Support scheme to stimulate start-up investment announced

Friday 20 September 2024

A new scheme has been launched to stimulate investment into start-ups and early-stage businesses.

Economic Development has created the Guernsey Enterprise Investment Scheme to encourage angel investment into high growth businesses by reducing income tax charges.

Guernsey-based investors who invest into a qualifying business will be able to apply for an equivalent tax relief incentive of up to 30% of the investment value.

Through the provision of investor incentives, GEIS, which will initially operate as a two year trial, aims to encourage an estimated £2.2m of investment into local businesses.

"I am very pleased to announce the launch of the Guernsey Enterprise Investment Scheme on a trial basis," said Deputy Sasha Kazantseva-Miller, Economic Development's Lead for Digital, Skills and Enterprise.

"This is a completely new idea developed by the Committee for Economic Development this political term with the objective of helping stimulate private investment into startups and early-stage businesses.

"Access to funding is key for businesses and well-established schemes operate elsewhere, making it easier to attract private capital. We are launching the scheme on a trial basis to be able to learn, adapt quickly and react to feedback from industry. The first round of applications for the GEIS will open soon and in the meantime we hope this gives businesses and investors a heads-up which can help in their fundraising and decision-making process on investment."

The scheme is based around the UK's Enterprise and Seed Enterprise Investment Schemes.

Applications for GEIS will open on 1 October and close on 9 November.

There are criteria to be met to be able to access the scheme.

Business requirements:

- Must be a trading company incorporated and registered in Guernsey

- Must have been trading for more than four months

- The company must not be raising more than £500,000 through GEIS

- The company must operate within a qualifying sector

- Must be a Guernsey based business and remain for five years

- Must have less than 25 full-time equivalent employees when the shares are issued

- Must be within seven years of the company's first commercial sale

- Funds raised must be spent within two years of the investment

- Funds raised must be used to grow or develop the company

- Investment must pose a risk of loss to capital for the investor

- Funds can't be used to buy all or part of another company

Investor requirements:

- £1,000 minimum personal investment

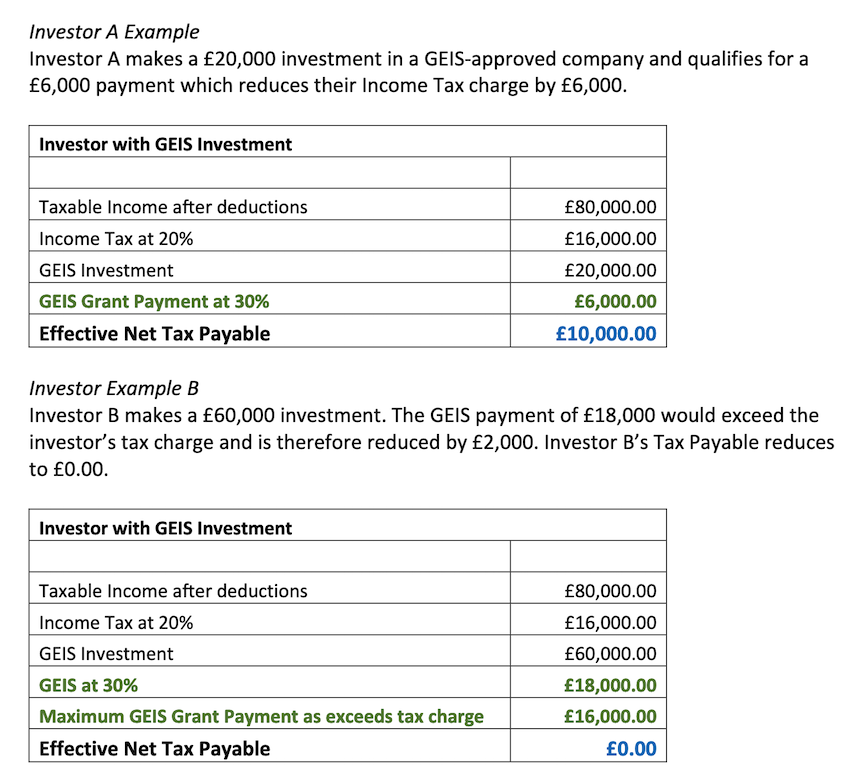

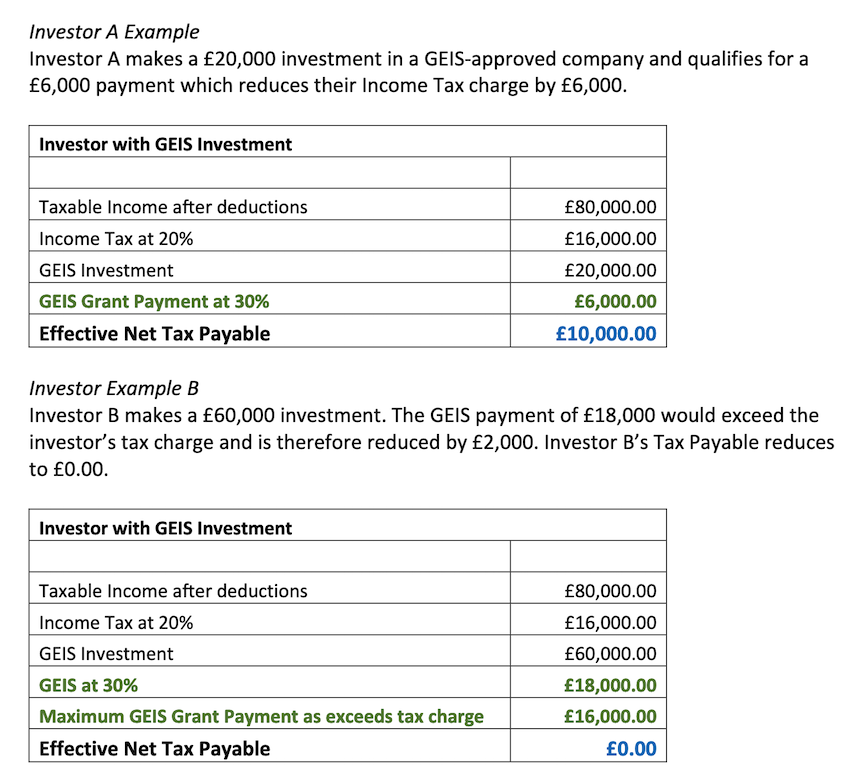

- GEIS payment equivalent of up to 30% of the investment

- Can claim a maximum of £30,000 GEIS payment per year

- Claimant must be a Guernsey taxpayer

- GEIS can only be claimed by individuals

- GEIS can be claimed for either the year of investment or the preceding tax year

- GEIS payment can not exceed an individual's tax liability for the year claimed

- Investor must not be connected to the GEIS company or any subsidiary either as an employee, business partner, spouse, civil partner, or family member (parents, grandparents and great-grandparents, children, grandchildren and great-grandchildren)

- Investors who are eligible for either the tax cap or standard charge are not eligible for GEIS

- Unpaid Directors of the GEIS company are eligible to claim

- Investor must hold shares for not less than three years

- Investor cannot hold a total of more than 30% of the company's shares; rights to assets if the company is wound-up; voting rights

How the scheme works:

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.