P&R’s “standstill” Budget for 2024 that hits homeowners with above inflation tax rises has been backed by the States.

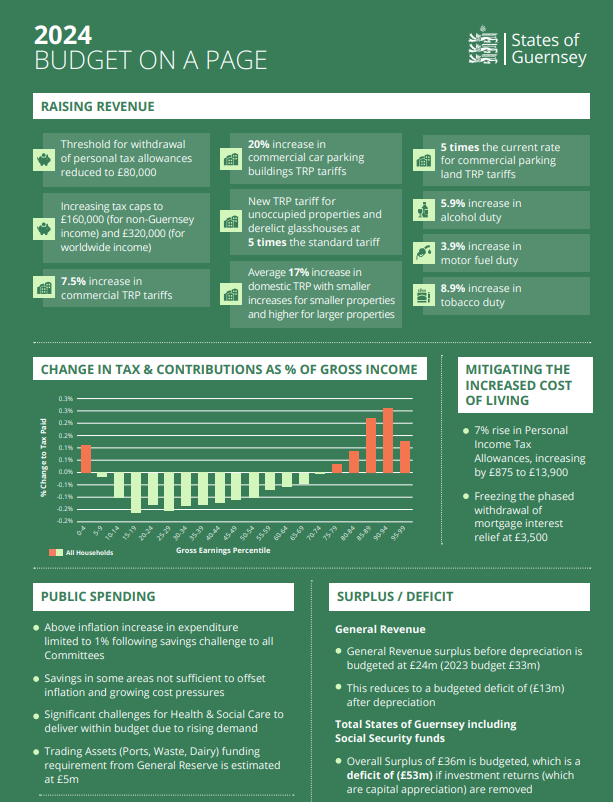

Property taxes will go up, with an average 17% increase in TRP for houses and a 7.5% rise for commercial rates.

Alcohol duty is up 5.9%, motor fuel by 3.9% and tobacco duty 8.9%.

The threshold for withdrawal of personal tax allowances will be reduced to £80,000.

There was limited debate around the core Budget proposals, with the meeting dominated about whether to fund Education’s building plans.

In the end, all propositions related to that were defeated and its president Deputy Andrea Dudley-Owen indicated it will come back with more detail to secure £26m. it says is needed to maintain the post-16 for the next five years.

Deputy David De Lisle spoke out against the TRP rises which he described as “lofty and excessive”.

Health and Social Care President Al Brouard warned that his committee “will struggle at times with our budget”.

“We will have some difficult decisions to make on our committee.”

Reducing services will be looked at last.

“One of the first may be increasing prices where we can, but I can just feel the knives in my back from when we tried moving the deckchairs around on cancer care.”

The only propositions to be rejected were around TRP increases targeted at derelict land and unoccupied properties as well as a staggered reduction tax relief in respect of interest paid on money borrowed for the acquisition, construction, reconstruction or repair of a let commercial property.

See our liveblog for full details of the debate.

Members move to debate a motion of no confidence in Policy & Resources today.

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.