The last two months before the 2022 tax return deadline saw 57% of all personal tax returns submitted, leading to calls for the public to try and get their 2023 returns in well ahead of the deadline.

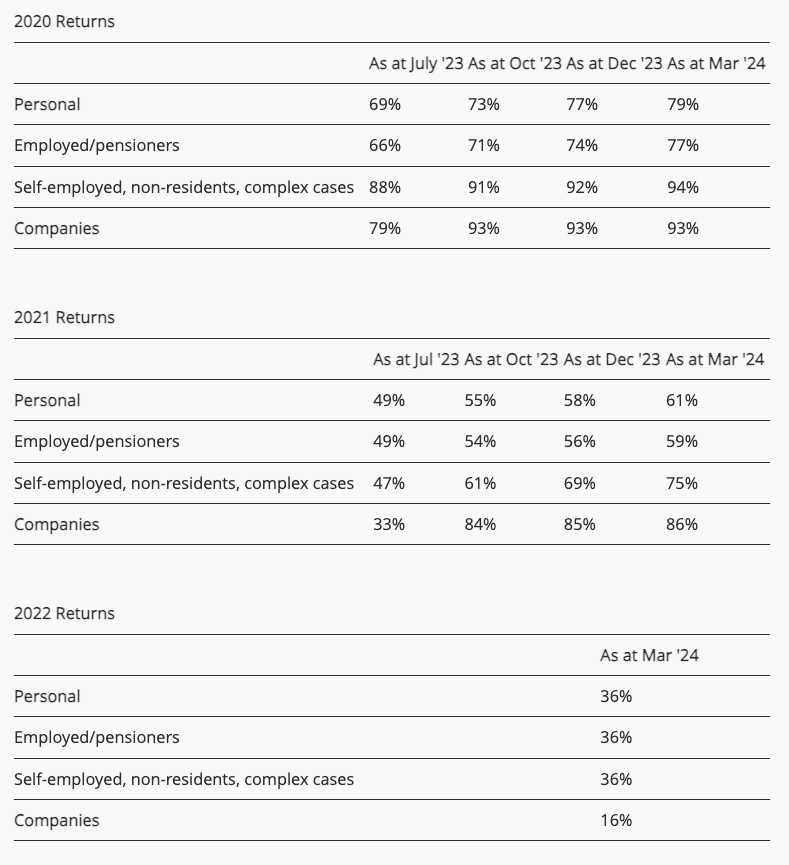

The Revenue Service has updated its backlog statistics online, indicating that nearly all returns for 2019 have now been completed:

“In the last 2 months leading up to the filing deadline for 2022 tax returns, we received over 57% (19,000) of the expected number of personal tax returns," said Nicky Forshaw, Director of the Revenue Service.

"In tandem, we naturally received a higher than usual number of enquiries over this short period of time. I want to assure people that we take steps to try and mitigate these challenges, for example by employing additional skilled temporary staff, and Revenue Service staff are working extremely hard to process returns in a timely manner.

"Where possible, it is helpful and appreciated if customers are able to file their 2023 tax return before the final few weeks ahead of the deadline.”

The Revenue Service wants to remind people that the easiest way to fill in a tax return is ONLINE.

"Over 21,000 personal tax returns were submitted online for 2022, the highest number of online tax submissions ever recorded."

The 2023 tax return deadline is 31 January 2025.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.