Far fewer gathered on the steps of the Royal Court this morning, but the strength of feeling against GST had not diminished from the previous protest.

Debate is now underway to find a way forward to plug a projected £85m shortfall in the Bailiwick's public finances.

Some deputies took the time to talk to those who had assembled, regardless of their views on P&R’s tax package.

Deputy Andrea Dudley-Owen explained to those in front of the court doors how she could not see an alternative to shore up the public coffers other than the revenue raising GST mechanism.

Deputy Al Brouard once again engaged in a testy exchange with a protester as he did last month, reaffirming his support of the GST+ tax package.

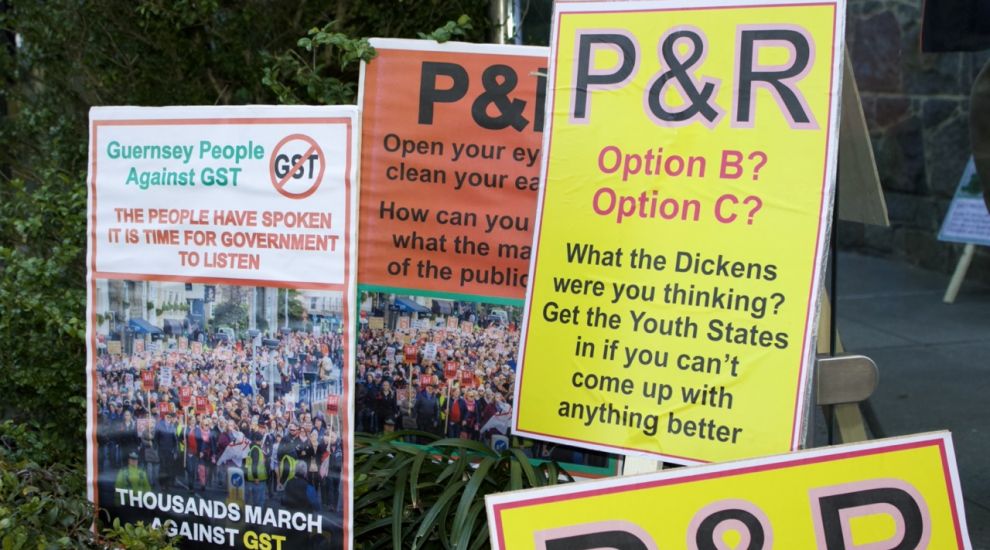

Pictured: Fewer turned out to protest at the resumption of the tax debate.

Yesterday, deputies who attempted to repeal or replace P&R’s tax package said they were not planning on laying additional amendments during the debate.

Deputies Carl Meerveld and Chris Blin, had previously led an attempt to delay decisions and instead investigate the size and style of the island’s government.

They criticised the late publication of the self-styled ‘Fairer Alternative 2’ from Deputies Heidi Soulsby and Gavin St Pier, saying politicians and business have not had sufficient time to interrogate the proposals and its effects.

Deputy Blin told Express: “This is very tight as I will have only a day to absorb it, and I see that P&R have already released their comments on its validity. This is pretty unheard of from my experience given that this is probably the largest debate for decades and we are not privvy to the content till the day before [the meeting]”.

Deputy Meerveld confirmed that he would not be supporting the headline tax package, or the TRP and vehicle tax alternatives put forward by P&R but would consider “Option C or the new Option D presented by Deputies Soulsby and St Pier”.

He also said a comparison between his late cost-cutting amendment and the second Soulsby amendment was not justified.

“My late amendment during the previous debate simply edited the existing text within the Policy Letter but did not introduce anything new. This amendment proposes sweeping changes to the proposed way forward and is being laid too late for anyone, Deputies, businesses, or members of the public, to give it proper consideration,” he said.

Pictured: The mammoth tax debate is underway once again.

Deputy Charles Parkinson, who unsuccessfully attempted to convince States members to reject the tax package and instead impose a territorial corporate income tax system, said he would not lay another amendment, but would likely support the Soulsby amendment since it empahsises a corporate tax review.

“But my position remains that there should be no further increases in taxation or reduction in public services until the corporate tax system is reformed,” he added.

The tax debate commenced just before 11:00 today, with Deputy Soulsby opening by laying her amendment with the hope of it being added as a final option to be voted on alongside P&R’s three options.

She said: “We're not hiding from that we fundamentally think we should be taking a different approach. We don't believe the Big Bang way of doing things is necessary. We don't need to raise £85m from business and households in the next couple of years.

“We're still saying that the longer term financial position is unsustainable, and effective measures must be implemented in a staged approach through the delivery of expenditure restraints, savings and revenue raising.

“The assumptions of the structural deficit by Policy & Resources are based on nothing changing between now and 2040, when the truth is that government should be looking to the future and planning a course for the islands. The lack of strategic thinking will just see us drifting to 2014 but without any common purpose. We believe a strategic vision is required on which we can determine services needed, our tax base and the revenues to be raised from that tax base.”

Education President Deputy Dudley-Owen disagreed, saying: “What I want to see is the fairest, quickest, simplest sustainable competitive solution for our islands. I don't like GST on its own. I'm not particularly keen on it as part of a suite of measures, but the package put forward by Deputy Roffey and P&R seems to be the thing that gets us to the place we need to be quickest.

“It's the fairest solution and maintains our competitiveness. It also is sustainable. And therefore at the moment, it seems to be the only package on the table that ticks the boxes that I want to see ticked.”

Economic Development President Neil Inder, speaking against the amendment, said: “This island is in trouble. It has lots of things it has to deal with. For the first time in 25-30, 40 years we can't write our cheques anymore. Now, if anyone thinks this is a lifeboat, they're wrong. This is delay. It actually looks in part like a manifesto to be perfectly frank with you”.

Debate has now been adjourned for lunch, with a decision on whether to incorporate the Soulsby alternative amongst the other options expected early this afternoon.

TRP could be replaced if States back 'proportional' alternative

Tax challengers unconvinced – fresh amendment expected

Tax plan includes 5% GST - but P&R says most families will be better off

Why States leaders STILL think GST and tax reform is needed

"Unacceptable" and "damaging" service cuts if States reject GST

A gallery of images from today's protest can be viewed below:

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.