The Policy & Resources Committee has rejected the suggestion that there has been chronic failure and inability to manage Guernsey's tax system.

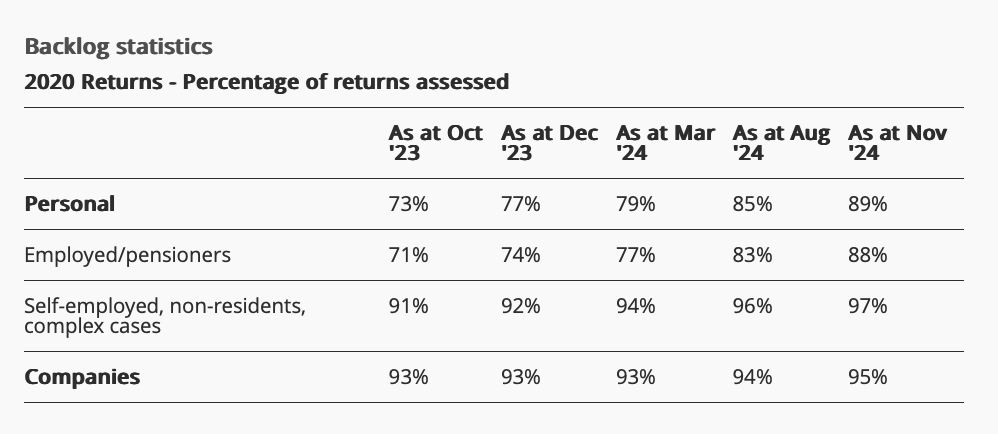

The latest data shows that 11% of personal tax returns for 2020 have not yet been assessed, while 24% and 47% haven't been dealt with for 2021 and 2022 respectively.

Deputy Mark Helyar asked P&R if they are willing to recommend changes in management and personnel and/or outsourcing options to the Head of the Public Service if the revenue service continues to underperform.

The President of P&R replied stating that it would not.

"The Revenue Service is staffed with dedicated and capable professionals committed to service improvement," said Deputy Lyndon Trott, on behalf of his committee.

"Whilst Members acknowledge the justifiable frustration of customers affected by delays in their income tax assessments, the Committee believes that addressing the long-standing backlog requires the support and strengthening of service resources, not drastic and reactive changes in personnel.

"The Committee does not consider that an accurate assessment of the Revenue Service’s current position warrants a suggestion for management change or for outsourcing the service. Despite the ongoing resource pressures (having suffered vacancies for some time and facing recruitment difficulties – exacerbated by the criticism of the service), the requirement to run dual IT systems, and the need to support States’ priorities this term (such as tax reform considerations and Moneyval), the service has increased the number of final assessments issued, enhanced its organisational structure to ensure focused support is available for operational and policy priorities, and continues to make improvements to its IT platform, digital offering, and customer engagement.

"Whilst improvements in the service will not remove the backlog overnight, the service is now in a better position. The Committee expects to see the backlog reducing further over time."

Pictured: The latest data shows the Revenue Service is making its way through the 2020 backlog.

Deputy Helyar posed a series of questions relating to the performance of the Revenue Service and around the possibility of unpaid taxes that could be used to fund public services if the income tax backlog didn't exist.

In response to those questions, Deputy Trott confirmed that they have no way of knowing how much might be owed. He said a reliance on 'interim assessments' is crucial instead.

"It is not possible to estimate underpaid or overpaid tax on returns which have not yet been processed," he said. "Interim assessments are, however, revised if processing returns for earlier years identify that updates are required.

"The underlying principle being that the Interim assessments will protect the States revenues, whilst the customer continues to have the ability to provide the Revenue Service with a more accurate estimate of the relevant income, so that the tax to be collected in year will, likewise, be more reflective of the final position once the Final assessment is issued. While there will be some individuals who have underpaid for various reasons, there will be others who have overpaid."

The full set of Rule 14 questions and answers can be read HERE.

Tax return backlog being chipped away

Tax office completes 85% of 2020 personal returns

TIMELINE: How the tax return backlog has grown and grown

Public urged to avoid filing 2023 tax returns just before the deadline

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.