The Policy & Resources Committee says the effects of a goods and services tax (GST) could be balanced out for poorer islanders by a more progressive social security system. But Deputy Charles Parkinson says the Committee's latest proposals for GST would simply shift the tax burden to 'middle Guernsey'.

The Policy & Resources Committee's treasury lead, Deputy Mark Helyar, has launched a weeks-long public campaign to persuade the Bailiwick to support the introduction of GST to address a projected shortfall in States’ finances of £85million a year ahead of another States’ debate on tax policy this summer.

The public campaign – ‘our island, our future’ – includes a new website which can be accessed HERE.

The Bailiwick's population is living longer and having fewer children. The Policy & Resources Committee projects that this will soon result in a deficit in States' finances of tens of millions of pounds a year. And it is proposing a new GST as its first option to deal with the deficit and has identified increasing income tax as a less satisfactory fall-back option.

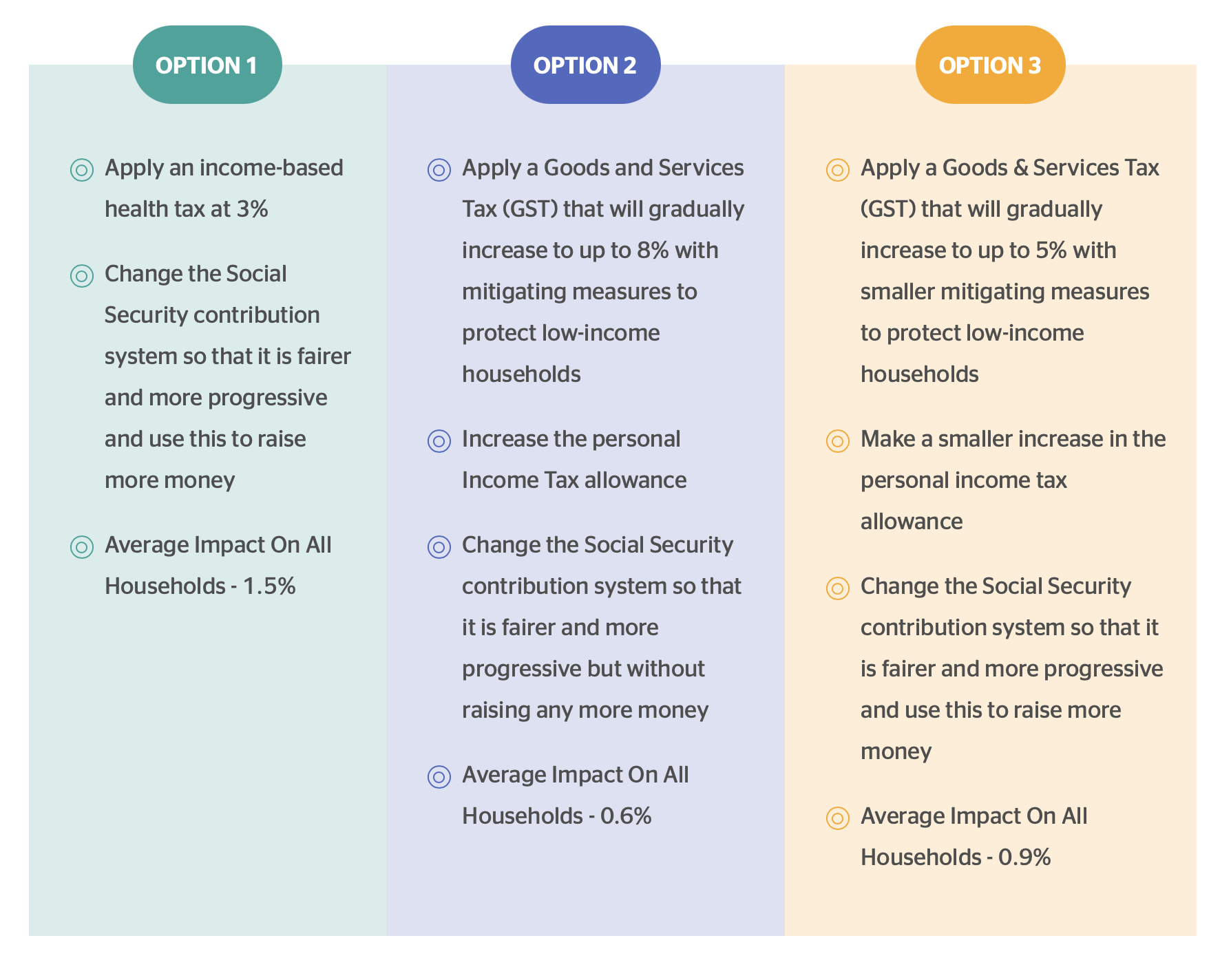

The Committee has previously suggested that GST should be introduced at a rate of 5% or 8%.

Pictured: Deputy Charles Parkinson told Express that he expects the Policy & Resources Committee to put a formal proposal for GST before the States this summer and that the proposal would probably be defeated by States' members.

“They’re saying they would adjust other features of the tax system to counterbalance GST,” said Deputy Parkinson.

"They could increase personal allowances, but that only benefits people who have income above the personal allowance threshold.

“Many pensioners, for example, only earn income up to the current personal allowance, so an increase wouldn’t benefit them at all.

"Then they say 'we’ll compensate further by adjustments through the social security system to increase benefits to those both in work and out of work to cover the cost of the GST they’re going to pay'. But all that does is shift the burden up to the middle income.

“It means people who have got lots of money will choose not to spend it, or not spend it in Guernsey, and won’t feel the effects of GST. And if those on the lower bands are protected through adjustments to social security then the burden falls on middle income earners.”

He said this group of taxpayers already has limited capacity to save in an island with high costs of living. And he fears that 'middle Guernsey' would find that it was not protected by any changes to social security contributions introduced alongside GST.

“They will bear the full brunt of GST,” he said.

Pictured: Deputy Mark Helyar, treasury lead for the Policy & Resources Committee, is leading tax proposals which, according to one of his predecessors, Deputy Charles Parkinson, amount to "offering two possibilities between the devil and the even worse devil, which are higher income tax or a GST".

Deputy Parkinson said that GST would exacerbate existing financial challenges in an island with “extortionate housing prices” where some families already feel they are better off elsewhere.

“We have an ageing demographic and a deteriorating dependency ratio," he said. "The taxes and the charges on the working population mean that many of them are better of living somewhere else and we’ve already got a bit of that going on now.”

During our latest PODCAST, which can be accessed HERE, Deputy Parkinson spoke at length about the issues raised by the Policy & Resources Committee's tax review and latest push for GST.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.