It appears to be business as usual for Credit Suisse in Guernsey, with no comment from the firm's local office about the recent trouble facing the international bank.

Earlier this week stock markets tumbled as the Silicon Valley Bank collapsed, leading to the Saudi National Bank withdrawing from further investment in Credit Suisse.

As a major shareholder, that left Credit Suisse needing to “pre-emptively strengthen its liquidity” which it did by asking the Swiss National Bank to lend it up to £44billion.

That helped Credit Suisse's value recover yesterday but many questions remain over the future stability of Switzerland's second largest bank.

There has been no confirmation yet of what the future may hold for the international lender's 160 staff in Guernsey, with the local office not commenting.

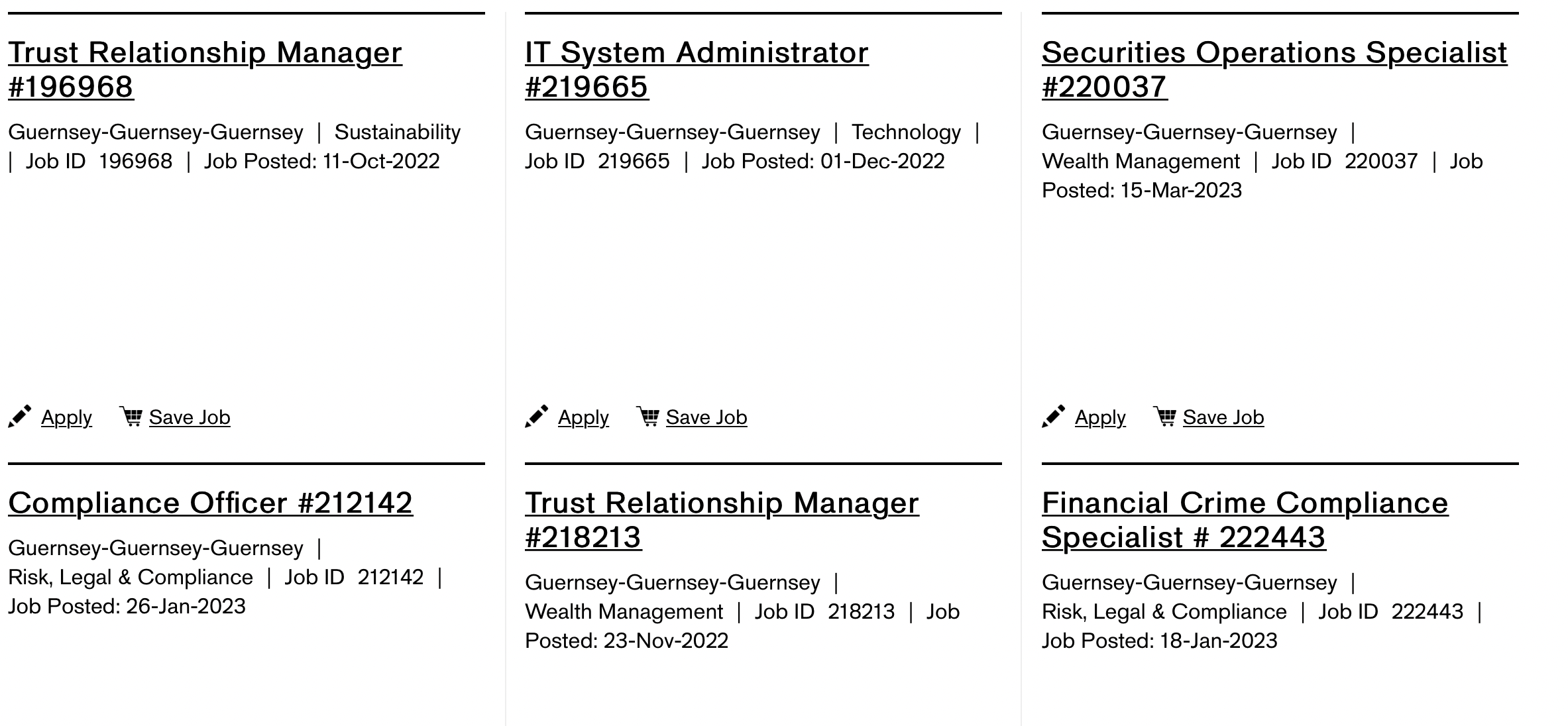

Job roles are being advertised at the St Peter Port office suggesting the local management are operating a 'business as usual approach' to the current circumstances. Some of the vacancies have been open since last year, while the most recent vacancy was advertised this week.

Pictured: Credit Suisse has a number of open vacancies at its Guernsey office - some have been advertised since last year.

Credit Suisse has had a presence in Guernsey for nearly 50 years, with its 160 staff currently based at its Helvetia Court offices, at Les Echelons.

Sections of the business have been consolidated or been sold off over the years with the Credit Suisse Trust company the most recent to split with the rest of the firm.

In light of the recent problems facing Credit Suisse, Express asked Butterfield if it is still going ahead with buying the Trust business from Credit Suisse. Neither company has yet to comment.

Pictured: Butterfield made a deal to buy the Credit Suisse Trust business in September last year, and it is due to complete in the first half of this year.

Credit Suisse has shed an unconfirmed number of staff from its Guernsey office recently with one former employee telling Express that "they've been making cuts for years" with at least two rounds of job cuts said to have been held in the past six months.

That is not a fact limited to Credit Suisse however, with finance firms globally changing their structures with remote working and artificial intelligence changing the workplace forever.

Credit Suisse is also not the only international banking firm to have received a bail out this week.

Within a day of posting his expert commentary on the Credit Suisse situation, Dr Andy Sloan - Guernsey's former States economist - answered his own questions about whether lessons would be learnt by sharing the news that "according to Bloomberg, banks borrowed $152.85bn from the Feds discount window in the week to Wednesday beating the previous record of $111bn during the financial crisis".

He questions whether a turning point has been reached in the global financial markets.

"I suggest there are a lot of investment boards out there now that might wish they had a little more than a bit of compliance or audit expertise from their non execs. Slide rules need to come out to navigate investment paths through the next few years."

Crisis hit Credit Suisse borrows £44b+

Credit Suisse plans major restructuring

Butterfield buys Credit Suisse Trust

Credit Suisse appoints new Guernsey CEO and Branch Manager

Credit Suisse makes senior management appointments

Five redundancies at Credit Suisse Trust

Three promotions in Credit Suisse's Guernsey office

Credit Suisse Trust celebrates 40 years in Guernsey

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.