Plans to launch Guernsey's secondary pension scheme appear to be on track for a January 2024 start date, after a temporary delay.

Sovereign Pension Services is the States partner delivering the auto-enrolment scheme. This week it welcomed the CEO of National Employment Savings Trust Pensions to the island.

Helen Dean CBE was involved in the design and implementation of the UK's auto-enrolment pension scheme and is now responsible for delivery as CEO of one of the largest pension schemes in the UK.

Over the past two days she met members of the Guernsey Association of Pension Providers and gave a presentation to States Members. She shared her experiences of auto-enrolment in the UK since its introduction 10 years ago.

"We run the national pension scheme for auto enrolment in the UK. Any employer can use us and can enrol their employees in our pension scheme, and we will charge the same low-cut price to every worker. So, we don't differentiate on how much people earn, or if it's a large employer, everyone gets the same high-quality low-cost pension from us.

Pictured: NEST has helped eleven million people start pension funds in the UK.

"It was just essential we had a national provider as when the UK brought in auto enrolment which has been such a phenomenal success but it's really essential that when you're requiring an employer to offer a pension that you can be certain that every employer's got access to high quality pension provision."

In the 10 years since NEST launched in the UK, with a loan from the government, it has grown to 11million members, with just under £26billion in the fund.

The fund grows by about £5.7b every year, and the number of members is expected to grow from its current rate of around 1/3rd of the UK's working population to around half.

Ms Dean said the success of the scheme can be seen in the response of people who have started saving having never put anything aside for their future before.

"I spend a bit of time going out and talking to some of the employers who use us, and I always remember in Edinburgh at a little nursery school, and they were part time women with an employer who really believed in pensions but had not been able to find a pension provider who would offer them a pension previously.

"I sat down in the little kiddy chairs in a circle and just started to talk to them about what it feels like for them, to suddenly be saving for retirement and the first thing that they felt was an enormous sense of relief. Thinking about saving for retirement, that's something they'd worried about for a long time but they hadn't quite known what to do about it so you just get a sense of 'oh, thank god', then they said they moved from that to a sense of pride, 'now I'm saving, I'm investing, I'm doing something positive for the future - get me!', you know, a real sense of pride, and almost empowerment from it, and then finally - and I think this is the key for the future - they said they began to get curious, and as their fund grew and it started to get more meaningful to them, well 'what is this?', 'what do you mean you're investing my money?', 'where are you investing my money?' and 'how are you investing my money?', and 'what does this mean?' so I think assuming that this is the route we're taking people through - relief, pride and curiosity - in terms of really ending up with a workforce who are more financially literate and more financially astute, auto enrolment could really be the start of something quite big."

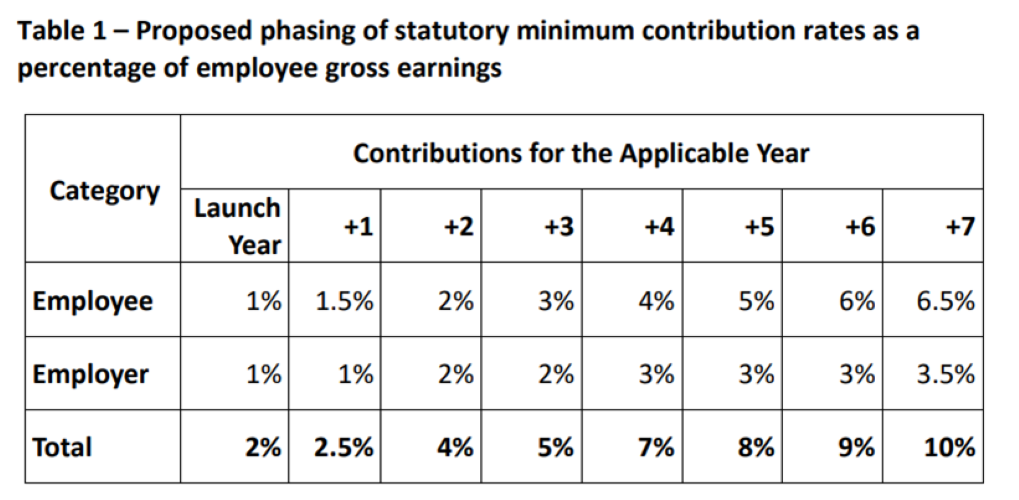

Pictured: The proposed contribution rates are above, The details will be expanded when secondary pensions are debated again by the States next month.

Since being selected as the preferred bidder for the Your Island Pension (YIP) Scheme by the States of Guernsey earlier this year, Sovereign Pension Services has been proactively engaging with the senior team at NEST to discuss issues, challenges and positives that were encountered following the introduction of auto-enrolment in the UK.

They said they want to learn from the experiences of others, prior to the introduction of Secondary Pensions in Guernsey.

Secondary pensions were due to come in next year, but a delaying motion supported by a number of deputies saw the States agree to a one year delay.

Deputies will now debate secondary pensions, with the added information from meeting Ms Dean this week, next month.

Of course nothing has changed, so the sursis you and the majority supported has achieved nothing - other than pointless and costly delay. But full credit for recognising that you were wrong and changing your position. https://t.co/milcohFbwl

— Gavin St Pier ???????? (@gavinstpier) October 12, 2022

Ms Dean understands that pensions can be a tricky subject for some, so she was heartened to meet a supportive taxi driver who picked her up from the airport when she arrived earlier this week.

"He's over 60 so it wasn't for him, he's got a pension he'd been in the navy for a while, but he said 'I didn't realise I had a pension until I retired, and I was so relieved I had. I want this for my daughters'.

"He had two daughters and he wanted to make sure they were also saving for their retirement. It seemed to him absolutely essential, and he was talking about the things that really are the founding stones of auto enrolment, he was saying 'you never think about saving for retirement until it's almost too late to do it'.

"Getting people to start young and to start early and to benefit from years of saving, persistently over time and the magic of compound interest it makes such a difference to people."

With economic turmoil again threatening the UK, Ms Dean said the scheme they operate, and which she was advocating to Guernsey's politicians and pension providers, mean invested assets are safer than in some alternative options.

"There are no guarantees, it's a standard defined contribution pension so the first thing to say is there are no guarantees, but there are ways as with any financial product that you can manage risk and volatility. we do that very carefully, particularly as we've grown and now have a very large asset base.

"What we've been able to do, we've been able to diversify across lots of different asset classes. When you do that, you find you're investing in a broad range of asset classes so some of the things that are struggling at the moment like equities are offset by things that are doing well like fuel. Renewable energy is doing rather well at the moment so because we're able to diversify and because we're a big scheme the other thing that we've got is a lot of bargaining power so we can drive great prices from our fund managers, so what we've been able to do is protect our members from a lot of those sort of shocks by the way we manage the money and the way we diversify by our size and our scale and if you look at us on a risk adjusted basis across the UK market we're doing very well - over 9% returns since inception but the thing is we have very little volatility in our funds so people aren't seeing their assets going up and down as much as they would in others."

States "kick can down the road"

EYE ON POLITICS: This week in the States' Assembly

ESS boss confident of getting final approval for new pension scheme

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.