A territorial system of tax is “far from being an exotic creature”, Deputy Charles Parkinson said, as he unsuccessfully argued in favour of introducing one, before the States comprehensively said no to it.

His amendment to Policy & Resources tax plan would have seen the Island introduce a new corporate income tax regime on a territorial basis with a general rate of 10 to 15% to raise a minimum of £20m a year.

After two years of that system operating, there would be a report on any measures needed to address any remaining fiscal deficit before the end of 2029.

"More than 30 countries out of the 38 OECD countries operate territorial systems of tax, this is far from being an exotic creature," said Deputy Parkinson.

"So if we were to replace zero-10 with a territorial corporate income tax, we would by and large replicate the effects of the pre-change Guernsey tax system, but with the important distinction that we wouldn't be exempting our domestic economy. Businesses doing business on Guernsey would become once again liable to Guernsey income tax.

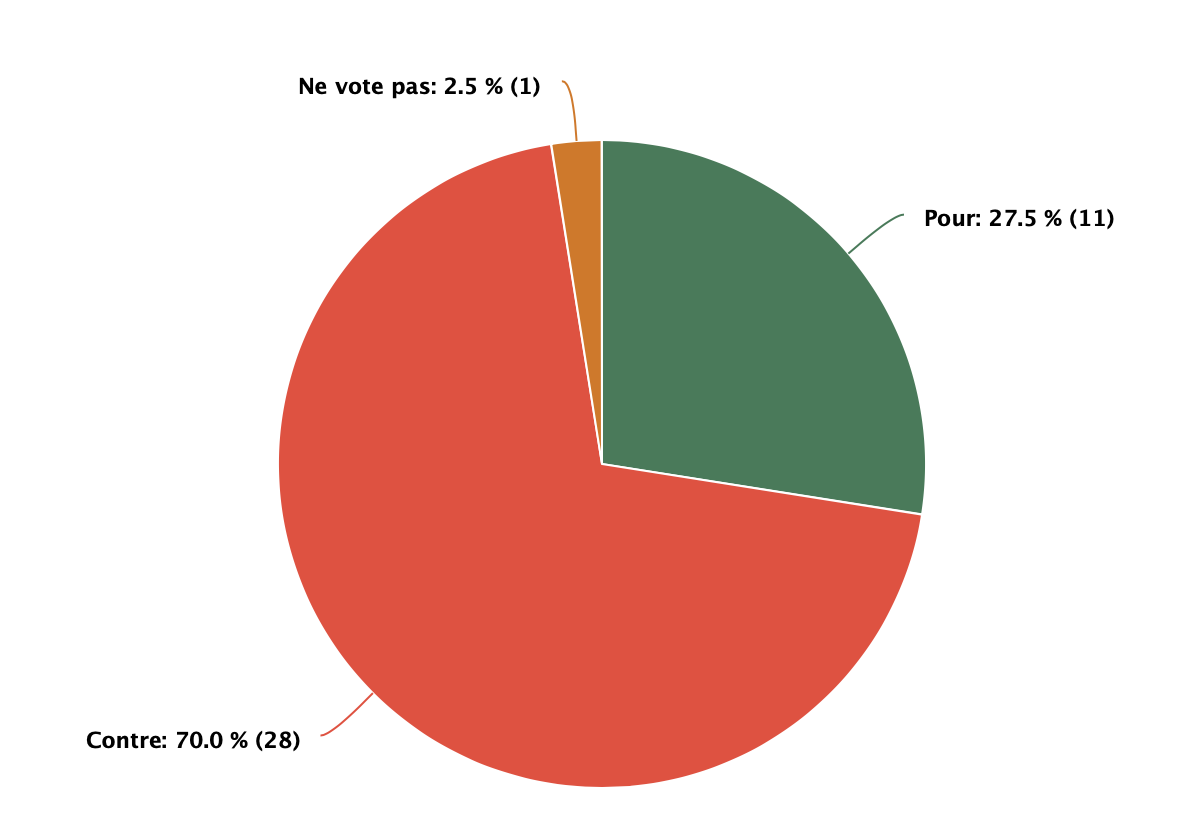

Pictured: States Members rejected the move proposed by Deputy Parkinson by 28 votes to 11.

"It was exempting businesses in our domestic economy which accounted for a large part of the £100m in corporate income tax that we gave up when we introduced Zero-10. There is no moral or logical reason why companies doing business on Guernsey should not be paying tax on Guernsey. They use our public services and they should be contributing to the cost."

He believed introducing a territorial tax would enhance the Island's international reputation saying the zero per cent rate of tax was a "red rag to a bull".

Deputy Parkinson said that growth was necessary to cope with demographic changes.

"The Policy & Resources policy letter basically attempts to show that the Island can raise an extra thick neck £50m of tax to plug the existing fiscal deficit, but it acknowledges that the deficits are only going to get bigger as the demographic changes continue. But it offers no solution to filling the future deficits that will arise because of demographic change other than to go on increasing tax. Their GST will do absolutely nothing to promote economic growth in Guernsey. In fact, quite the contrary."

The island's finance industry is shrinking, he said.

"The proposals on the table will only make those problems worse. I believe that we have to look at a sensible alternative, taxing companies judiciously is a sensible way of raising more money without killing off growth and which actually offers the possibility of a more stable, more internationally acceptable tax regime, which will encourage more investment into Guernsey if Guernsey is not perceived as a tax haven or perceived less as a tax haven."

Pictured: Deputy Lyndon Trott.

Some companies choose not to invest in Guernsey precisely because they do not want to be associated with that kind of brand, he said, adding there was very little pressure on the Isle of Man to change its corporate tax regime.

"Unless and until some international body like the OECD or the EU tells them that they can't have Zero-10, I think it's unlikely that they will change from it. If we shackle ourselves to them and say we can't move until they move we're going to be stuck here forever in a growth killing unfair regressive GST."

Deputy Lyndon Trott, who led the original move to Zero-10, said the island could not be unilateral on territorial tax and had to work with Jersey and the Isle of Man.

He had little doubt that we would eventually end up with what Deputy Parkinson envisaged, but it would be by the end of the decade.

It was not the right time to be discussing this transition and that was advice from all but a very small number of tax advisors, he said.

P&R member Jonathan Le Tocq spoke out against the change.

Pictured: Deputy Jonathan Le Tocq.

He said that Guernsey would not be in the position of having long established scheme, but designing one and that would inevitably prompt a review by the EU Code of Conduct group and being placed on its grey list for a significant period.

This would result in a period of uncertainty, deterring investment at a time when growth in the economy was an imperative, he added.

P&R's Mark Helyar compared the amendment to Dante's Inferno.

He warned that it was not wanted by industry, would create an unsettling level of insecurity and potentially lead to a serious loss of business.

How they voted

For: Tina Bury, David De Lisle, Simon Fairclough, John Golllop, Chris Le Tissier, Marc Leadbeater, Aidan Matthews, Liam McKenna, Charles Parkinson, Gavin St Pier, Andrew Taylor.

Against: Sue Aldwell, Chris Blin, Al Brouard, Yvonne Burford, Andy Cameron, Lindsay De Saumarez, Andrea Dudley-Owenm John Dyke, Steve Falla, Peter Ferbrache, Adrian Gabriel, Sam Haskins, Mark Helyar, Neil Inder, Sasha Kazantseva-Miller, Jonathan Le Tocq, David Mahoney, Carl Meerveld, Nick Moakes, Bob Murray, Victoria Oliver, Rob Prow, Steve Roberts, Peter Roffey, Alexander Snowdon, Heidi Soulsby, Lyndon Trott, Simon Vermeulen.

Did not vote: Lester Queripel.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.