Guernsey residents will be treated as independent individuals for tax purposes from 2023 onwards after the States approved the change in 2020.

Currently, only one partner in married couples has responsibility for managing the couple’ tax affairs. Each person will submit their own tax returns in future, much like how social insurance contributions are independently managed.

Whilst the change will be active from January 2023, married couples will submit their 2022 Personal Tax Return jointly. February 2024 will be the first time that independent tax returns become available.

From October, around 12,000 people who do not currently manage their own affairs will receive a new Tax Reference number from the Revenue Service.

New coding notices will be issued in November, and these will be sent to employers in December.

The Service will be communicating directly with these individuals providing them with more information in due course.

Pictured: A presentation on the changes was held at Frossard House last Friday.

Sarah Davies, Head of Service Delivery for the Revenue Service, said the current system is “outdated, inequitable and not in line with social security”.

And Guernsey’s treasury lead, Deputy Mark Helyar, called the move a “big and important change” for the local tax system, delivered on-time.

Nicky Forshaw, Director of the Revenue Service, said additional support will be available for those who need help under the new system: “Our staff are ready to help answer questions, and importantly, the improvements we’ve been making to our online portal and digital services, as well as our technology behind-the-scenes should help make it a much smoother process than it would have been even just a couple of years ago.”

Provisions are available, through Powers of Attorney, for individuals tax affairs to be managed by another party.

The public are asked to ensure their details, held by the Service, are up-to-date and to consider setting up a digital MyGov account if one is not already held.

Ms Forshaw said over 20,000 tax returns we’re submitted online for 2020.

More information can be found online HERE.

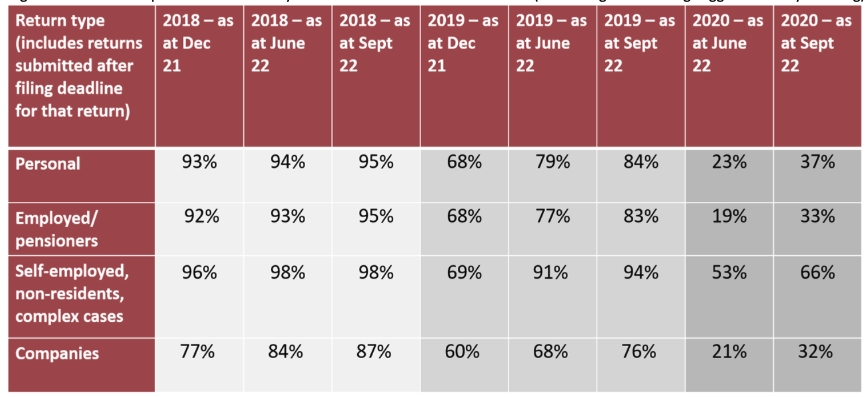

Pictured: A breakdown of completed tax returns since 2018.

The Revenue Service say they are making good progress in clearing a historical backlog of income tax returns, with a hope that 2018 and 2019 returns will be resolved by the end of the year.

The latest assessment shows that 95% of personal and employed/pensioner returns, 98% of self-employed, non-resident and complex returns, and 87% of companies 2018 returns have now been reconciled.

Outstanding returns for 2019 range between 24% and 6%.

Pictured (top): Sarah Davies and Nicky Forshaw.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.