Industry lobbying has led to a u-turn from P&R in respect of one of its 2024 Budget propositions.

The Policy & Resources committee said it has responded to "industry concerns on tax relief for loan interest for rented commercial properties" and will now ask the States to vote against that specific proposal when the 2024 Budget is debated early next month.

Businesses had raised concerns about some of the very small profit margins involved in key development projects where removing this relief, albeit in a phased

way, could act as a significant disincentive and could be the difference in whether a project is commercially viable or not.

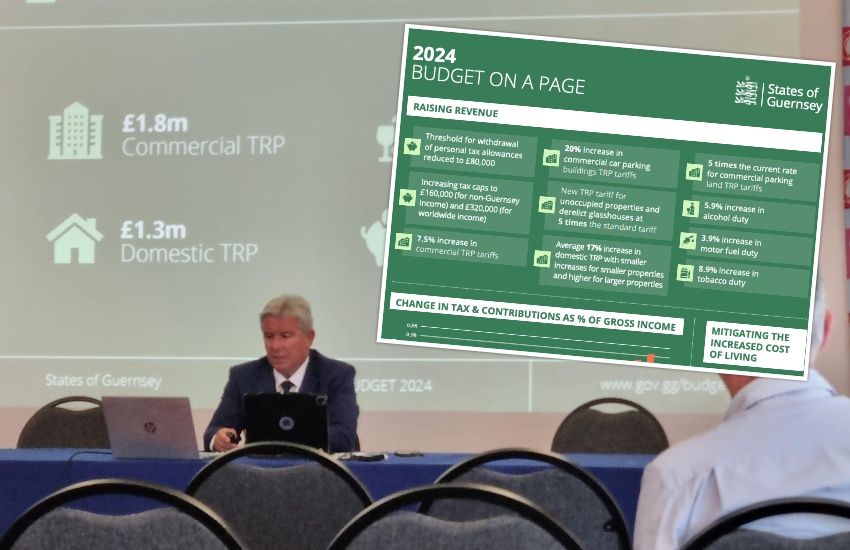

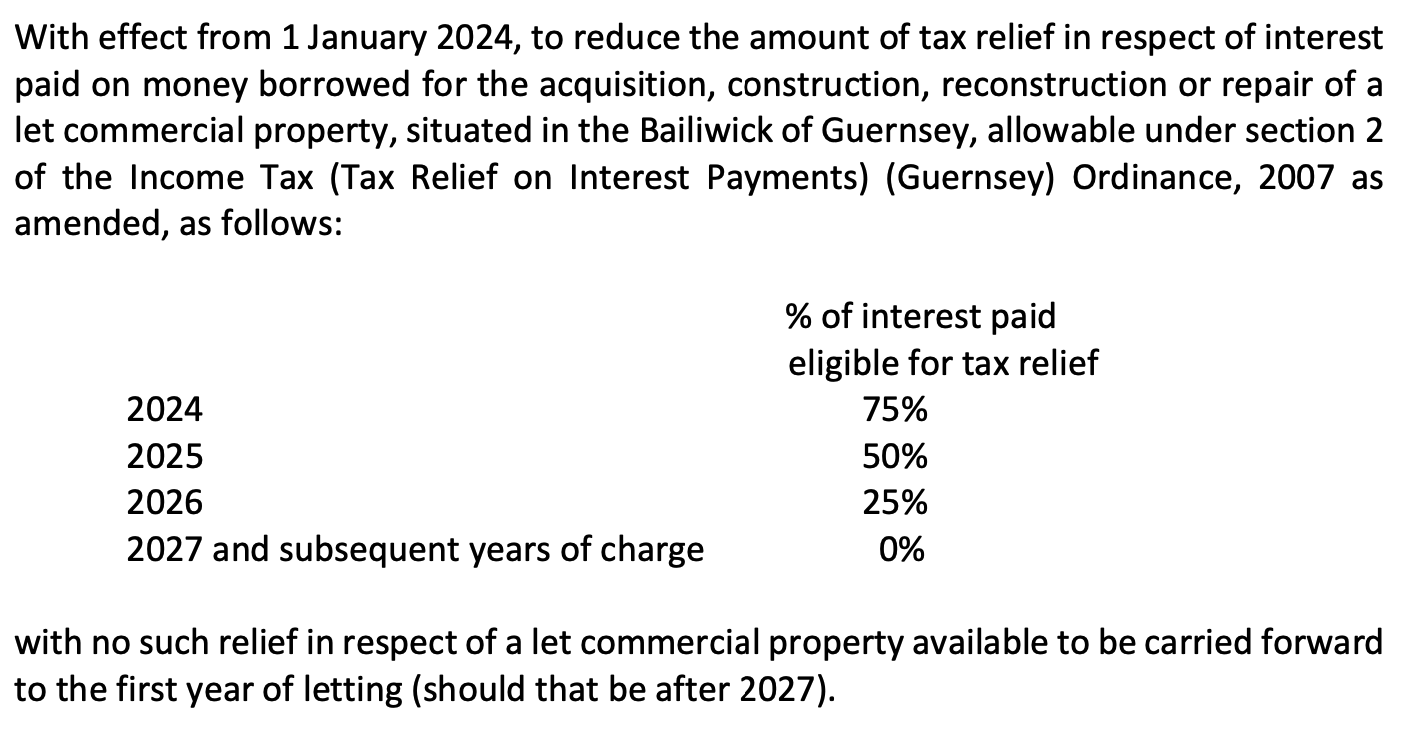

P&R's 2024 Budget included the idea of reducing the amount of tax relief levied on the interest paid on money borrowed for the purchase, construction, reconstruction or repair of a let commercial property.

This would have only be applicable to local properties and not any premises owned locally but situated elsewhere

P&R wanted to cut the level of tax relief to 75% from 1 January 2024 and then reduce it to 0% in phases over the following three years.

Pictured: The relevant section is in the 2024 Budget Report which can be read in full HERE.

P&R has acknowledged "representations from the business community" regarding this particular aspect of the 2024 Budget proposals and said it will now ask States Members to reject the specific proposition relating to withdrawing tax relief on loans related to the upkeep of commercial properties at next month's debate.

The Committee said that it had to make "some difficult recommendations given the ongoing unsustainably of the island’s finances and has been examining all opportunities for raising additional revenues, including looking at all tax allowances and reliefs.

"But it has listened carefully to these representations and come to the view that it would be better not to introduce a measure at this stage which may deter private development in this way."

Deputy Mark Helyar, P&R's Treasury lead, said they don't want to deter any investment in local properties and business.

“We already have a situation where there has been significant under-investment in our public infrastructure for years. A lack of investment in Guernsey’s infrastructure undermines growth in the economy, and thankfully even though the States has not invested nearly enough, some significant private developments have gone ahead which show there continues to be good confidence in the local economy.

"We do not want to deter that sort of investment, it supports local industries and provides new business and social facilities. In fact, the underlying intention of this budget is to encourage better use of both domestic and commercial properties, hence our proposals to increase the TRP on those which are unused or derelict.

"The business representatives who we have spoken to have made a good case for why removing this tax relief would not support that objective and so we will ask the States not to approve this proposition.”

Property tax shake-up key feature of 2024 budget

The draft budget - at a glance

Health accepts lower budget than it wanted

States companies need millions again to wash faces next year

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.