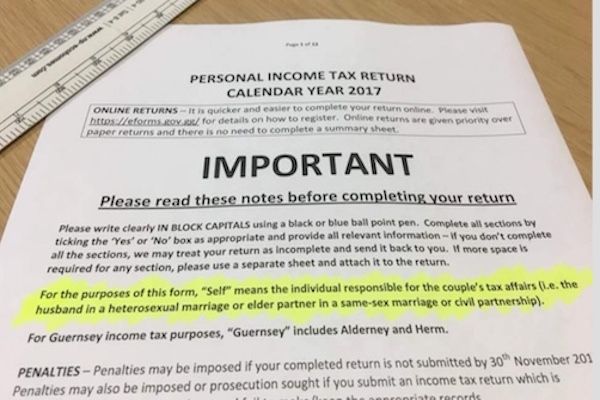

The wording on Guernsey's Income Tax forms has been amended following the introduction of same-sex marriages - and it will soon change again, to remove any reference to husbands and wives and same sex partners.

As well as giving husbands authority over their wife's tax affairs, the decision was made last year to give the elder partner in a same-sex relationship the authority over their spouse's tax.

That decision was made after the introduction of same-sex marriages in Guernsey in 2017, and the wording which has appeared for the first time on Income Tax forms, issued this month, was agreed with the equality charity Liberate, which worked with the States of Guernsey on the change in the law.

However, Deputy Gavin St Pier has already recommended the system be changed to allow everyone who is married the right to be taxed independently. That was suggested when he presented his 2018 Budget in November 2017. That work is ongoing but a spokesperson for the States of Guernsey says the change will be made as soon as possible: "The States agreed as part of the 2018 Budget to introduce a system of independent taxation, including individual assessments. Work on that is ongoing.

Under the current system a married woman may request separate assessment if they want to complete their own tax return and keep their tax affairs separate. Notification should be made by 31 March in the year the couple wish to be separately assessed.

Regarding same-sex married couples/those in a civil partnership, with effect from 1 January 2017 they are also assessed jointly (with the option to elect for separate assessment), albeit it is the eldest spouse that is responsible for the tax affairs of the couple. The wording to explain this was agreed with Liberate as part of our ongoing engagement with the charity. More detail is available via a FAQ document at gov.gg/taxationfaq".

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.