Guernsey’s housing market remains busier than pre-pandemic levels and average house prices continue to rise, but 2022 is looking to be a slower year than 2021.

The States of Guernsey have released the latest quarterly residential property prices bulletin, revealing 236 local market transactions during the second quarter of 2022. This is 61 fewer than the same time last year.

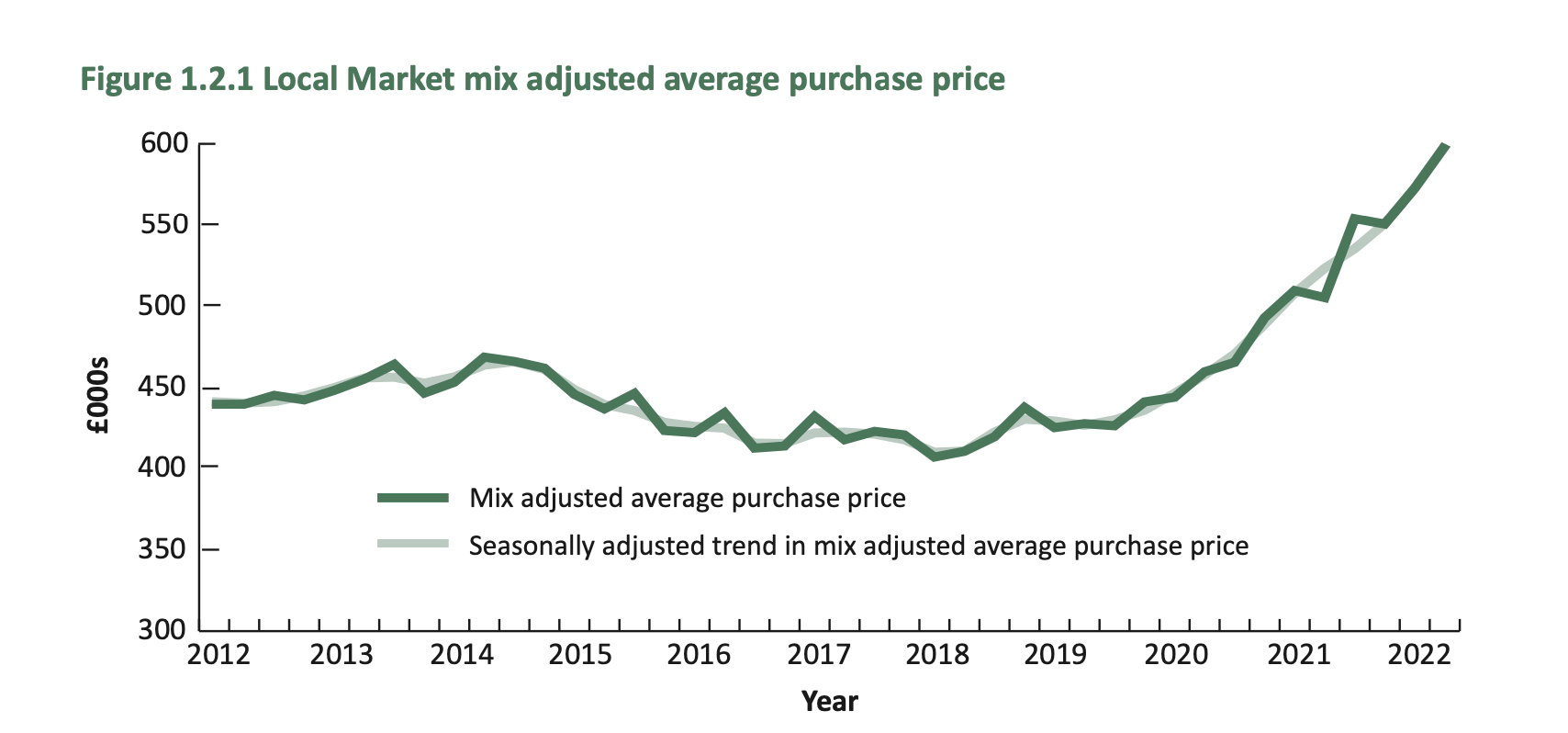

However, the mix adjusted house price for this quarter - £598,963 – is 18.5% higher than the same quarter in 2021.

Commenting on the latest statistics, the Director of Savills’ residential sales team, Nick Paluch, said: “In many ways we are mirroring the situation in the UK. Successive interest rate rises and a challenging economic backdrop have led to a slightly more cautious outlook, while the last month or so has also been more seasonal than the previous two summers – with people quite understandably deciding to take a well-earned holiday.

“Consequently, a little of the heat has come out of the housing market in terms of activity when compared to this time last year – however it still remains busier than pre pandemic.

“When put into context there are still a healthy number of motivated buyers who are committed to a move.”

Pictured: “There are still a lot of people looking for property,” said Mr Paluch.

Mr Paluch continued: “The Local Market in particular is continuing to be affected by an imbalance between supply and demand which has driven price growth.

“There are still a lot of people looking for property. Interestingly Q2 witnessed more than 230 transactions – one of the busiest quarters in the last five years. The properties have been available – the sales are just exchanging very quickly and buyers have had to act fast. That’s where having a good relationship and registering with an agent can be a huge help.”

Looking to the future, Mr Paluch said the ‘supply/demand’ imbalance will continue to underpin activity in the island.

Pictured: The overall mix adjusted average purchase price for a local market property.

Similarly, the rental market is being weighed down by the same issues.

“There are still not enough rental properties available to meet people’s needs – and that’s especially true for larger family homes,” said Gill Mooney, lettings team lead at Savills.

“Longer term it will be interesting to see how the cost of living and wider economic factors affect the market,” she said.

“You may find that landlords keep any potential increases to a minimum because they value having a long term tenant who will look after their property.

“Many tenants in existing tenancies are also renewing with their current landlords rather than face looking for a new home in an increasing rental market.”

Comments

Comments on this story express the views of the commentator only, not Bailiwick Publishing. We are unable to guarantee the accuracy of any of those comments.