The ever-mounting cost of maintaining States services and delivering on all of government's agreed resolutions has been laid bare - and no revenue-raising measure is off the table.

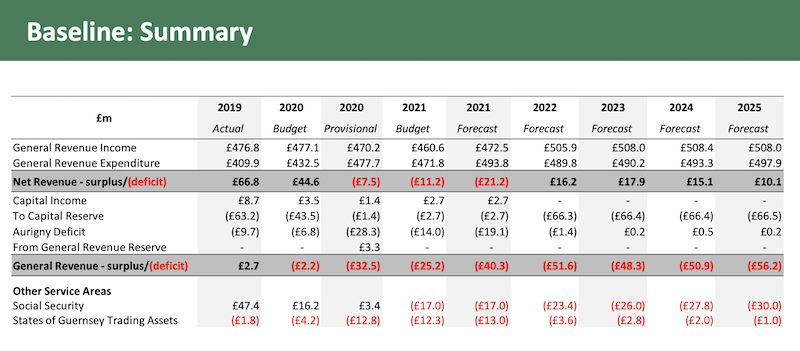

Policy & Resources has today published a five-year medium term baseline, forecasting its expectations for public finances in terms of income and expenditure. The figures indicate general revenue deficits worsening year by year as the working population declines.

With the current direction of travel, it is forecast that annual deficits will reach £56.2m come 2025. At a briefing yesterday led by P&R's Treasury Lead Mark Helyar, the media was told Covid-19 has made our need to act more immediate, however the long-term issues have been building for many years.

Pictured: In a surprise move, the States is forecasting that Aurigny will stop losing money in the years to come.

These issues are manifold and complex, with around two-thirds of the States' current spend tied up in essential services, leaving little room for manoeuvre.

"There is upward pressure on all of that spending," said Deputy Helyar. "It is the majority of the States spending, so the deficit position will only get worse."

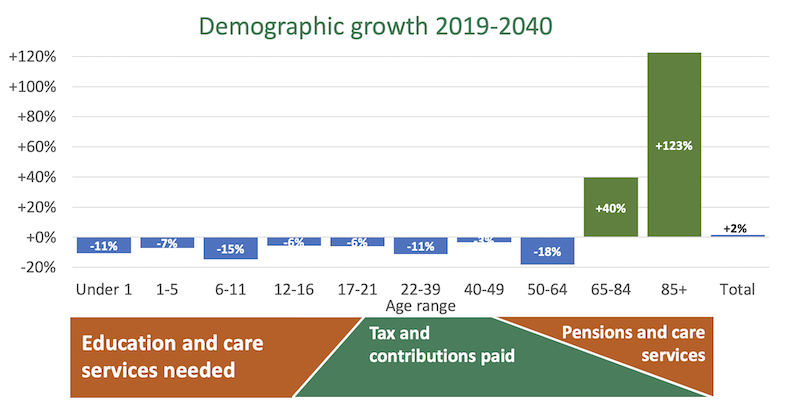

The financial need to rein back spending is at odds with the island's severely ageing demographic, which is expected to see the number of people aged over 85 more than double in the next 20 years.

Guernsey's workforce is expected to shrink, said Deputy Helyar. Express has recently documented some of the crisis-level issues facing young people who are trying to build a life in their island home, but cannot afford to get onto the housing ladder.

Pictured: The States of Guernsey will meet for its second debate on the Government Work Plan on 21 July. The meeting will determine the actions it seeks to prioritise and the ‘funding and investment’ requirements this generates. Any additional spending commitments made through the GWP are not factored into the baseline forecasts.

The workforce supports the majority of government revenues, and Deputy Helyar said he is wary of increasing taxes, knowing that it could prove counter-productive.

"My preference is not to raise taxes. It is not the right thing to do in a recovering economy." His committee will create a 'toolkit' which will set out all possible revenue-raising measures, how much they would raise, and exploring some "novel ways" to grow the economy in ways that may be unprecedented for Guernsey.

"This is going to be a very thorough review. We are going to look at absolutely everything."

"[If this was a business] I would say we have to cut the budget by 20%, but we cannot do that."

Pictured: Expected demographic changes between 2019 and 2040, which have been set out in a briefing to States members and the media.

The Committee is continuing to prepare a Tax Review, which will be published in September and "will seek to address the longer-term problems."

“The problems in our tax system, our reliance on a small tax base, and its vulnerability when faced with an ageing population, cannot go unaddressed any longer," said P&R President Deputy Ferbrache.

"If we do not prepare now and make some difficult decisions, it could prove to be even more of a crisis than the pandemic itself.”

Deputy Helyar said it will ultimately be up to the States as a whole to decide. "Deputies must ask themselves, what is the role of government in Islanders’ lives? What are our real priorities? What do they cost? What do they achieve?

"One thing we cannot do is keep acting like the costs don’t matter, because as the gap grows between what we can fairly raise and what we need to spend, they absolutely do.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.