81% of respondents to an Express survey said they would be worse off if a goods and services tax is introduced in Guernsey and Alderney.

The tax is included in Policy and Resources preferred option for tax reform which will be debated by the States next week, just eight months after deputies voted for a 'do nothing' approach over the proposed changes.

Our straw poll suggested a majority of our readers would be worse off under the proposed reforms, based on 26 case studies published by P&R intended to enable individuals and families to see examples close to their own circumstances.

The 26 case studies showed different situations such as one or two adults, with or without children and other variants including gross income levels.

We asked readers to select the case study closest to their own personal circumstances and then according to that States-provided example tell us whether they would be worse or better off if a GST is introduced in the island.

We asked for your comments too and the majority of those were negative.

Not every respondent gave answers to each of the three required sections, with some people not specifying which case study they come under.

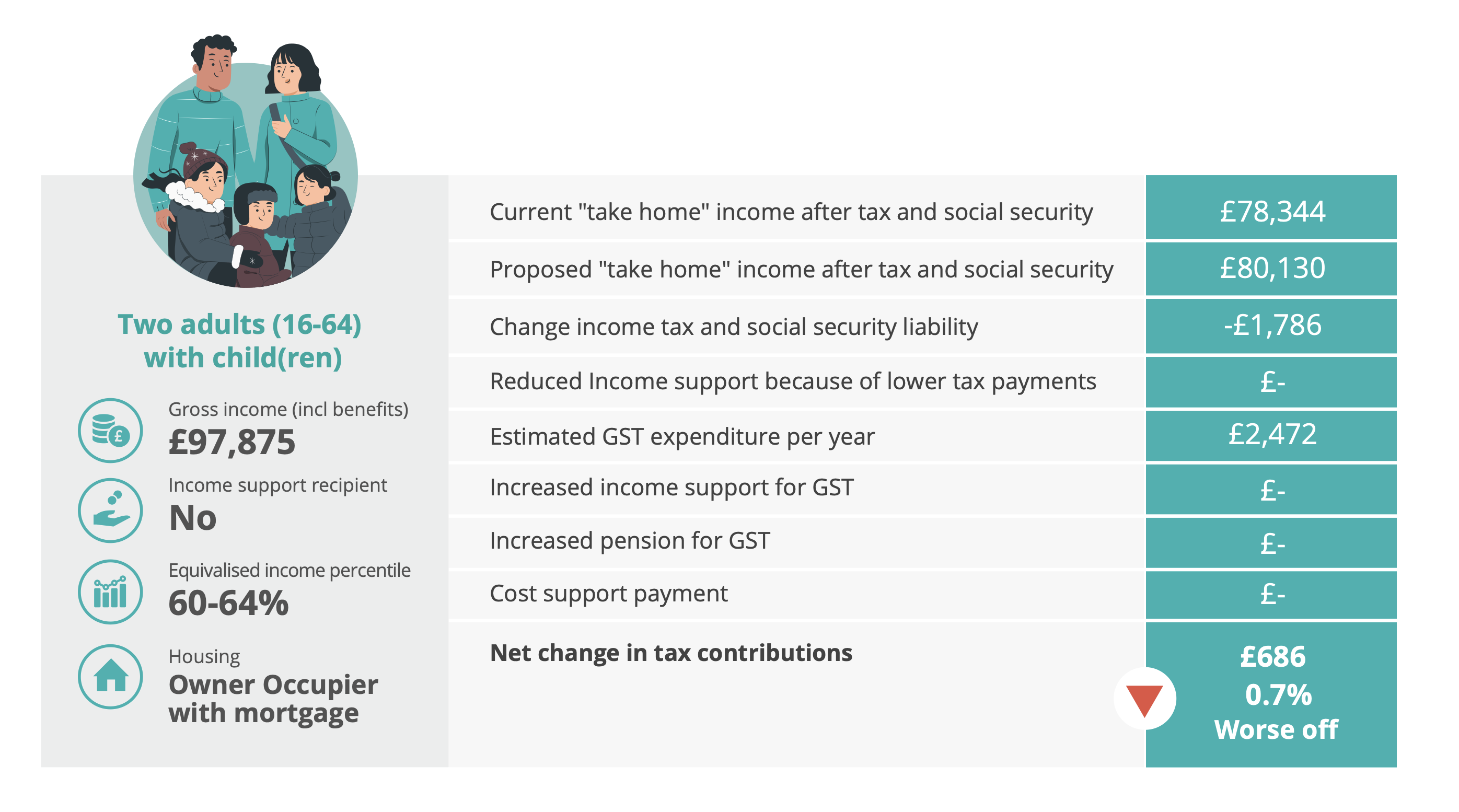

The largest category of respondents came under case study 7 - two adults (16-64) with child(ren) and a gross income of £97,875 including benefits.

That case study suggests that it would leave people £686 or 0.7% 'worse off' if GST is introduced.

That accounted for 16% of respondents to our online straw poll.

Pictured: The majority of respondents to our survey came under case study 7 which would leave them worse off with GST introduced.

The next two most popular categories were case study 8, two adults (16-64) with a gross income (incl benefits) of £85,474 and case study 22, one adult (16-64) with a gross income (incl benefits) of £48,424.

Those two case studies would leave people worse off by £344 and £341 per year respectively.

81% of respondents in total identified with a case study which would leave them worse off if a GST were introduced, while 13% said they would be better off and 6% said they'd be left in a 'neutral' financial position.

Not every person selected a case study similar to their own situation though meaning some did select 'worse off' without comparing their own situation to a case study.

Some respondents said their situation did not match a case study while others said the figures were too vague to give a realistic impression of what life would be like with GST.

Others did suggest that they would be worse off but by a 'reasonable amount' with GST.

Create your own user feedback survey

POLL: Are you better or worse off?

Case studies re-published in continued GST push

GST will not damage small businesses, P&R says

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.