The introduction of a Goods and Services Tax (GST) has been criticised by the Guernsey Tourism Partnership and most of its membership.

The GTP is a new organisation created to represent businesses in Guernsey who rely on tourism. It includes businesses such as Island Coachways, Guernsey Surf School, the Petit Train and National Trust Guernsey.

Following the push from the Policy and Resources Committee for a GST, the GTP launched a survey to gather opinion from its membership.

“The Guernsey Tourism Partnership committee felt that the suggestion that GST could be introduced would impact the businesses that make up our membership,” said the Chair of the GTP, Ant Ford Parker.

“As part of our preparation to be involved in the debate and in order to be able to speak on behalf of the tourist industry we decided we should first ask our membership for their opinions.”

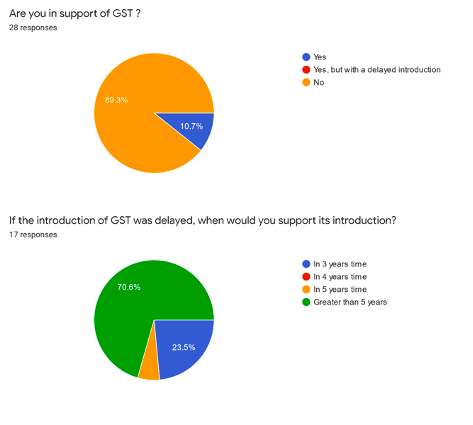

Pictured: The GTP posed a series of questions to its membership.

The majority of GTP’s membership thought other avenues should be investigated before GST.

“90% of our membership are not supportive of GST being introduced,” said Mr Parker.

“Most are still trying to recover from the impact of border closures and restrictions on travel.”

P&R has proposed GST as its preferred answer to the predicted annual deficit of £85m that Guernsey is facing. However, earlier this week the Committee announced it could delay the debate on tax reform in light of feedback from the community.

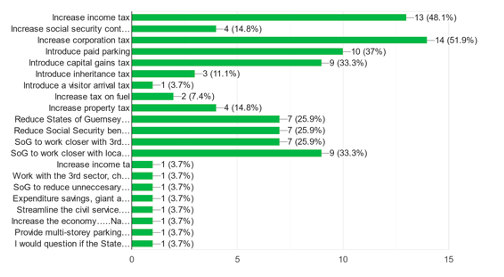

Pictured: GTP voted on alternatives to GST.

In response to the survey some of GTP’s membership shared experiences of businesses impacted by GST in other jurisdictions. One example being in Jersey, where GST was introduced in 2007.

Some said that GST had had a negative impact on sales for three years after its introduction and inter-island business dropped by 6%.

Furthermore, it was said that GST created a lot of extra work for businesses when they shipped goods in: “Our team has to process the value of every item into the cutoms system,” said one of the respondents.

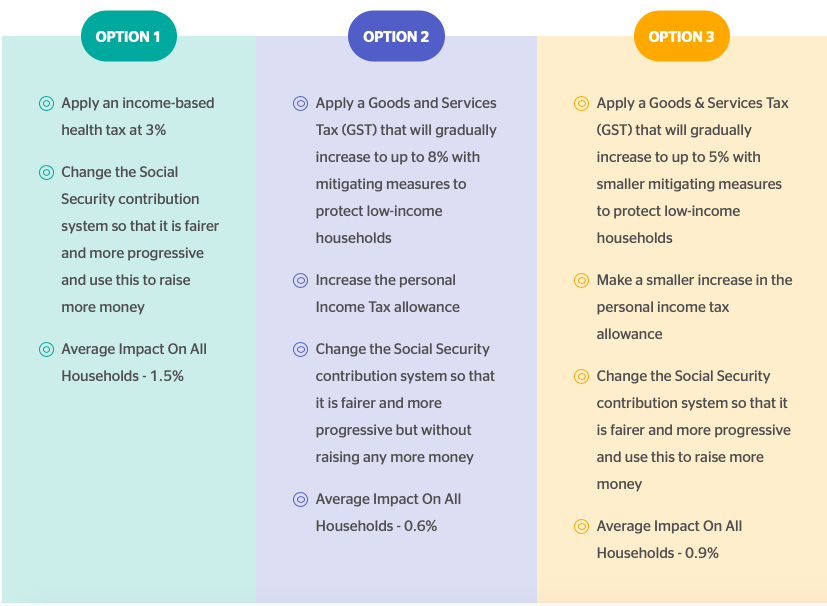

Pictured: P&R has launched a public campaign, informing islanders of various revenue raising options.

Mr Parker said GST will be a regressive tax and alternative options of taxation should be fully considered first.

“The impact on already weakened businesses could be very serious and could lead to tourism and retail floundering,” he said.

"Our town and coastal infrastructure is already suffering from the lack of business and population. A regressive tax will do nothing to solve these problems.

“We believe Guernsey needs positive spend and growth and a fairer spread of measures to help pay for it.”

P&R wants to win public support for GST ahead of summer debate

P&R tears up its own tax proposals and commits to "extensive consultation"

PODCAST: "Middle income earners would bear the full brunt of GST"

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.