Policy & Resources is certain that its Budget is the solution to Guernsey's immediate problems as it faces up to a raft of attempts to change it.

19 amendments have been placed ahead of next week's Budget debate, with 20 individual deputies either proposing or seconding these amendments.

Many of the amendments focus on pivotal talking points for next year's election, and attempt to tackle some of the biggest issues facing Guernsey. From housing to food costs, corporate taxes and everything in between.

You can read about all 19 amendments in detail here.

The major spending amendment is being brought by former P&R treasury lead Deputy Mark Helyer to cap things at this year’s levels. Should that fail, Deputies John Dyke and Simon Vermeulen will try instead to reduce expenditure by £27.8m.

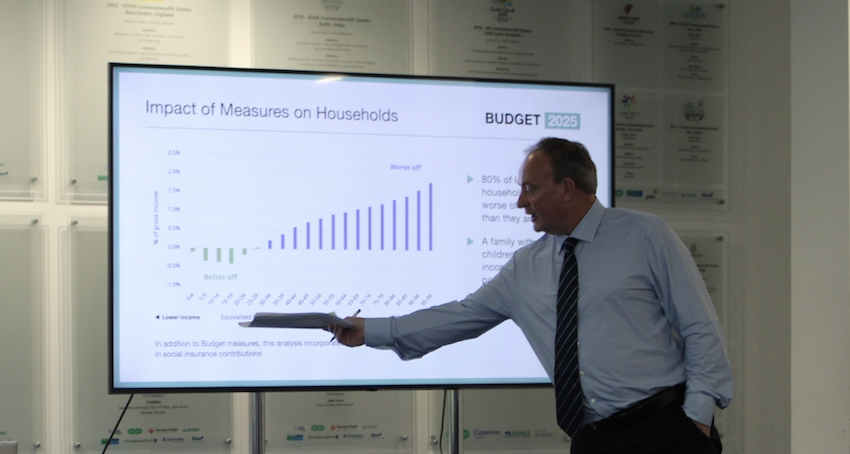

Deputy Trott said that “the one that seeks to take a knife to public spending” ignores how much is spent for services per person, when compared to similar jurisdictions, and would be “potentially quite reckless” and “certainly ill advised”

“The comparison between us and Jersey is significant. We spend less by 14% on public services. Now there's a number of reasons for that, relatively speaking we're lean, but there is also an element of underinvestment and that underinvestment in infrastructure has been well documented over many many years and cannot be allowed to go on.

“So we've got two issues that need to be addressed. The first is that there is a burgeoning budget deficit and it would be fiscally irresponsible to ignore it, but secondly investment into our community is essential not only to ensure that we maintain good levels of public services but also to ensure that we stimulate the economy and promote growth in the appropriate way.”

Pictured: Deputy Lyndon Trott outlining his planned proposals for the 2025 budget.

He was also a stalwart defender of P&R's proposed rise in income tax - from 20 to 22% - when compared to options supporting GST. Earlier this week the Guernsey Chamber of Commerce broadly backed the GST option, and you can read more about that here.

“Well the thing to bear in mind is that what our Budget does, is what this States is mandated to - look after its public finances right now. If the income tax proposals are not supported then this community, the public service will be, and by definition this community will be, £55m. worse off in terms of being able to invest in our future.

“It's a fundamental principle that one States can't bind the next but it's also a fundamental principle that the States of the day need to concentrate on what it's mandated to do, and in this case it's to deliver a budget that in the short and medium term is in the very best interest of this community and all five members of the Policy and Resources Committee are absolutely certain that the proposals that we bring are the only solution to address the problems that are faced right now.”

Deputy Parkinson’s amendment seeks to introduce a territorial corporate income tax from 2026 and also maintain the individual standard income tax rate at 20%.

Critics of the scheme say it could leave the island uncompetitive when compared to the other Crown dependencies, and Deputy Trott counts himself among them.

“We've heard this over and over and over again from my friend Deputy Parkinson. One day Deputy Parkinson will be right, and I think that is getting closer, I think that's a few years away.

“But what is absolutely fundamental is that we, as one of the three Crown dependencies, do not move on this issue unilaterally. This needs to be a multilateral solution because what we mustn't do is move in a manner that affects our competitiveness.

“Rather than listen to Deputy Parkinson, who has been out of this world now for some time, we've decided to rely on information that we've asked for from those in the know, and the States will make the same decision it has on many other occasions, and that is that these proposals will have their day but that day is still some time away.”

Pictured: Deputy Charles Parkinson's amendment is estimated to cost up to £2m, but the pay back would come from tens of millions of pounds of extra revenue it then brings in.

On several more amendments Deputy Trott is also pessimistic, calling the Taylor amendment “superficially unattractive”. That one seeks to utilise a potential construction village ear-marked for temporary and key workers, as housing for those needing it locally as well.

However, the amendment has already led to interactions between senior States committees.

“We have gone out to the committees with the clearest mandate on this, ESS and E&I, and we've asked them for their thoughts. My view is that they're conflating two issues here.”

You can read more about Deputy Andrew Taylor’s amendment here.

There were question marks over an amendment to the proposed Rent-a-Room initiative by Deputies Sam Haskins and David Mahoney.

P&R’s proposed scheme to encourage householders to rent a room in their house, offers a tax break on this rental income but only if it does not exceed £10,000, that equates to £833.33 per calendar month.

The amendment would allow rental income to exceed that amount, but with the portion above £10,000 subject to tax.

Deputy Trott said: “it could be counterproductive. You could have a situation where the incentive of having the tax break which corresponded with the desire to keep rental rates low was lost as a consequence of this.”

The public might not get to see the decisive arguments for some of these points, as deputies lodging amendments, and committees with the mandates to make any changes, are being invited to meetings later this week.

“We're asking all States members that have laid propositions to come and have a chat with us,” said Deputy Trott.

“We're going to see if we can streamline the process in any way so we may be able to gain some time, by making it clear that there are some amendments that we're unlikely to oppose, others that we're neutral on, and so on.”

States members are due to begin debating the 2025 budget on Tuesday 5th November, and you can find out more on the States website.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.