Guernsey’s spending on pensions is in line to reach nearly £300m. by 2040.

From March the pension age will be 66 years as it continues to gradually increase with the intention of reaching 70 by 2049 as part of measures to make sure the cost is sustainable.

The weekly rate of a full States pension will increase next year by £13.09 to £280.32. This equates to an annual uplift of £680, to almost £14,600 a year.

"Pensions often fly under the radar publicly as they are very much business as usual for ESS but financially, they are by far the biggest issue we deal with," said Employment & Social Security President Peter Roffey.

As at 16 November 2024, there were 19,100 people in receipt of a pension from Guernsey.

This figure has been increasing year on year with a total increase of around 2,000 people in the last decade alone.

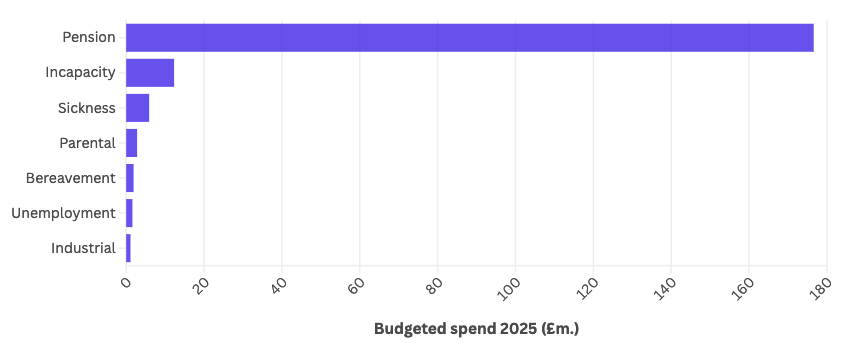

In 2023, pension expenditure was £154.2m with spending this year forecast to be £169.1m.

The last actuarial review projected that there would be a 74% increase in expenditure on pensions over the 15 years between 2025 and 2040.

This would equate to an estimated spend of around £296m by 2040.

The current balance of the Guernsey Insurance Fund, out of which pensions are paid, is £745.8m, compared with £736.8m at the start of the year.

The estimated operating deficit, before investment returns, is £26.1m in 2024 but in the current year, up to 3 December 2024, investment returns of £34.3m have been paid.

"Although the value of the fund has increased by £9m in cash terms in 2024, it has reduced both in real terms and, crucially, in terms of the number of years expenditure it covers," said Deputy Roffey at the last States meeting.

In 2024 it's forecast that the balance of the fund would cover 3.8 years of expenditure.

This compares to last year when the balance of the fund would have covered four years of expenditure and compared to five years ago when it would have covered 4.8 years of expenditure.

"This is a trend which has to be arrested, and this is what the current 10-year plan is designed to do."

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.