

The data for 2022 was published yesterday and can be read HERE.

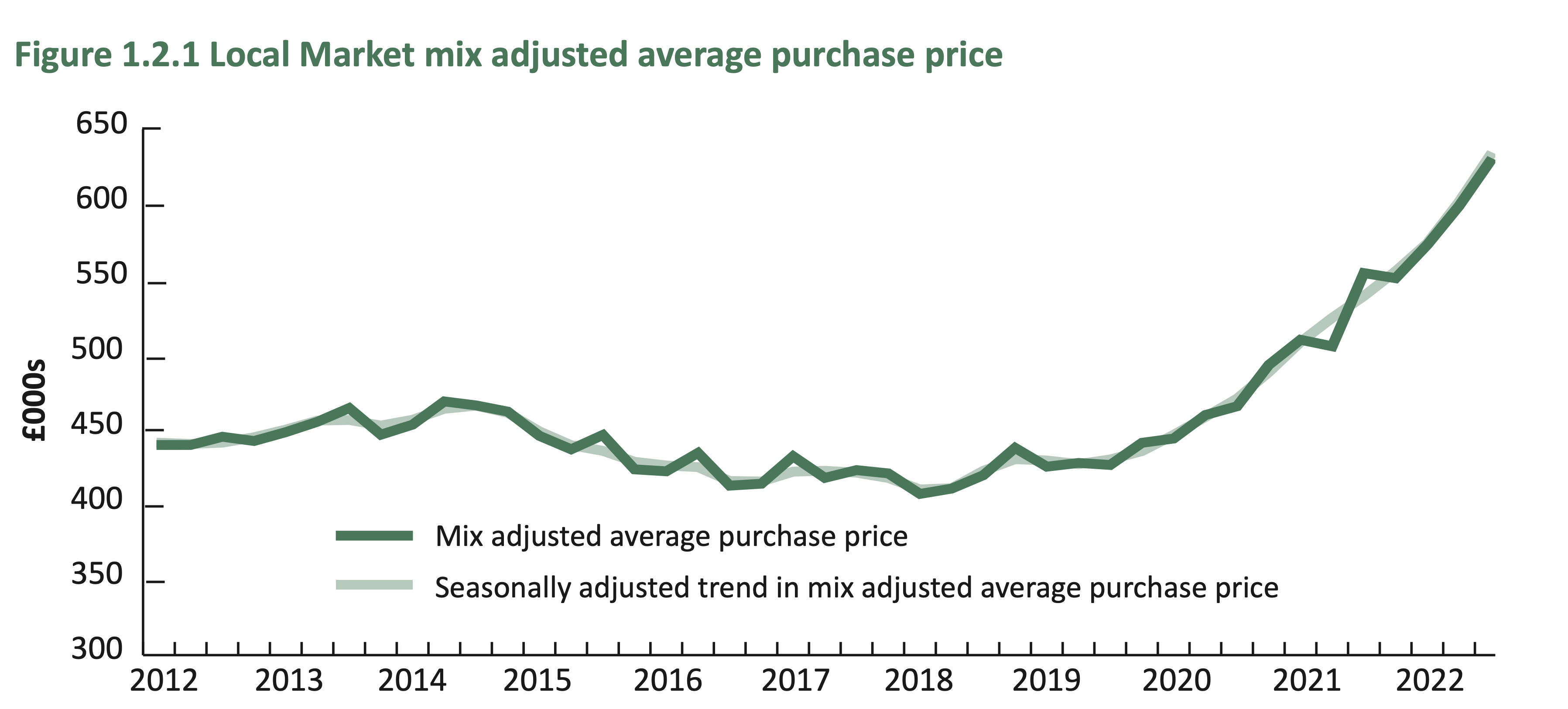

It shows that the mix adjusted average purchase price for local properties in the third quarter of this year was £629,297. That is up 13.5% from a year ago.

Of the properties sold during July, August and September, 234 were local market and 23 were open market. The raw media price, based on the realty only, of those open market properties was £1,576,345.

The number of properties sold during quarter three was down two from the previous three months, and also down 51 from the same period during the previous year. This is thought to be based to the knock on impact of the covid pandemic measures which had a noticeable affect on the housing market.

Although prices appear to have been steadily increasing, there was a dip in the average selling price of local market properties prior to the pandemic, especially noticeable during 2018. Prices have returned to a pattern of steadily increasing since then.

Pictured: The States data shows the rolling pattern of average house prices.

Keith Enevoldsen, Head of residential sales at Savills Guernsey, said that during the pandemic, and since then, and "despite the wider economic headwinds the housing markets in Guernsey have remained relatively robust".

He acknowledged an ongoing "shortage of property for sale – particularly in the Local Market" which is impacting on prices.

He said "...transaction levels are healthy, albeit slightly down on the last quarter and when compared to the same period last year. I don’t think that’s too much of a surprise. The market since mid-2020 has been unprecedented in terms of activity and it would have been unrealistic for it to continue at the same pace.

"Demand for well-presented, sensibly priced homes is strong and properties are selling within a good time frame. We have also been pleasantly surprised by the number of buyers who are still committed to a move. There are some who are having to readjust their budgets, but those who remain are very motivated.

Pictured: Keith Enevoldsen, Head of residential sales at Savills Guernsey.

"Looking ahead, I think it’s inevitable that levels of activity will calm – we already started to see a little bit of that at the end of this last quarter. It’s also worth remembering that the majority of transactions which this latest update covers would have taken place over the summer when the base rate was lower. It’s not necessarily reflective of what we are currently experiencing.

"Rising interest rates and the higher cost of living are having an effect. That said, historically Guernsey has often been insulated against any wider financial uncertainty and it will be interesting to see if that plays out once again. I would expect the supply/demand imbalance to continue to support activity, but setting a realistic asking price will be fundamental for anyone looking to sell.”

Responding to the change in interest rates today was Skipton International.

It has reduced mortgage rates across its residential fixed rate range, including five-year fixed rate products.

Pictured: Roger Hughes, Business Development Manager at Skipton.

Roger Hughes, Mortgage Business Development Manager at Skipton said it is part of wider efforts to keep rates as low as possible.

“Despite the base rate rising by a further 0.75%, we are committed to keeping rates as low as possible to support local homebuyers through these challenging times.

“This move is one of the many initiatives we have launched to ease the burden of buying a home or remortgaging in the current market. We will work with the industry and policy makers to do everything we can to keep rates as low as possible.”

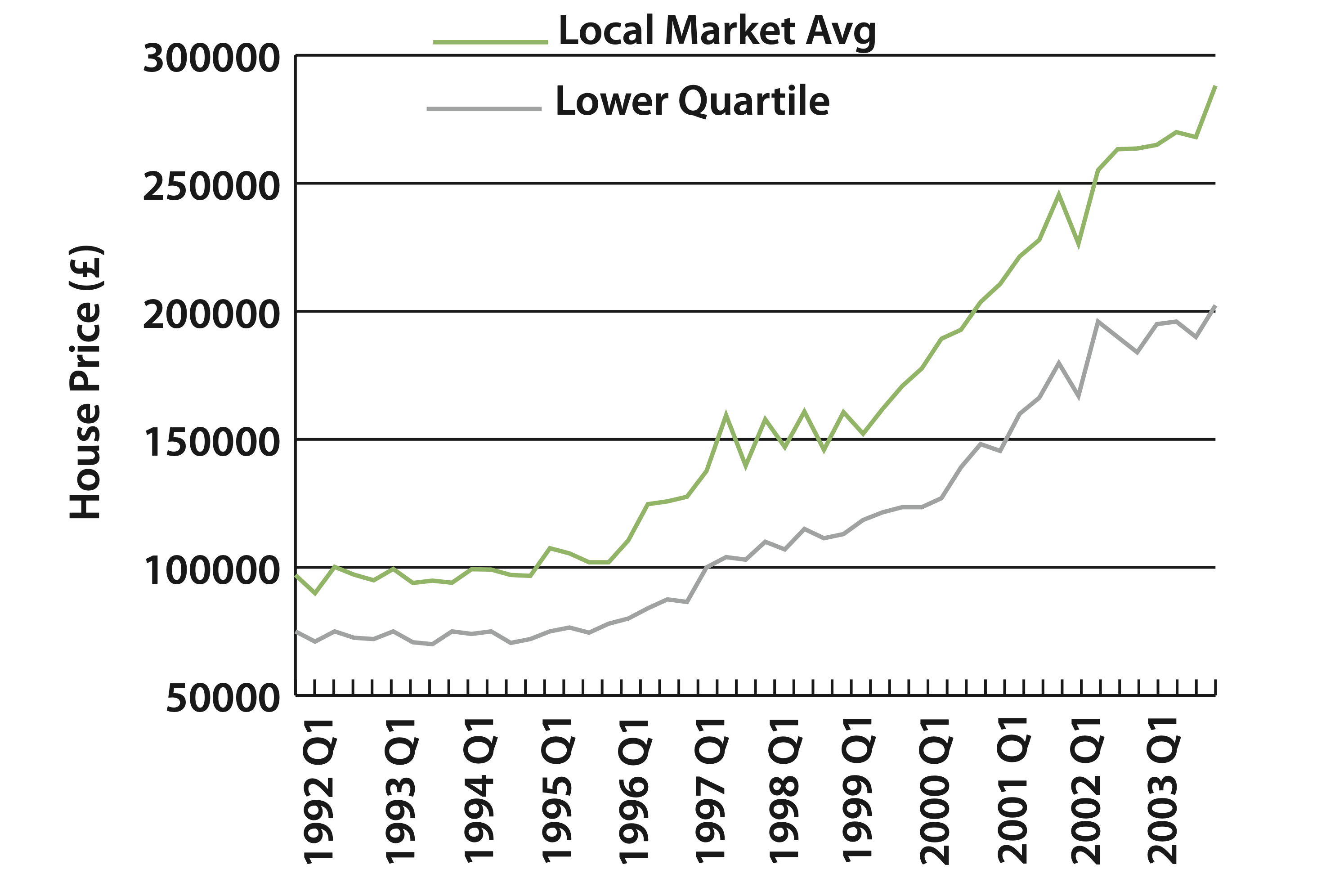

Pictured: House prices in the 1990s as listed on the States website HERE.

While comparisons can't be drawn directly between the purchase price of properties prior to 2008 and 2022 due to the change in the way the States have measured the average prices, data is available via the States website for house prices back to the 1990s.

Prices were below £100,000 for the average local market property in 1992. Within a decade average prices were up to £250,000.

Comparing the rate of inflation for 1992 to 2022, £100,000 then is worth around £200,000 now, meaning property prices have risen exponentially compared to the cost of living.

"A little of the heat has come out of the housing market"

Average house prices rise by more than 12% in a year

House prices remain 10% higher than last year

House prices drop slightly again

Average house costs £550k before fees

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.